Recent headlines about climate change make it difficult to bury one’s head in the (rapidly receding) sand.

In 2018, a total of nearly 400 natural disasters caused US$225 billion in damage worldwide. The insurance industry covered $90 billion of those losses, according to reinsurer Aon. For historical context, consider data from the Brussels-based Centre for Research on the Epidemiology of Disasters: In the last half century, the number of natural disasters worldwide has risen more than 450 percent.

Concern over the financial effects of weather events has rippled through other industries, including financial services. In a post titled “Hedging Climate News” on the Harvard Law School website, several finance professors outline a strategy for hedging against climate-based risk.

Viewed over a longer horizon, the numbers are staggering. Total global economic losses from natural disasters between 2005 and 2015 were more than $1.3 trillion, with direct losses in the range of $2.5 trillion since 2000.

While scientists work to assess the fate of the planet, insurance companies are dealing with the immediate and long-term consequences and costs of climate change. Increasingly, insurers of all types are using location intelligence to get a more complete picture of risk at each property, across supply chains, and across portfolios.

The reality for insurers is that understanding risks specific to location matters greatly, and is key to reliable risk assessment and pricing models. Without accounting for the context of location, insurance companies put themselves at risk. And as the insurers of last resort, reinsurers face even greater exposure. They are the final entity in the chain of climate-change-related liability; the buck stops with them.

More Transparent Risk Analysis

Andreas Siebert, head of geospatial solutions at global reinsurer Munich Re, says the realities of climate change are making Munich Re’s underwriters hungrier for data that can provide both a holistic and fine-grained picture of climate-related property risks.

“We try to keep our clients insurable in the future by supporting them with not only the financial strength of Munich Re but also our knowledge and experience,” Siebert says.

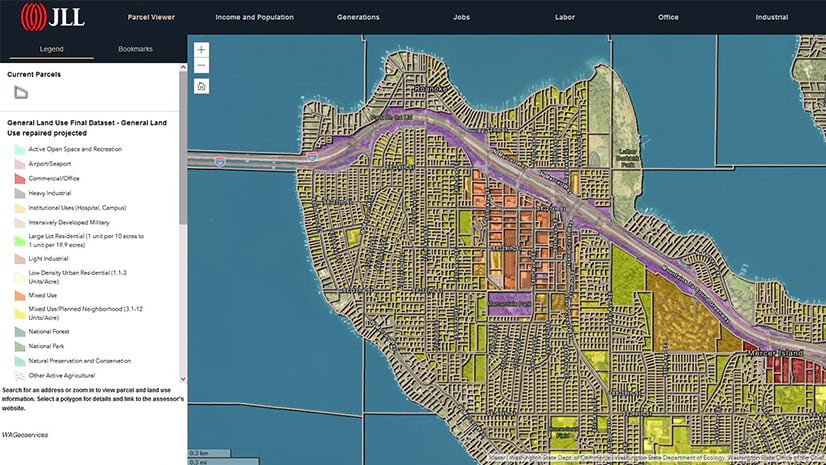

Like other insurers, Munich Re needs highly granular data upon which to base its risk pricing, as well as greater transparency into how risk-related decisions are made throughout client supply chains. Increasingly, that means relying on location intelligence powered by a geographic information system (GIS), which maps, analyzes, and models risk for a property and its surrounding area.

“More transparency means a better understanding of what the industry is insuring these days,” Siebert explains. “We have to learn more [about building] construction types, occupancies, the age of buildings—a lot of additional data. We have to bring it together to have the full transparency when we are doing risk assessment.”

