What’s on Tap for 2024

The National Retail Federation’s (NRF) Big Show has been the unofficial kickoff for my professional year since the late 1990s. The Big Show is many things. It’s part forum, a place for retailers and their allies to share their concerns and the issues affecting their business. It’s part brainstorming and part prognostication exercise, forecasting what new strategies are coming and understanding what hot trends attendees should consider. Finally, it’s a massive showcase for technology providers, who connect the concerns and opportunities on retailers’ minds with technology solutions that help deliver those strategies or mitigate the threats, depending on the issue.

I’ve been attending this event for over 25 years, and I can honestly and without hyperbole say that this year’s show was unlike any other I’ve attended. The most obvious difference this year was the attendance. Forty thousand people gave up their holiday weekend to converge on the Javits Center in New York to interact in person. People are ready to leave their home offices and start interacting with people in person. Personally, I’m quite happy to put three years of virtual meetings and being told I’m on mute twice a day behind me.

That’s just part of the story.

I think the bigger motivation that drove people to the Javits Center this year was a sense of urgency. While there may not be consensus on precisely what the future holds, there is 100 percent agreement that change is coming and will be significant.

Attendees and their organizations are eager to better understand what’s coming in order to make the right investments to ensure that their companies are positioned for the “new” future. Canadian Prime Minister Justin Trudeau recently said this:

“The pace of change has never been this fast, yet it will never be this slow again.”

This certainly applies.

Letting Go of 2023

NRF Big Show 2023 was all about Meta. Meta was going to be the new engagement platform for multiple channels; it would connect consumer behavior scores in virtual and physical spaces.

This year, not a whisper. I’m not surprised by that. Here’s the lesson for retailers: anything that adds friction to a retail transaction will not gain mass adoption. Meta’s vision of a virtual shopping experience falls into that trap. It’s cool, for sure, and certainly worth exploring to see what other sorts of innovation Meta technology can spawn. However, expecting consumers to strap on headsets to shop virtually, as opposed to quickly entering their list in a search box and checking off items, is not realistic.

In contrast, this year’s big buzz was around generative AI. To be clear, I believe this is the future of retail and consumer technology. Last year in this space, I predicted that the biggest story in retail technology for 2023 would be the addition of generative AI to Microsoft Bing. I was correct. This year, to quote the pithy signs I saw everywhere, “You can’t spell ‘retail’ without AI.” z

The Future Is Here Now

Here are of my key takeaways for 2024:

A Renewed Focus on the Store

I think we can finally, once and for all, put the stake in the heart of the “retail apocalypse” monster and call it dead. The promise of unified commerce has always been to provide customers with experiences that cross channels and modes of distribution. Customers should be able to engage with their favorite retailers in the ways they want to engage. Experiences should be the same regardless of channel.

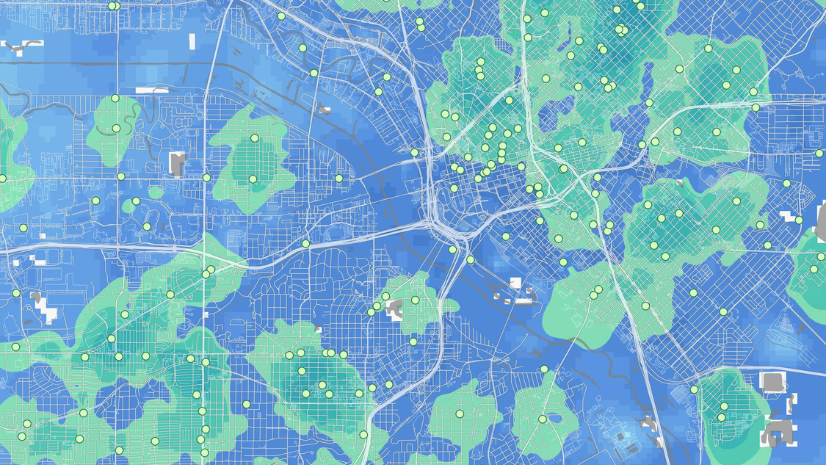

Somewhere, there was this idea in the industry that the brick-and-mortar store would lose importance. I’m delighted to report that’s not the case at all! One of the prevailing themes at the Big Show was the “rise of the store.” That was a misnomer; stores have always been at the center of retail. Maybe a better way to say this is to call it the “rise of the local retail network.” I was delighted to see that technology providers are more focused on integrating customer experiences across channels than I’ve seen in the past, and I couldn’t be more excited. We’re finally realizing unified commerce—an ecosystem of store, mobile, online, and virtual channels that support customers through the entire purchase process. New tools and data types enable retailers to reach customers on their terms—exactly where they are—with more personalized recommendations, more intelligent offers, and real, value-added enhancements to their relationships. The good news is geospatial technology is at the center of this ecosystem. Remember, every retail transaction, order, distribution, purchase, or return happens in a specific place for a particular reason.

