In 2023, over 800 Bed Bath & Beyond stores permanently switched off their lights—the linen aisles emptied, the iconic signage gone. They were one of 26 retailers that went bankrupt last year, the most since 2020. This year is on pace to surpass that mark.

Call it a dynamic shift instead of a downturn.

US retailers are expected to open more stores than they close in 2024, according to The Wall Street Journal, but finding the right space could be challenging. Construction of retail buildings has been slowed by inflation and higher interest rates, and the retail vacancy rate is low.

Companies that have adapted to new consumer preferences—a community-focused, omnichannel, experiential way of shopping—are looking to expand in locations where other retailers have failed.

Location, always a key factor in business success, is now even more important. With the retail vacancy rate low, retailers feel added pressure to analyze markets and meet customers where they are.

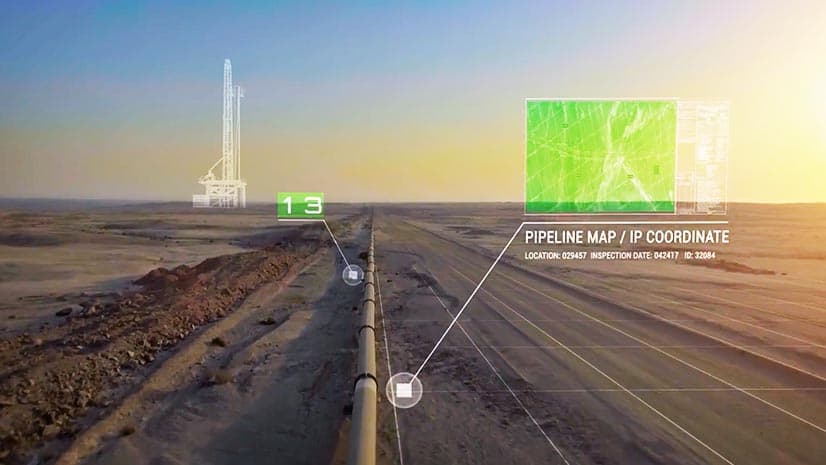

Expansion demands precision, and intuition is not enough; data is key to such high-stakes decisions. Retailers have prodigious amounts of customer data available to them, with sales transactions, loyalty programs, and online interactions revealing who their customers are. Combining customer data with location data surfaces valuable insights about where customers are, and how to engage them. Top retailers rely on geographic information system (GIS) technology for this kind of analysis.

Mapping Psychographics When the Retail Vacancy Rate Is Low

With retail space in short supply, smart executives will look to analytics for an edge.

Psychographic research builds on demographic information to segment markets, helping retail planners better understand their target customers. Psychographic profiles comprise the attitudes, motivations, values, opinions, and other characteristics of consumer groups, and GIS technology brings psychographic research to life by grounding it in geography—a form of location intelligence.

One of the world’s largest commercial retail firms analyzes psychographics when designing shopping centers to fit the communities they serve. In one location, GIS-based analysis revealed that a shopping center was a destination for families. With this information, the firm added spaces for family-centric events, concerts, yoga classes, and pet-friendly amenities, and drove the retail vacancy rate below 10 percent.

Omnichannel Sales Data Informs Smart Expansion

Location intelligence also informs the expansion strategy for a popular work apparel brand.

As the company’s omnichannel strategy matured, leaders sought to understand the relationship between a growing e-commerce presence and the performance of physical stores—including company-branded stores and those of retail partners that carry their apparel.

GIS technology helped contextualize customer behavior and gave decision-makers a way to view performance by location. Now, it’s even offering predictions. As WhereNext reported, the company relies on:

. . . an advanced form of location analytics that crunches sales data from multiple channels along with information on consumer demographics to predict how a geographic market will perform. It represents the next stage of strategic planning for omnichannel retailers . . .

In a time where expansion opportunities are limited, the stakes are too high for a guessing game. With GIS-driven location analysis, apparel brands, restaurant chains, grocery stores, and other retailers are transforming data into guidance as they decide on their next expansion sites.

The Esri Brief

Trending insights from WhereNext and other leading publicationsTrending articles

December 5, 2024 |

November 12, 2018 |

July 25, 2023 |

February 1, 2022 |

July 29, 2025 |

August 5, 2025 | Multiple Authors |