Despite a reliance on actuarial tables and statistical sureties, the insurance industry has always nursed a hopeful streak.

Those who work in the sector know that at some point, things will go wrong—a roof will leak, a car will crash. They take solace in the belief that an insurance company can set things right. Making a customer whole, after all, is more than a financial concept; it’s the assertion that well-timed assistance can put a person back on solid ground.

As climate hazards and other risks increasingly intrude on our lives, hope can seem like a quaint notion. Yet, insurance insiders have found reason to be optimistic. The source is a technology that takes guesswork out of damage assessments and speeds up the process of making customers whole again.

Author David Yarnold flew shotgun—sometimes literally—with the professionals behind those innovations, and shares their stories in The Geography of Hope, published this fall. In addition to a chapter on insurance, The Geography of Hope ranges across the economy, celebrating the water-saving work of Prague municipal officials, collaborations between African conservation and development groups, and the indefatigable stewards who clear land mines left over from war.

In this exclusive excerpt for WhereNext, Yarnold chronicles a place in the insurance business where hope and technology intertwine:

When Ryan Bank told Sheel Sawhney at Brit Insurance that he could reduce the cost of settling a post-hurricane claim from $12,000 to $8, he had Sawhney’s full attention.

Sawhney has been in the insurance business since the early 2000s. Today, he’s the chief operations officer for Brit, one of the largest players in one of the most recognizable names in insurance, Lloyd’s of London. Lloyd’s is an umbrella organization for more than 50 companies. As Lloyd’s second-largest syndicate, Brit writes most of its policies in the US.

More than 300 years old, Lloyd’s has insured everything from the ships that carried enslaved people during the 1800s to oil freighters, buildings, and satellites.

It also famously insured the legs of footballer David Beckham and actor Betty Grable, the hands of Rolling Stones guitarist Keith Richards, Bruce Springsteen’s voice, and the Titanic. Lloyd’s drew a line at film director Stanley Kubrick’s request to insure against the invasion of aliens before the release of 2001: A Space Odyssey.