Generative AI

Last year, ChatGPT and generative AI products were just getting started and building momentum. The prevailing discussion in the tech world was about taking it slow and ensuring that we use AI safely and ethically. This year, technology providers are falling all over themselves to talk about how they have added AI to their offerings, emphasizing how this technology will be transformative for their customers.

There is no doubt in my mind that AI will be a game changer, and we’re just starting to understand its potential.

Here are some of the key areas where this technology is already having an impact:

Customer Service

Imagine your frontline store teams having access to information about every product in the store, served up with natural-language queries. Enter the AI chatbot, accessed through a handheld device or prompted verbally through a headset, giving staff access to this information through a conversation with a customer. An example might be, “I need dog food for an older dog with a sensitive stomach.” The AI can take that query and quickly provide suggestions based on the products available in that store in real-time, allowing the team member to provide input into the customer’s decision-making process at the time they’re making that purchase decision. Anyone who has tried to find information about a product with a store associate who has no experience with that category and doesn’t quite know what to ask a legacy search engine will be able to relate to how transformative this could be.

Taking this a step further, AI will monitor cameras around the store to gauge dwell time and provide notations for qualified team members that a customer might need help. It can provide data about where the customer is and what products they are examining.

It’s compelling stuff from a customer service and sales perspective. For geographic information system (GIS) professionals, this is a location-centric workflow that brings spatial awareness to a business transaction. The potential return on investment (ROI) here is significant.

Automation

Companies have been struggling since before the pandemic to staff their warehouses and stores. Staffing issues have become even more acute for frontline retail and warehouse positions. This has resulted in supply chain disruptions across the retail spectrum, and consumers have noticed. Companies have looked to technology to find solutions to mitigate the impact of these issues on their customers and bottom lines.

Automation in warehouse management has been around for decades. The solution to automate a warehouse—where fixtures and aisles are static and don’t move and where products, once assigned to a location, tend to stay put longer—is much easier than one for automating a retail sales floor, where customers, products, and team members are constantly moving. The good news is that location intelligence can help mitigate these issues. With data about store configuration, fixture alignment, and product location, GIS tools are uniquely suited to provide the navigation data for team members and devices to efficiently move and perform activities on and around the sales floor. In addition, GIS is an authoritative repository for location analysis and data gathered while customers, team members, and their devices move in and around stores and facilities. Insights acquired here can provide data into shopping patterns, efficiencies of store layouts, and the effectiveness of product placement and in-store marketing.

These insights have the potential to deliver significant ROI. Retailers will be able to make faster, data-driven decisions about products and services that will drive incremental sales growth as assortments are optimized and customer experiences are improved by products being easier to find and less frequently out of stock. Retailers will also experience reduced operational expenses in their stores and warehouses as more efficient workflows are implemented by providing team members with location-based task management.

Personalization

In the retail world, localization and personalization are critical. Customers who feel that the store they shop in is tailored to their needs are far more likely to be loyal to that store and to make repeat visits. When a retailer can push offers to customers that are aligned with their tastes and experiences, they are far more likely to see those offers converted. Retailers have been thinking about store-specific assortments and offers for a long time. However, they have had a difficult time executing store-specific plans. Typically, it’s an issue of scale and the inability of available assortment and planogramming tools to extrapolate store-specific plans based on criteria effectively.

The promise of AI and geospatial technology includes the ability of these tools to consume disparate data, like store-specific layouts, product data, and population data, to create accurate and—most importantly—executable store-specific merchandising plans. This will enable true automation in developing assortments and planograms by store. Correlation between customers, locations, stores, and customer-specific purchases can inform engagement tactics like merchandising and marketing. This data, aggregated with other customers’ behaviors organized by neighborhood and city, can inform broader strategies and tactics to grow sales in new markets or make changes in underperforming stores based on the performance of similar stores with similar geographic profiles. GIS has a huge part to play in this space because it is the unique purview of GIS to append behavioral, economic, and customer-specific data to find those insights.

The Year Ahead

If 2023 is any indication, I expect to see massive advancements in the application of generative AI, automation, and customer-centric insights to retail strategy in the next year. With an even more significant incorporation of AI into GIS and business intelligence tools, in combination with natural-language queries, we will see even more democratization in access to analysis and insights for business professionals and frontline team members. The benefits for retailers are clear: team members will be better equipped to answer questions and help customers make purchases, and more efficient store operations will allow retailers to reduce expenses without sacrificing the level of service and customer interactions.