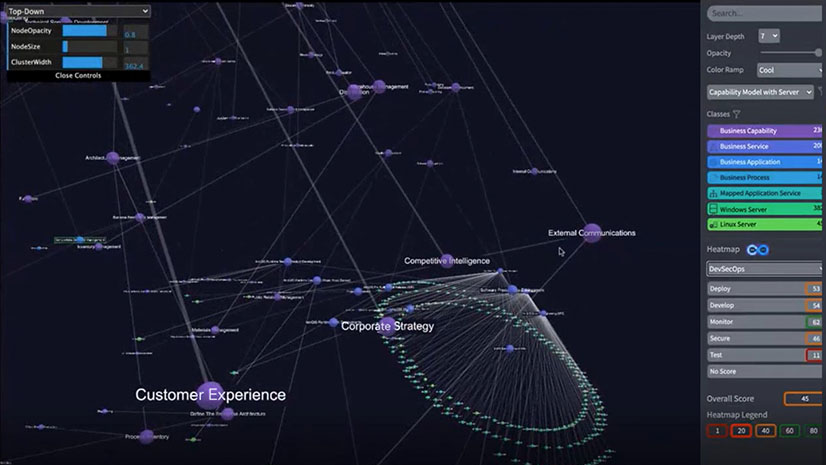

For Munich Re, there is a tight linkage between business intelligence and location intelligence. “We are on our way to fully integrating both worlds,” Siebert says. “For us, it means we have direct access to the operational data, which we enrich and analyze with the capabilities of geo-analytics and other dashboard methodologies.”

Munich Re is bringing easy-to-use tools with geospatial capabilities to its underwriting practices. Since the underwriters are not geospatial experts, the tool has to be especially user-friendly and accessible.

Seeing Risk with More Precision

Until roughly the 1980s, the insurance industry did not think at a detailed level about the link between risk and location. That has changed dramatically. NatCat models, for instance, now compensate for the fact that areas that weren’t prone to wildfires are now hot zones.

With GIS-driven location intelligence, the risk profile is much more granular, examining questions such as, “How has this home in this neighborhood been affected by wildfires and other risks?” Smart maps provide an immediate and compelling illustration of that risk.

Such location intelligence helps drive “point-based risk scoring,” which gives underwriters a more complete view of a property than they have traditionally had. Insurers might take into account everything from local soil composition to the types of trees in a nearby forest (since some are more fire-resistant than others), as well as age and type of property (and a long list of other factors) to arrive at a point-based risk score.

Location intelligence helps unify disparate data relating to a property and its type of risk, whether that is flood, hurricane, wildfire, hail, tornado, earthquake or other calamities. A holistic risk profile also includes threats such as terrorism and civil unrest. In fact, a small cohort of specialists—companies such as CONIAS Risk Intelligence—supplies multinational corporations with GIS-driven insight on where those risks exist, and to what degree.

The location intelligence these analysts deliver can affect multimillion-dollar decisions on how a supply chain is organized and which markets a company serves.

AI-Based Risk Scoring

Using GIS-based location intelligence, insurers have identified risks that appear counterintuitive, but actually reveal new realities. Case in point: Many Californians are not required to have flood insurance because most homes there are not in 100-year floodplains. However, one of the greatest risks in the last five years in California is flooding.

This seems strange for a state that has been in a drought for eight years. Yet, an analysis of location-specific factors reveals the culprits: soil composition, the amount of concrete, the lack of drainage, aging infrastructure, and the type of rainfall events increasingly common to California. In short, there’s more pooling of water and more flooding because the water has nowhere to go.

Location intelligence provides insurers a more nuanced and fully faceted picture of risk, rather than a simple “yes” or “no” answer to the question, “Is this property in a floodplain?”

GIS can quickly analyze those events and produce a risk score for a specific property or a dashboard reading of green, yellow, or red. According to Siebert and others in the industry, the process of data correlation and scoring is becoming automated through artificial intelligence (AI)—specifically machine learning (ML), which is trained to see patterns in large volumes of data. Going forward, all an underwriter will need to do is input an address, look at the score, and then only review a policy if it is automatically denied or flagged for more review.

