For executives and analysts seeking to understand the state of the consumer, economic clues—including data on credit card delinquencies and housing costs—provide helpful indicators.

Credit card delinquencies have been on the rise, according to studies by the Federal Reserve Banks of St. Louis and New York. The rise was more pronounced in the wealthiest 10 percent of ZIP codes than in the least-affluent 10 percent (although still lower in absolute terms).

The trend in housing costs also varies by geography. While median residential rental prices have climbed to near record levels nationally, they’ve recently dropped in Sun Belt cities, according to Business Insider. The declines range from almost 6 percent year over year in Phoenix to as much as 10 percent in Jacksonville, with San Diego and Austin in between.

These economic clues, along with unemployment rates, the consumer price index, the purchasing managers’ index, and other metrics, can presage economic changes. The data feeding the indicators is often geographic, allowing business executives to gauge the state of the consumer region by region, county by county, or even block by block.

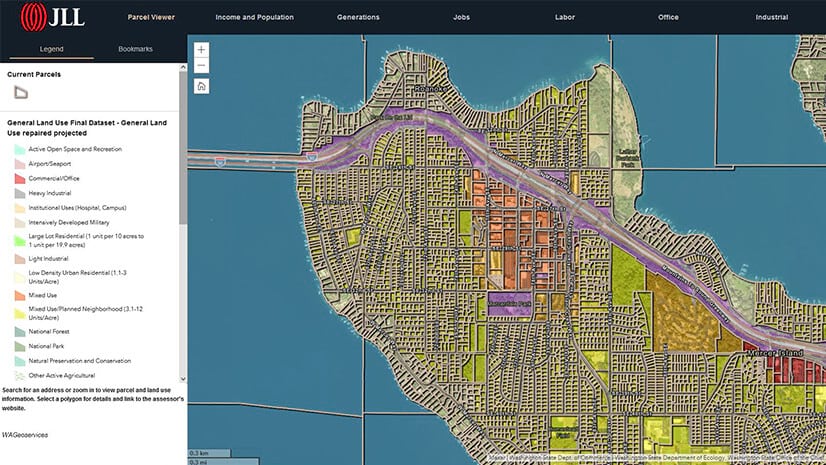

With the analytical capabilities of a geographic information system (GIS), CFOs, real estate planners, pricing managers, and supplies buyers can apply location intelligence to make smarter decisions about how and where they’ll grow the business, giving them an edge on competitors.

Making Geographic Sense of Economic Clues

Forward-thinking businesses routinely analyze economic and demographic data to build a competitive advantage.

One dental practice that has expanded to 140 locations across nine states uses GIS to examine each area where it might grow. The economic and demographic factors executives consider include population density, population growth rates, annual incomes, education levels, even purchase patterns for consumer dental products.

Decision-makers also analyze dentist-to-population ratios to determine ideal office locations and examine traffic flow to optimize the placement of billboard ads.

Smart maps that include demographics and economic indicators can justify decisions about where and how to reach customers, including whether they are entrenched in an area, moving in, or moving out.

In contrast to charts and spreadsheets, GIS maps show precisely where customers are likely to be.

Cross-Referencing Customer and Economic Data

Across the corporate world, companies use GIS to uncover advantageous patterns in datasets.

Declining residential rental rates could be a sign that an area’s population is shrinking. To gain greater context, a GIS analyst might integrate this economic indicator with data on company sales in those regions. Correlations that might be hard to discern in a spreadsheet stand out on a map.

For credit card delinquencies, the national trend may be up, but regional variations can be pronounced. Knowing the severity of the rise in each area can help businesses adjust credit policies, shift marketing to attract price-sensitive consumers, or develop new products.

Organizations that analyze the geographic reality behind today’s economic clues—including public data, consumer demographics, and company performance—have a distinct advantage in localizing their customer outreach and staying ahead of the trends.

The Esri Brief

Trending insights from WhereNext and other leading publicationsTrending articles

December 5, 2024 |

November 12, 2018 |

July 25, 2023 |

February 1, 2022 |

March 18, 2025 |

May 28, 2025 |