America has a trucking problem—or, more specifically, a trucker problem.

Among its other supply chain headaches, the US is experiencing the worst shortage of long-haul truckers in 30 years. Trucks haul nearly 75 percent of the nation’s freight, but there aren’t enough people to handle the load. Analysts say the industry needs 80,000 new drivers just to keep pace with demand.

The long-haul trucker shortage is occurring at a moment when employers in many industries are scrambling to fill positions. But with the help of a White House initiative, recent legislation and a simple application of location intelligence, trucking companies can locate a new labor pool. And they can use the same strategy to navigate the challenges of training and licensing new drivers.

Breaker 1-9: A New Class of Long-Haul Truckers

One of the biggest challenges in addressing this supply chain shortfall is an aging workforce. The average age of a long-haul trucker is 47.

Federal law says that commercial truck drivers crossing state lines must be 21 or older. But by that age, many people have settled on a trade or career path, according to Bob Costello, chief economist for the American Trucking Associations (ATA). Costello believes the typical age of someone seeking long-haul training—35—suggests that trucking is often a midlife career change.

As Quartz recently reported, the $1.2 trillion infrastructure bill passed in November 2021 drops the minimum age for long-haul trucking to 18, a longtime goal of organizations like the ATA. The legislation instructs Transportation Secretary Pete Buttigieg to create an apprenticeship program that allows companies to train young drivers. By 2024, the program is expected to add 75,000 people to the long-haul ranks, nearly enough to fill the current gap.

Roads Less Traveled

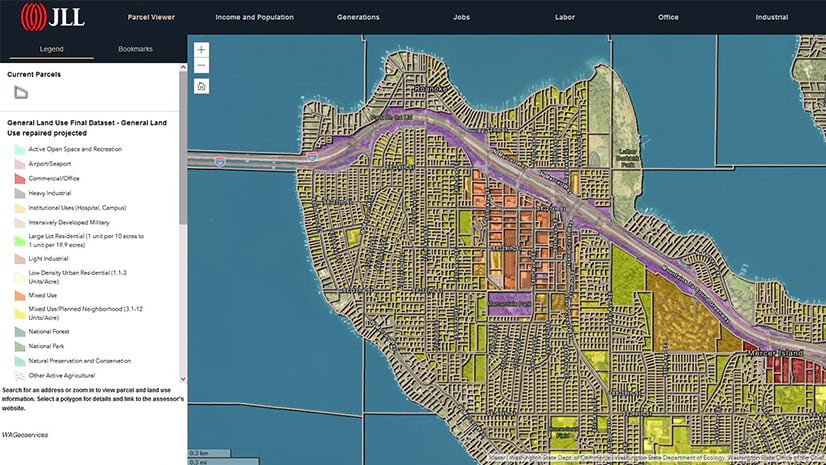

Trucking companies will need to locate this potential workforce just as HR executives and recruitment managers in other industries are hustling to fill labor gaps. Amid the scarcity, transportation executives need every data-based advantage they can find, and geographic information system (GIS) technology has long helped employers identify areas where they’re likely to find strong job candidates.

For the long-haul trucking industry, one lingering challenge is that amid the ongoing “great resignation,” workers are less likely to take on employment with a reputation for being unfulfilling. But trucking may actually appeal to workers’ postpandemic desire for more autonomy and jobs that don’t require daily trips to an office.