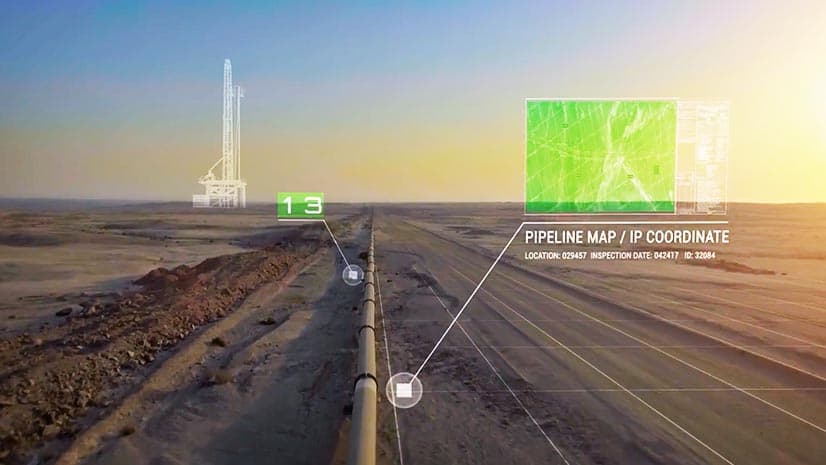

Munich Re is doing location-based risk analysis, both internally and as a service for clients. For example, its NATHAN service—the Natural Hazard Assessment Network—helps companies assess the risks of natural hazards around the world, from location-based individual risk through to entire portfolios of assets.

“We combine data on global natural catastrophes and enable the user to upload their [property] portfolio to have a very complex and flexible location-based analysis,” Siebert says. Even professionals who don’t work with GIS—including claims managers and underwriters—can input an address and understand its risks, Siebert explains.

