The COVID-19 pandemic has strained most businesses, but retailers’ challenges have been exceptional. Some were already struggling with industry disruption, and nearly all experienced a sudden cratering of revenue from unprecedented levels of unemployment and the shuttering of physical stores.

Retail sales fell 16 percent in April, the biggest drop since record keeping began in the early 1990s, according to the US Commerce Department.

Now, as people begin to venture out, stores reopen, and sales pick up, retailers face an inflection point. Rarely has the need to overhaul business models and practices been so pronounced.

In this pivotal moment, we’ve outlined five strategic areas where retail executives need to adopt new practices:

Local Market Awareness and Assessment

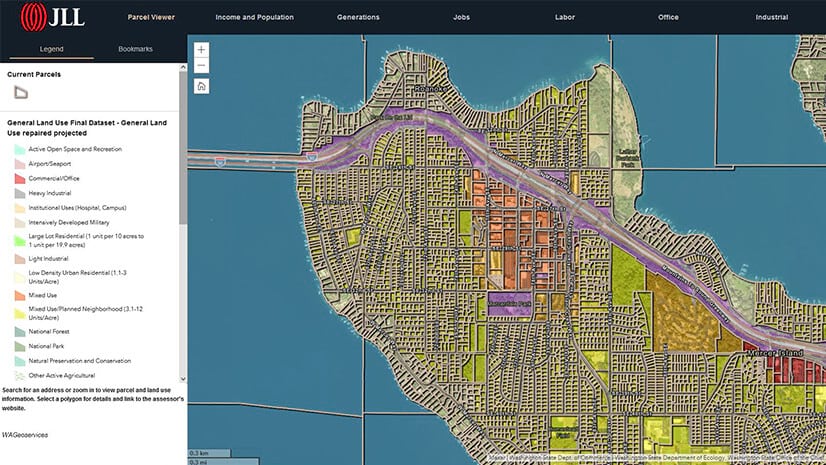

OLD PRACTICE: When expanding into new markets or creating new stores, retailers traditionally performed a trade area analysis. As part of that exercise, they often used technology called a geographic information system (GIS) to map out the location’s catchment area. With these maps, retail executives could visualize the neighborhoods and areas from which they expected to draw customers—and determine the best product mix. Few retailers updated that trade area profile over time.

Likewise, companies used GIS analysis to assess risk for a particular location—from storm damage and other threats. But they rarely established situational awareness to track and react to real-time conditions.

NEW PRACTICE: The science of understanding a market and its customers has changed markedly with COVID-19, demanding more sophisticated analysis of online customers and local conditions around each store, restaurant, or location.

To keep up with market dynamics, retail executives should start by monitoring human movement data for signs that customer types are changing. With GIS technology, planners can map and analyze anonymous movement data to reveal general demographic characteristics of shoppers visiting a specific location or area.

During the COVID-19 upheaval, many retailers have seen a drastic shift in customer profiles. People accustomed to shopping at five different stores to fulfill their weekly grocery needs might now visit one to reduce their exposure to the public. A recent McKinsey article noted that during the pandemic’s peak in China, the total number of grocery transactions fell by 30 percent, but the value of the average transaction rose by 69 percent. Some of these habits will outlast the pandemic, and retail executives need to be alert to the shifts.

Just as important, they must monitor real-time conditions around each company location as COVID-19 outbreaks ebb and flow in different geographic areas. Some will do so through GIS dashboards that show the health and regulatory conditions near each store—whether that’s a few locations or hundreds across the country.

Indoor Space and Navigation

OLD PRACTICE: Traditionally, organizations had significant leeway in designing their stores, restaurants, and other retail spaces. It was common to create indoor navigation that attracted the greatest number of shoppers and encouraged them to stay as long as possible.

Retailers by and large used their own instincts and techniques to drive engagement and revenue. They established cleaning practices to keep employees and shoppers safe, but they did so in a very different environment, with far lower risk than exists today.

NEW PRACTICE: Now, indoor navigation is all about safety through practices like enforcing social distancing, reducing the number of shoppers in a store at one time, providing clear traffic flow guidance, and assuring customers of safe practices. Retailers must comply with local restrictions, which may differ from one locale to another and change from week to week.

To start, it’s important for retailers to conduct density analysis to manage indoor space. There may be a regulatory requirement to trigger a warning if density exceeds a maximum rate. A store may need to station employees where customers congregate, such as in the cleaning aisle when the bleach wipes are finally restocked, or the garden aisle during the summer months. Store managers need to know when there are conditions that could create liability.

Prior to the pandemic, industry leaders had embraced indoor location intelligence as a way to monitor and improve retail and office spaces. The pandemic has upped the interest in the GIS technology that creates this intelligence and guides retailers toward safer practices.

Demand Sensing

OLD PRACTICE: Like their supply chain partners in manufacturing and consumer packaged goods, retailers have traditionally based demand forecasts on time-series techniques, using sales history to predict future revenue. This method drew on several years of data to provide insight into what were often predictable seasonal patterns. However, when market conditions change, past sales can be a poor predictor of future performance, and forecasts tend to grow obsolete quickly.

NEW PRACTICE: Traditional fulfillment strategies like just-in-time inventory planning, which attempt to guard against overstock situations, have proven to be ineffective in meeting demand when consumers change their buying patterns. Retailers need a more agile approach to demand sensing.