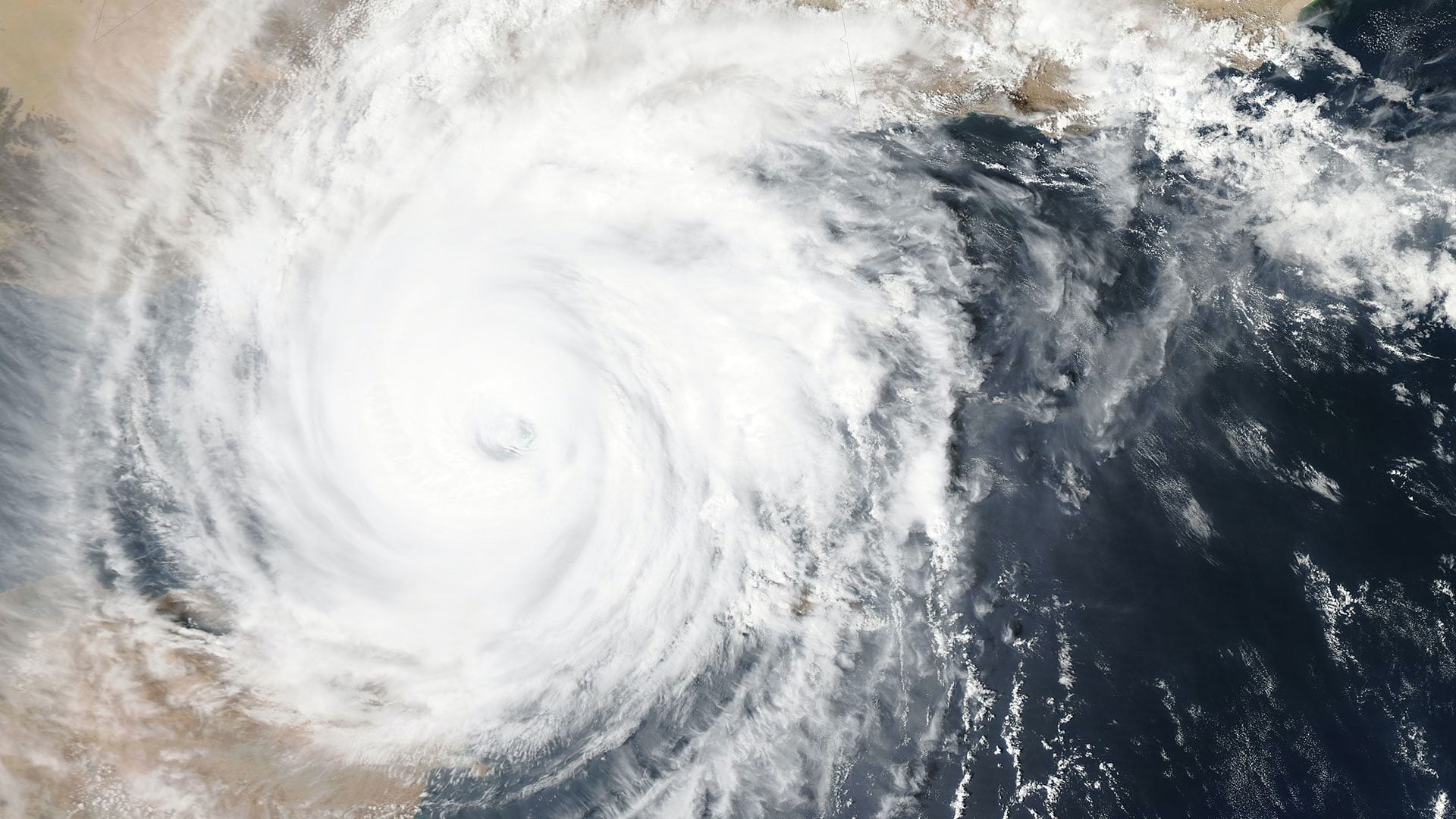

Sawhney arrived in London in 2016, just in time for what he calls, unironically, the perfect storm. In 2017, Hurricanes Harvey, Irma, and Maria crushed parts of Florida and Texas. Also in 2017, California burned—from Santa Barbara to Sonoma—and in 2018, the Camp Fire became the deadliest in the state’s history. Atmospheric rivers had unleashed unprecedented rainfall and flooding in Colorado and Tennessee and now California. These were climate change-driven disasters for countless families and for insurers.