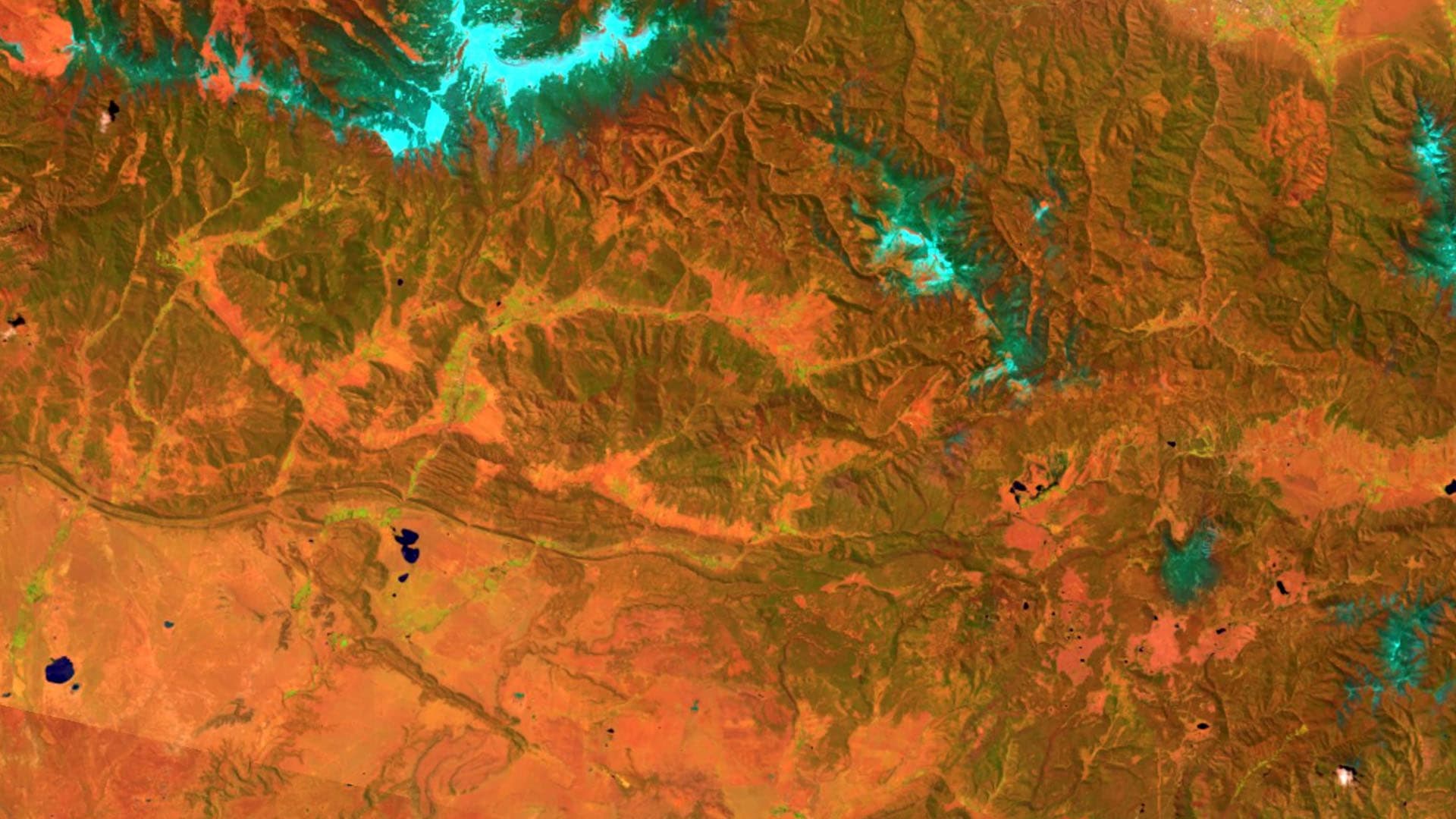

A Wealth of Imagery

In the insurance industries and across the business landscape, torrents of location-specific data are pouring in from new sources, including satellite images and aerial photography. Munich Re uses some of this imagery to better monitor storms and evaluate other extreme-weather events. The high-resolution images now assist claims adjusters and engineers in calculating losses on a per-building level.

This is another instance where location intelligence and business intelligence merge.

“We are working in a very tight collaboration with our data analytics teams,” Siebert says. “We want to integrate geospatial tools and functions in our data lake to enrich more of our common data sets with geo-referencing and analytical capabilities. So often, geospatial data is the glue between the different entities.”

As a reinsurer, as well as a primary insurer, Munich Re is keeping a keen eye on what Siebert calls “accumulation control”—using location intelligence to identify where it has the highest potential for losses. “This is so important to steer our business,” he says.

Sharing Data

Of course, location intelligence and other types of data are not just relevant within a single business—even a global reinsurer like Munich Re. Insurers and reinsurers are looking to both receive and share data with their clients and partners, as well. With the rise of natural and human-made risks across the supply chain, insurers want to know who their clients’ suppliers are—and where they operate—to accurately price risks.

Though it’s critical, the current state of data exchange is not where it should be, Siebert believes. “We have to improve,” he says. “Many of us are hoping for more open data initiatives where we have a common understanding of our risks or infrastructure.”

It is still difficult to obtain data sets that cover whole markets or whole countries, Siebert says. “Data availability is still sometimes a nightmare.”

At last year’s Reinsurance Association of the Americas (RAA) event, catastrophe response managers seemed to confirm this view. Attendees said they use NOAA and United States Geologic Survey (USGS) information as a baseline and would like other data sets to help build visibility.

“In many cases, major losses can occur due to the failure of one supplier in the value chain,” Siebert notes. “We try to visualize it, to get a better understanding [and] link the different supplier tiers according to the product chain.” To that end, Munich Re is working on creating a GIS-based solution for its clients by late this year or early 2020.

“We need a better exchange of information at all levels,” he says.

Going forward, such data will be increasingly important. A deeper understanding of location-based risk—associated with individual buildings and supply chains alike—can be an effective tool against loss from epic storms and other natural disasters triggered by climate change.

The Esri Brief

Trending insights from WhereNext and other leading publicationsTrending articles

December 5, 2024 |

July 25, 2023 |

November 12, 2018 |

February 1, 2022 |

July 29, 2025 |

August 5, 2025 | Multiple Authors |