Parcel mappers tend to be detail oriented and have a sense of guardianship over the data they maintain. When it comes to adopting new solutions, it can be hard for parcel mappers to let go of how they previously performed parcel maintenance and fully embrace the benefits of switching to a new system. This was a challenge that GIS staff and other employees at Fauquier County, Virginia, faced when it migrated its file-based legacy mapping system to ArcGIS technology.

Fauquier County, located about 50 miles southwest of Washington, DC, was an early adopter of computerized mapping, dating back to the late 1980s. When it moved to ArcGIS technology several years ago, Esri’s initial consultations and assessments indicated that using the Esri parcel fabric would be the most logical method for the county to use to manage its parcel data in the new system. With a land area of 650 square miles and approximately 33,000 tax parcels that encompass the towns of Warrenton, The Plains, and Remington, Fauquier County’s tax parcel information was of considerable consequence.

At the time, Esri’s parcel fabric was unfamiliar to the county staff members who manage parcel editing, and they were hesitant to start using a system that seemed so complex. But Esri consultants were resolute in their suggestion that the parcel fabric, which stores land record information in a unified data structure and connects parcels in a continuous surface or network, would help Fauquier better maintain and edit its parcels. It could even be flexed to fit some of the county’s distinct characteristics. So the migration team—which consisted of four GIS employees, two staff members from the Office of the Commissioner of Revenue, and a few designated IT staff—went for it.

Identifying Parcels

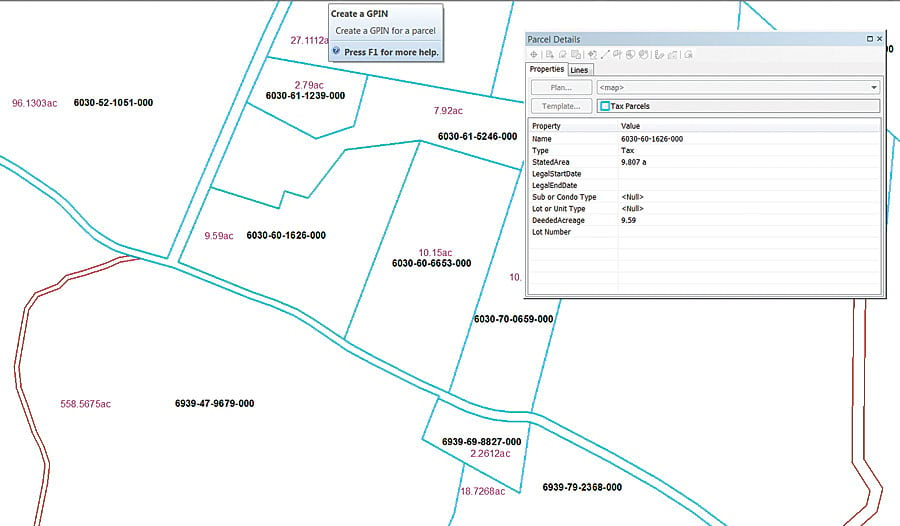

Fauquier County has a unique way of naming parcels. Called the Grid Parcel Identification Number (GPIN), this method generates parcel numbers based on the State Plane Coordinate System grid. GPINs are created by using the approximate center, or centroid, of a parcel’s location and a combination of x- and y-coordinate values. The GPIN is a 13-digit identifier that has no relation to any specific attributes of the tax parcel. It is used throughout county departments to index all the records associated with a tax parcel.

When Fauquier County’s tax parcel data was migrated from the legacy system to ArcGIS Desktop and the parcel fabric, Esri was able to build a custom GPIN tool that mirrored this procedure. The underlying grid is invisible to editors, but once they select the GPIN tool, they can click within a certain parcel to manually indicate its centroid and generate a unique GPIN. The parcel fabric then automatically puts the GPIN into the Parcel Details window and related tables.

If a tax parcel’s configuration is changed—it is divided in two, for example, or several parcels are consolidated together—then the original GPIN is permanently retired, and a new GPIN is assigned to the newly created parcel. For boundary line adjustments, which move property lines between two or more lots, and boundary surveys, which determine the property lines of existing parcels, the unique GPIN remains active and is reassigned to the newly adjusted parcel.

