Summer is for beer lovers, with nearly 40 percent of all beer sales occurring between Memorial Day and Labor Day. This year that figure will include a record amount of nonalcoholic beer, the industry’s swiftest-growing segment.

Over the past five years, the market for nonalcoholic beer has nearly tripled in volume. In 2023 alone, sales were up 31 percent, and some estimates project the industry will surpass $32 billion in revenue by 2030.

Understanding the growth of this trend is a question of location intelligence: analyzing who is driving the nonalcoholic market and where they can be found.

Seeing Straight on a Nonalcoholic Trend

New brewing techniques now remove alcohol without compromising flavor, coinciding with changing public drinking habits. Alcohol use and related deaths spiked during the pandemic, but since then, events like “Dry January” and “Sober October” have gained popularity, especially with younger drinkers.

The Beer Institute, an industry association, is bullish on the future of nonalcoholic pilsners and IPAs, even though they still account for a small percentage of beer sales. Brewing fads come and go (remember the hard seltzer craze?), so it’s best to use caution when assessing the industry’s future. Now is an opportune time for breweries, retailers, bars, nightclubs, and entertainment venues to analyze the future of the nonalcoholic trend.

A location-based approach offers a way forward.

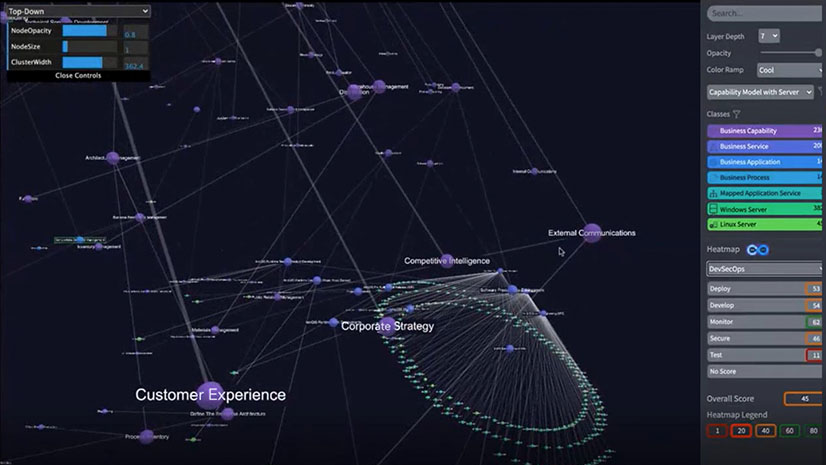

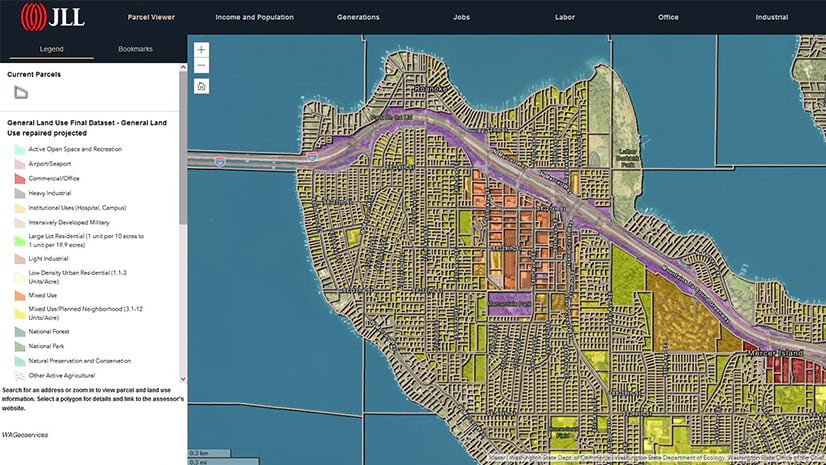

Geographic information system (GIS) technology unites geographic and demographic knowledge to answer questions like, Which groups of consumers are buying nonalcoholic beer? What are their ages and other spending habits, and in what cities are they concentrated? This information, represented as layers on a map, reveals demand patterns that can inform a business’s strategy.

With a modern GIS platform, decision-makers can analyze demographic data in preset geographies like zip codes or metropolitan statistical areas, or in custom trade areas.

For retailers, distributors, marketing firms, and other businesses, demographic projections can be especially helpful in business planning. If the nonalcoholic market really will be worth $32 billion by 2030, then location intelligence on which consumers will drive the expansion—and where—will be a hot commodity.

NA and AI

Beyond identifying where nonalcoholic sales are increasing, there are a host of other considerations GIS might address for companies—from SMBs to national chains.

Consider the owner of a gastropub or microbrewery with a geographically dispersed customer base. In contrast to the clientele of a neighborhood bar, customers of this establishment are likely to arrive from many neighborhoods and ZIP codes.

The owner can use the AI capabilities of GIS to reveal the predominant demographic groups that frequent the establishment, along with spending preferences and interest in nonalcoholic products. Similarly, the purchasing team for a national restaurant chain can perform GIS analysis on several locations in a geographic area, revealing trends that could affect company purchasing patterns.

The next generation of AI-infused GIS increasingly allows users to access data via simple prompts. The questions might be as simple as, Where are nonalcoholic beer sales strongest in the Midwest? Or more complex: Based on three-year projections, which census tracts are likely to see a significant increase in residents aged 25 to 35?

As the “A” in IPA becomes increasingly alcohol-free, understanding who drinks what and where remains crucial, with modern geospatial technology helping companies uncover it.

The Esri Brief

Trending insights from WhereNext and other leading publicationsTrending articles

December 5, 2024 |

November 12, 2018 |

July 25, 2023 |

February 1, 2022 |

July 29, 2025 |

August 5, 2025 | Multiple Authors |