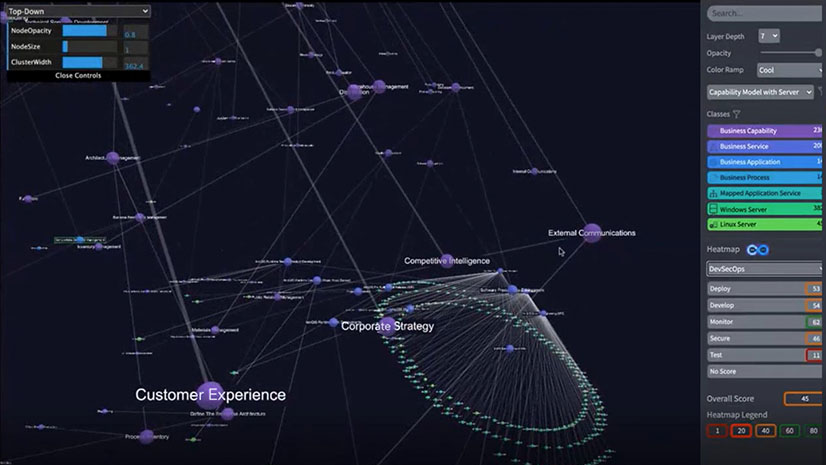

Location intelligence can guide a trucking company’s recruitment efforts. HR managers use GIS software in much the same way retailers do to find the consumers likely to buy their products. The technology can identify neighborhoods or cities with a demographic profile matching potential truck drivers, based on data such as educational achievement, age, trade affiliations, and even hobbies. Just as a hair salon or local restaurant would, a trucking company can then focus marketing efforts to those target groups—a process that decreases wasteful ad spending and increases the likelihood of connecting with the right job candidates.

A Dangerous Time for New Long-Haul Truckers

As a trucking company builds its apprenticeship program, it will have to find ways to integrate trainees safely into the workforce. As with so many facets of life over the past two years, the pandemic has both worsened the trucking industry’s challenges and complicated the solutions.

The spread of COVID‑19 in the US beginning in March 2020 coincided with a sharp and protracted decline in enrollment for trucking schools and applications for commercial licenses. Pandemic-related supply chain problems that force truckers to wait hours to load or off-load cargo—unpaid time for most contract workers—haven’t helped the profession’s allure.

At the same time, US Department of Transportation research suggests that while driving in general has decreased during the pandemic, high-risk behavior has increased, including speeding, not wearing seat belts, and driving under the influence of drugs or alcohol. Even before the pandemic, young drivers were the most likely to engage in those behaviors. With the exception of drivers aged 16 or 17, no age group has a higher crash rate than the one now empowered by the law to drive long-haul trucks. Furthermore, in fatal accidents involving large trucks, two-thirds of those killed are in passenger vehicles. Lowering the minimum age for long-haul truckers may be necessary, but it carries certain risks that a location intelligence strategy could help mitigate.

Growing the Workforce

Once a trucking company has taken on young drivers, it will want to keep close tabs on them. As in recruitment efforts, there is precedent for a location-focused strategy, with logistics companies routinely using GIS as part of a fleet management program.

With digital maps reading GPS pings, apprenticeship administrators can see where their young drivers are at any moment, with dashboards revealing data on individual driving patterns, groups of drivers, or even the whole fleet. And since an apprenticeship program is likely to include benchmarks for both drivers and participating companies—similar to the way pilot trainees must fly a certain number of hours and distance—the same system could be used for record keeping and certification.

The danger of putting inexperienced drivers on the road could be managed through data-based route selection. Logistics and delivery companies often use GIS to plan “smart routes” that optimize time and fuel—part of the industry’s overall trend toward efficient logistics and decreased carbon emissions.

Trucking companies could perform a variety of geographic analyses to boost safety for long-haul truckers. With modern GIS technology, route planners can easily access national or local datasets on crashes as they design routes for trainees, flagging or avoiding perilous areas. Some researchers have even used machine learning to analyze millions of road segments and cross-reference them with such variables as weather conditions and the time of day.

Insurers, truck leasing companies, licensing agencies, and other stakeholders could use similar technology to identify and mitigate risks as thousands of young long-haul truckers take to the nation’s highways.

Placing young drivers behind the wheel of big rigs could go a long way to addressing the country’s supply chain challenges, but it’s not without risk. With a careful, data-driven strategy, transportation companies can attract the right job candidates and lower their risk as they strengthen a critical link in the nation’s infrastructure.

The Esri Brief

Trending insights from WhereNext and other leading publicationsTrending articles

December 5, 2024 |

November 12, 2018 |

July 25, 2023 |

February 1, 2022 |

July 29, 2025 |

August 5, 2025 | Multiple Authors |