After an abysmal April, retail sales jumped nearly 18 percent in May as retailers embraced new engagement channels and rebuilt inventories, while consumers got back to shopping—buffeted by stimulus checks and easing lockdown restrictions. Even as we’ve seen during the reopening phase, volatility is likely to be the new norm, prompting retailers to seek a better understanding of demand signals and plan product assortments accordingly.

In this pursuit, retailers would do well to learn from fast-fashion purveyors like Zara, that stay abreast of gyrating consumer trends and react quickly. What those retailers recognize better than most is that demand does not change uniformly across geographies. While retailers have always planned seasonal merchandise based on a store or restaurant’s region, the pandemic drove home just how quickly consumer tastes—for hand wipes, hair clippers, or pizza—can change. With GIS-based smart maps to track where and how sales are trending, retail executives put themselves in position to react more like their fast-fashion peers as demand signals change.

Fulfillment and Delivery

OLD PRACTICE: Retailers introduced a host of innovations in fulfillment and delivery long before the pandemic, offering consumers the ease and convenience of things like same-day delivery and buy online, pickup in store (BOPIS) or at curbside. These options improved the omnichannel customer experience and promoted contact-free commerce, but represented only a small percentage of most retailers’ business.

NEW PRACTICE: Seemingly overnight, BOPIS went from a small percentage of many retailers’ business to their primary sales channel. The need for consumers to keep away from other people as much as possible exponentially increased the appeal of contact-free commerce, making BOPIS and online ordering (with home delivery) routine practices for many shoppers. By one count, BOPIS activity was up 208 percent in the first few weeks of April compared with the same period in 2019.

As we enter the pandemic’s middle period, data indicates that many shoppers believe they have abandoned old habits permanently. For instance, 56 percent of consumers report a strong intention to continuing using BOPIS after the pandemic.

So, any retailer that had not fully implemented new delivery mechanisms will need to catch up, and quickly. As stores begin to reopen to in-person shopping, retailers should think of their stores as warehouses from which orders are fulfilled. (This article explains some of the AI-based techniques retailers are using in next-level fulfillment.)

Retailers’ focus on experiential shopping, popular right up until about January, will need a rethink as consumers prioritize health and safety over interaction with brands.

Supply Chain Agility

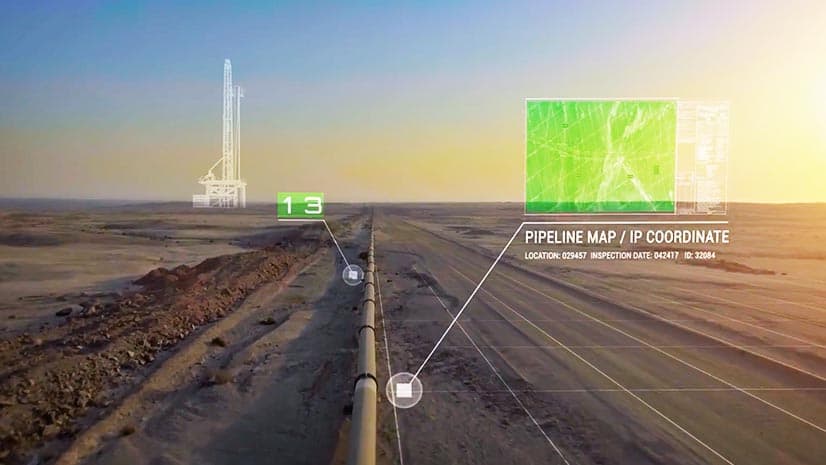

OLD PRACTICE: In the past, retailers tended to focus more on supply chain transparency (i.e., visibility into goods’ locations within the supply chain) as opposed to supply chain agility (i.e., the ability to use alternate sourcing). This made sense in a world where supply chains in many sectors were generally stable.

NEW PRACTICE: With consumer trends now in flux, retailers need to refocus on agility, diversifying supply chains and building in redundancy to hedge against the unexpected.

For example, a supply chain executive might reconfigure distribution networks to create geographic diversity. This practice is often used for suppliers in areas susceptible to natural disasters like hurricanes or wildfires. In this scenario, partnering with other vendors in less vulnerable areas can create backup supply—and much-needed agility—in times of disruption. Maps of the supply network are essential to that planning work.

For retailers that sell private-label products, focusing on the product development process can expose opportunities to move commitments and products closer to customer demand. As antithetical as this would have been just a few months ago, now it is reasonable to shorten supply lines for key items by building inventory reserves where necessary. The starting point for planning those redundancies is often a smart map.

History has shown that best practices should be cast aside when conditions change. It may be difficult to imagine anything more disruptive to the retail business than COVID-19, but change will come again. And it will favor the retailers that learned valuable lessons during this trying time.

A retailer’s ability to survive and thrive as conditions improve depends on resilience. In the new world of retail, resilience is built on data, location awareness, and a willingness to let go of practices that have outlived their usefulness to retailers and consumers.

The Esri Brief

Trending insights from WhereNext and other leading publicationsTrending articles

December 5, 2024 |

July 25, 2023 |

November 12, 2018 |

April 1, 2025 |

April 29, 2025 |

February 1, 2022 |