Financial services firms must embrace digital transformation at the pace of their customers. That means catering to clients who’ve never set foot in a bank branch as well as those who won’t perform a transaction any other way. Between those poles are millions of businesses and individuals who expect to move seamlessly among a variety of banking formats—from a mobile phone to an ATM to a teller.

In this Fast Four interview, Esri’s Alex Martonik explains how banking leaders have adopted geographic information system (GIS) technology—which they first used for branch planning in the 1980s—to deliver insight on everything from climate change to social equity to effective strategies for bridging the physical and digital realms.

Watch this short interview or read the transcript below.

Chris Chiappinelli: Thanks for joining us on the WhereNext Fast Four series. These are short videos that explore the past, present, and future of location technology in different areas of the business world. Today, we are focused on the banking and financial services sector. I’m happy to have Alex Martonik with me to talk about how companies in the industry use GIS tech and location intelligence. All right. Alex, we like to rewind when we start things off on the Fast Four. So, when banks were first using GIS software, what were they trying to accomplish?

Alex Martonik: Well, in the early days, it was all about site suitability analysis and retail network optimization. And let me just rewind here to understand the context. Really, the adoption of spatial thinking has its roots in the 1970s and ’80s. And it’s the direct result of a series of mergers and acquisitions that consolidated hundreds if not thousands of locally focused banks into what we have today—a collection of larger regional and national brands that control the vast majority of the market. GIS came into play because business leaders of these new larger companies needed a better way to understand their physical layout so that they could continue to provide the services needed for individual communities, but also optimize their networks so that they were lowering operational costs.

Chiappinelli: Makes sense. So that was the foundation. If we fast-forward to today, can you explain two uses for GIS in the industry?

Martonik: Absolutely. This is a long time coming. We’re seeing a growing social awareness and greater corporate responsibility in the C-suite, both in social equity but then also climate awareness and environmental stewardship.

