“Available in select locations.” It’s a phrase so common as to pass by almost undetected. It might hide at the end of a commercial for a fast-food chain’s new sandwich or on the web page of a fashion brand’s limited capsule collection.

Behind that familiar phrase is a core principle undergirding much of corporate strategy: a geographic approach is key to business decision-making. The complexion of a market can determine not just where a store is placed or a service is offered, but how a brand curates specific products—even how it prices them.

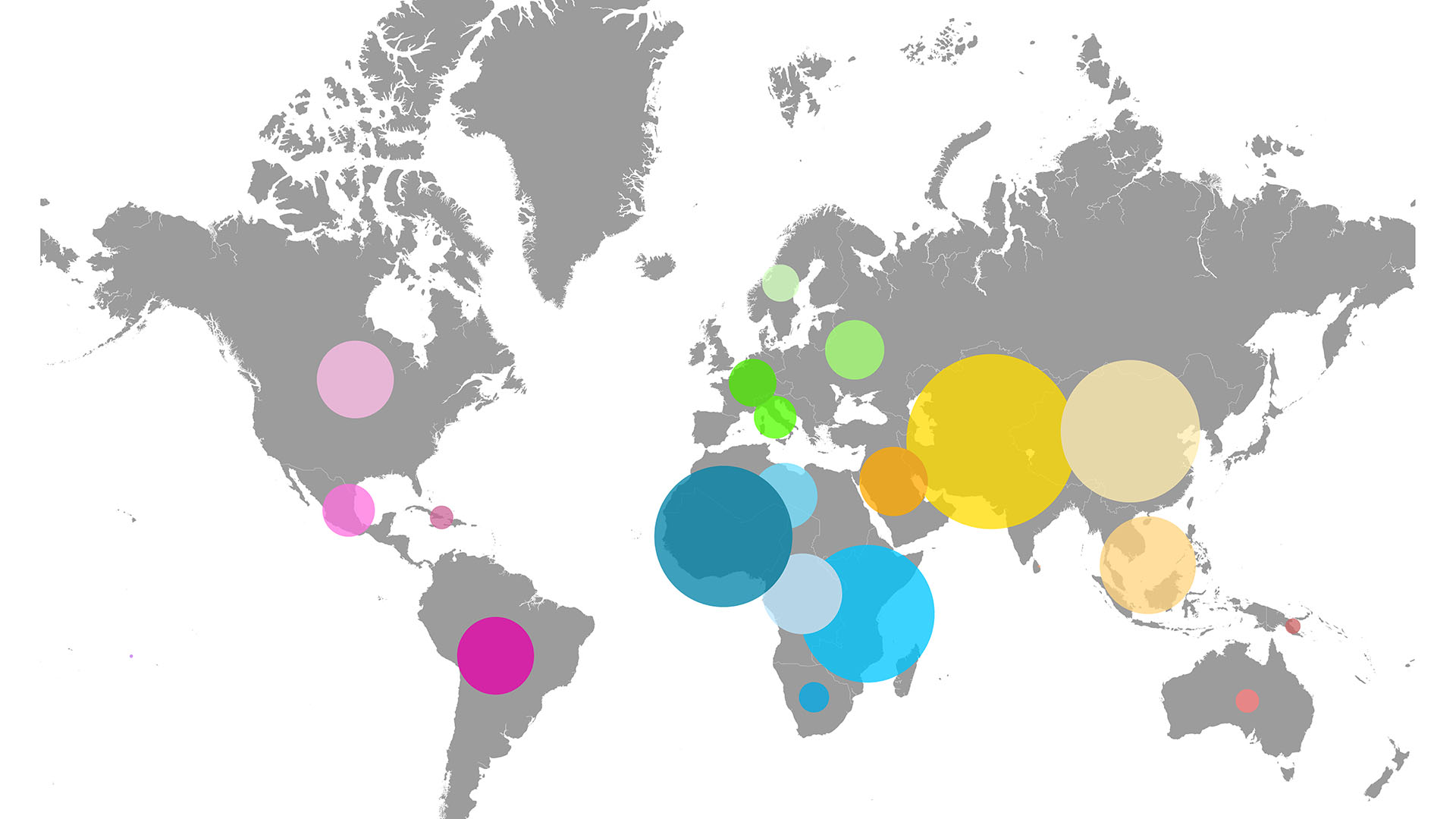

For Fortune 500 businesses, location strategy is often shaped by a geographic information system, or GIS. On smart maps and dashboards, business leaders analyze demographic and psychographic data about consumers in various geographies. With the business insight drawn from this spatial analysis—known as location intelligence—leaders plan and optimize the roll-out of new product lines. A brand can tailor releases to specific audiences with the hobbies, tastes, income and education levels, and other traits that align with the new offering.

What’s on the Menu in Select Locations?

Franchise operator Yum! Russia pursued this very strategy when introducing new KFC locations throughout Eastern Europe. The company relied on location intelligence to analyze markets, looking for areas where population levels, level of competition, and demographic information indicated a good match for the popular chicken brand.

But the company’s spatially minded business analysts also took the expansion plan one step further. They examined granular data about pedestrian traffic, how much diners typically spend when eating out, and proximity to other stores, retail centers, universities, or office buildings. Thanks to this information—which comes to life on smart maps—Yum! could customize store size, layout, and menu offerings to the customer profiles that defined each market.

It’s a form of spatial analysis that can lend competitive advantage to almost any business. Analysts at a coffee chain, for example, could cross-reference peak morning commute times for a Northeastern college town with anonymized social media data about local trends to determine whether a new breakfast menu might succeed there.