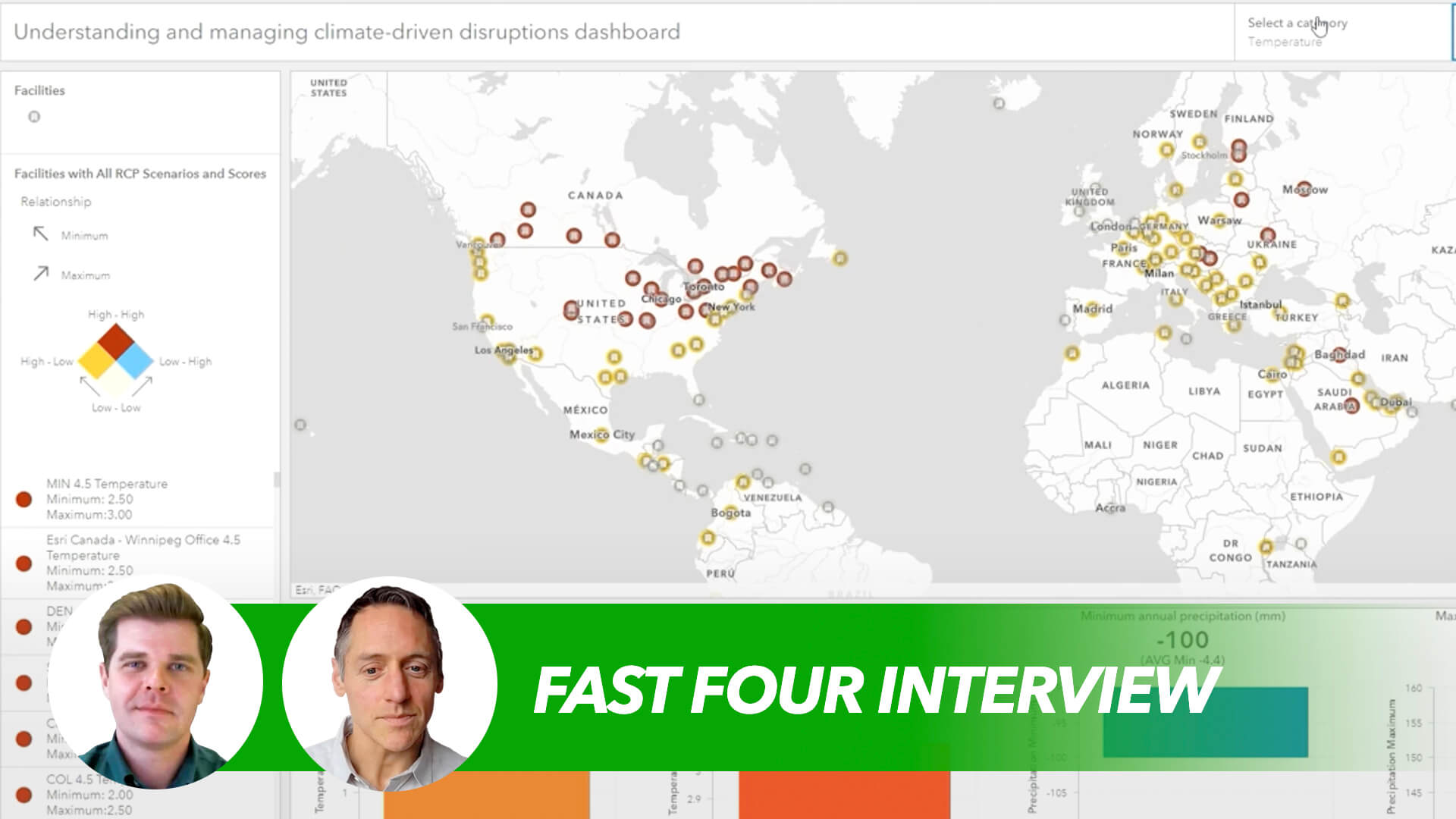

Meeting Ryan Bank and GIC [the Geospatial Insurance Consortium] was a revelation, Sawhney said. Internally, Brit’s team called GIC “Goldeneye” after the James Bond film [for the high-resolution imagery the organization delivers when disaster strikes]. Brit became a GIC member in 2019: “Things started to converge, the idea that we would have virtual claims-adjusting capability out of London,” Sawhney said.

About three-quarters of Brit’s claims come from high-risk areas in the US. When a hurricane hits, Brit knows GIC data will soon follow. Brit’s systems first interpret the GIS data in the form of shapefiles, polygons based on latitude and longitude that are the jigsaw puzzle pieces of geospatial data.

In the wake of Hurricane Ian in 2022, that first step allowed Brit to narrow the computer search from 5 million customers to 50,000 policyholders around Fort Myers, Florida.

Then the imagery met Brit’s AI software, which a Brit technology leader describes as “customers of the GIS data.” First, an algorithm scanned GIC’s images for the addresses of Brit’s policyholders. Another algorithm stepped in to assess and categorize damage. All of that was sent to insurance companies or brokers who had the data to reach out to policyholders.

Speed matters. Insurance companies that pay promptly make everyone happy. That includes the independent brokers who sell policies and help customers pick insurance companies. The brokers don’t want to deal with nitpicking insurance companies any more than customers do.

After the devastating fires on the island of Maui in 2023, Sawhney says GIC’s data plus Brit’s tools enabled Brit to pay 80 percent of initial claims in just a few days. “The rest of our competitors in the London market weren’t even able to understand if they had losses and they were still unfortunately looking for people.”

Learn more or order The Geography of Hope.

The Esri Brief

Trending insights from WhereNext and other leading publicationsTrending articles

December 5, 2024 |

July 25, 2023 |

November 12, 2018 |

February 1, 2022 |

July 29, 2025 |

August 5, 2025 | Multiple Authors |