Dealing with Complex Geometry

Tax parcels in Fauquier County often contain complex geometry because their boundaries commonly conform to the natural features of the land, including rivers, creeks, and streams. The majority of the parcel divisions, consolidations, and boundary line adjustments recorded in the county are based on current field run surveys (measurements and data collected in the field by a licensed surveyor) and comprise updated perimeter geometry. This means that the entire parent parcel needs to be revised before a child parcel is constructed.

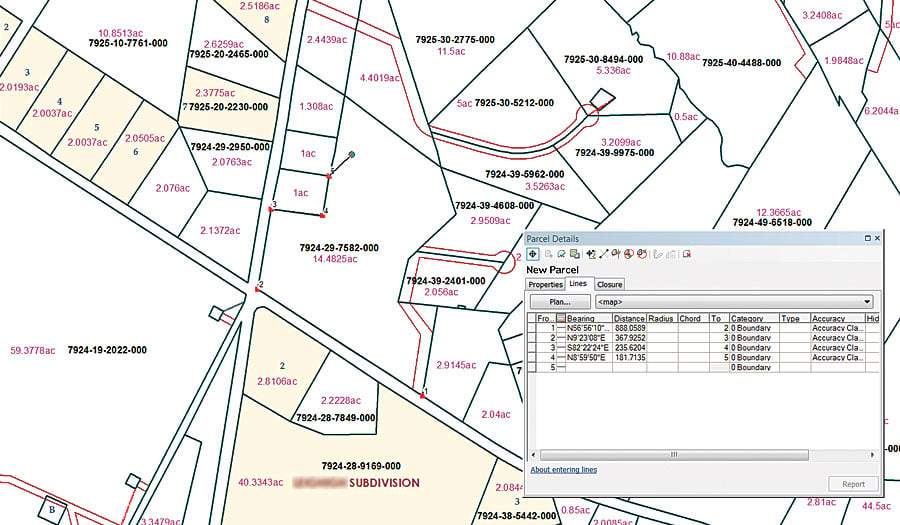

Standard division methods in the parcel fabric, such as Construct From Parent or Parcel Division, were minimally useful, since those tools only allow users to divide existing parent parcels without updating or reconstructing the perimeter boundaries. Thus, it was necessary to customize the editing workflows used to alter parcels in Fauquier.

With help from Esri staff, new workflows were built that fit the county’s unique needs and integrated with the other programs it uses to track tax parcel data—all while working in step with the parcel fabric.

Now, to modify a parcel, an editor begins by duplicating the original parcel and marking one of the two parcels as historic to preserve the integrity of its former attributes. Next, the editor creates the new parcel with the New Parcel tool, which allows users to traverse, or construct, a parcel with all new attributes and join it to the fabric. After the new parcel is joined, the editor deletes the original parcel. The new parcel can then be divided or adjusted based on the recorded plat. Finally, the editor assigns GPINs and updates the parcel’s attributes manually.

By flexing the out-of-the-box workflows that come with the parcel fabric, Fauquier County was able to design an entirely effective ArcGIS software-based system for updating tax parcels.

Higher Accuracy, More Efficiency

Initially, it took considerable effort from GIS and Office of the Commissioner of Revenue staff—and especially the parcel mapping editor—to learn how to use Esri’s parcel fabric and understand its tools. But once they accomplished this, the ingenuity of the parcel fabric became evident.

Having implemented many of the standard features of Esri’s parcel fabric, as well as extending some tools to fit its needs, Fauquier County now maintains its tax parcel data at a much higher level of accuracy than it did with its legacy system. With all the refinements Esri makes to the parcel fabric at each new release, Fauquier continues to significantly improve its parcel editing techniques and create more efficient processes.

For more information on how Fauquier County extended the Esri parcel fabric, email Corinne Compton at corinne.compton@fauquiercounty.gov or visit the county’s website.