This kind of location intelligence can also guide retailers’ decisions on what not to offer in certain locations, reducing real estate footprint or freeing shelf space for more profitable items. For instance, one of America’s top sporting goods retailers recently used GIS to guide site selection for new concept stores on the East Coast, customizing offerings to those regions. Across its existing store network, product decisions vary by location; southern outlets may not stock cold-weather gear, while California venues might not include hunting and fishing departments.

Using Location to Plan a Pivot

A location-smart strategy has become standard at fast-food chains experimenting with meat-free options. Brands that have become almost synonymous with red or white meat are proceeding carefully.

Burger King recently announced the roll-out of its plant-based Impossible Nuggets, which will be tested in just three cities—Miami, Des Moines, and Boston—to gauge success. Similarly, Chipotle has tested plant-based chorizo in select markets, while Panda Express sold out of its new vegan “orange chicken” dish, piloted in the greater New York City and Los Angeles areas.

Location-specific product releases can be targeted at innovative or untested markets. British luxury brand Burberry has chosen a handful of stores where products fitted with RFID tags connect with apps and in-store screens to offer customers bespoke fashion advice. Meanwhile, music streaming leader Spotify, which is expanding into 85 new markets, teased a premium service offering lossless sound quality in limited areas. The company used the same approach to allow groups of podcasters to monetize their programs through subscriptions.

Keeping up with Ultrafast Innovation

Another service available in select locations is “ultrafast delivery,” a high-risk, high-reward offering from big box brands and start-ups alike. Instacart offers 30-minute deliveries in certain areas, and in New York City, companies are offering grocery items and household goods at breakneck speeds—sometimes as quickly as 10 minutes after an order is placed. The Big Apple has become a testing ground for brands to prove themselves to both customers and investors. If you can make it work in this market, the logic goes, you can make it work just about anywhere—as long as you understand each market’s unique dynamics.

New technologies and data analysis platforms like GIS are improving companies’ understanding of customers in markets worldwide. “Available in select locations” sounds like a simple phrase, but often it’s part of a spatial strategy helping companies chart a course to innovation.

The Esri Brief

Trending insights from WhereNext and other leading publicationsTrending articles

December 5, 2024 |

November 12, 2018 |

July 25, 2023 |

February 1, 2022 |

March 18, 2025 |

May 28, 2025 |