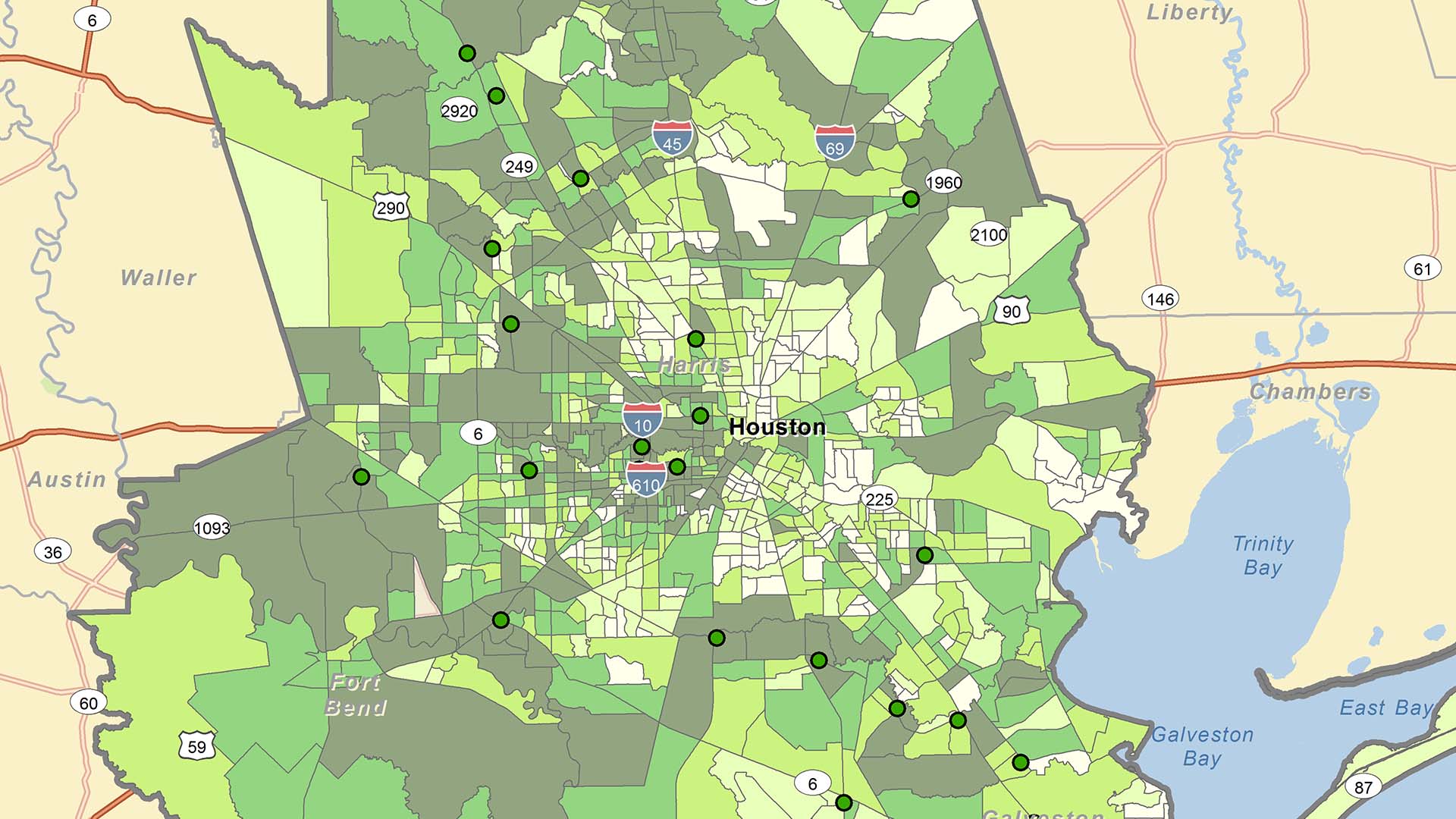

On the equity side, let’s be honest. There are stark inequities here in the United States that largely fall along racial lines. And this is the consequence of decades-long exclusionary tactics, like redlining or racial covenants, which have impeded generational wealth transfer. So banks are leveraging location intelligence to undo those practices and the systemic issues by looking where to proactively invest in greater entrepreneurship or increasing home equity and ownership through specially tailored financial instruments.

On the climate side, 2050 is a year that’s looming for many executives today. But banks want to be able to visualize the impact of climate change, not only on themselves, but their customers so that they can get ahead of some of the looming existential risks facing their businesses today.

Leveraging GIS, it’s similar to that network optimization that I talked about in the past. It’s similar workflows, but now it’s looking at not just consumer trends but climate trends. How will that impact their physical network? And how is that also going to impact their customers? It’s important for these banks to understand how their account holders, how their mortgage portfolios are going to be impacted by these disasters moving forward.

Chiappinelli: Got it. So really important work there going on in equity and climate resilience. What comes next for banks and the financial services industry? Do you expect any particular use case out of location analytics for these companies?

Martonik: Well, absolutely. With e-commerce and digital banking being one of the primary routes that most of us engage with our banks today, they’re trying to leverage advanced spatial analytics to understand the physical relationships between consumer behavior in the cyber realm and in the physical realm. This way, they’re able to tailor their products and services at a more hyperlocal level, even down to the census block of where they need to increase different vehicles for homeownership versus entrepreneurship or even investments. There is only so much market share left, [so] cross-selling and upselling will be the major area that banks are going to grow.

Chiappinelli: And I’m guessing it takes a lot of information, a lot of data to get that done.

Martonik: Yeah. This isn’t a big data problem. This is a massive data problem. And this is why location is uniquely fit for the job because it’s able to integrate disparate streams of data in order to produce greater context around . . . why a certain event is being seen or why there’s a correlation.

Chiappinelli: Interesting innovations to come for the industry. Thank you very much, Alex, for your perspective and helping us put that in context.

If you’re interested in learning more about geospatial technology in the financial services industry, check out the URL on the screen. Or if you’re watching us on WhereNext, look for the link in the article. For the WhereNext Fast Four series, I’m Chris Chiappinelli. We’ll see you next time.

The Esri Brief

Trending insights from WhereNext and other leading publicationsTrending articles

December 5, 2024 |

July 25, 2023 |

February 25, 2025 |

November 25, 2024 |

April 1, 2025 |

November 12, 2018 |