Miele, Inc., sells high-end, sleekly designed appliances such as computerized smart ovens preprogrammed to cook 100 dishes, and washing machines that automatically dispense just the right amount of detergent. Miele markets these products to affluent homeowners.

But not all well-to-do consumers want to own a Miele oven, refrigerator, dishwasher, coffee maker, washer and dryer, vacuum cleaner, or cleaning products. And not everyone who buys from Miele is wealthy.

To find niche markets that take into account more than high income, Miele analyzes data from Esri’s Tapestry Segmentation.

Tapestry Segmentation classifies neighborhoods in the United States based on socioeconomic and demographic composition—down to the census block group level. Studying socioeconomic and demographic characteristics, such as education, age, income, technology use, and interests and hobbies, helps companies such as Miele tap into markets they might otherwise overlook.

“We have a very discrete market, which is why Esri has been so powerful for us in terms of trying to understand our consumer base,” said Matt Kueny, a senior business analyst for Miele who will speak next year at the Esri Business Summit in San Diego, California.

Aspirational Customers

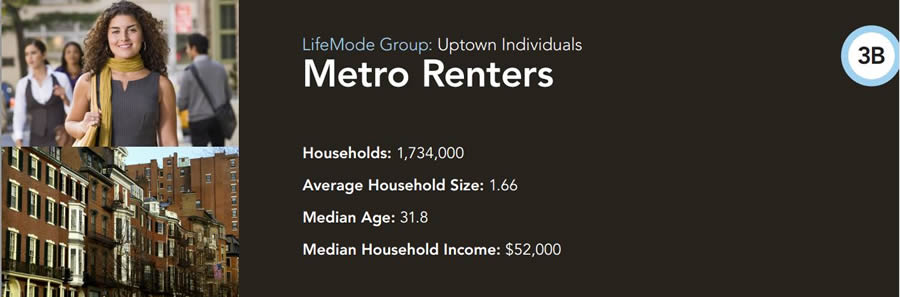

Tapestry Segmentation’s 67 segments include Metro Renters [PDF] (mostly single, young, and tech savvy), Enterprising Professionals [PDF] (a mix of well-educated married couples and singles who love technology and yoga), and American Dreamers [PDF] (young, ethnically diverse married couples who own a home and have children).

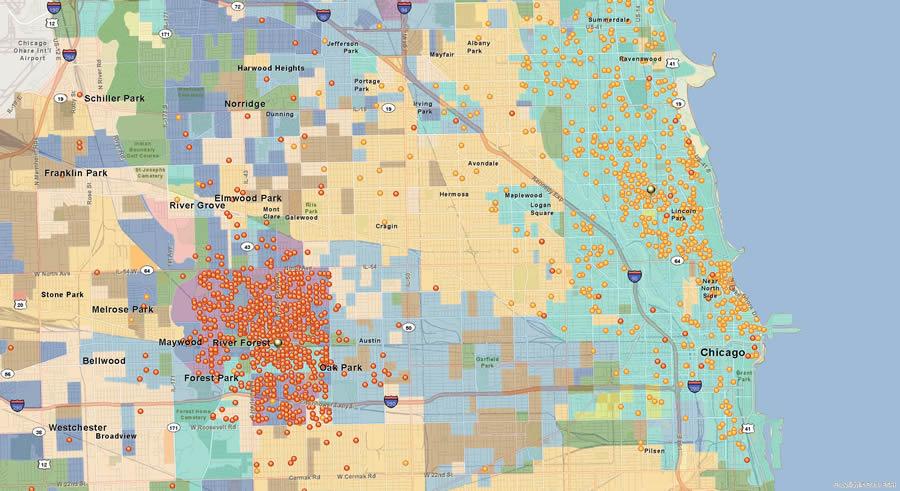

Kueny and his team at Miele use Esri Business Analyst for Desktop to analyze and map the data, overlaying each segment’s lifestyle characteristics (preferences for products including technology, services, media, and activities) with demographic and economic variables to find the types of consumers that best fit the Miele customer profile.

“We are not a product for every person,” said Kueny, who has worked for Miele for 24 years. “Clearly income is not the only variable in deciding whether you are going to spend a huge amount of money on appliances. And even if you are going to spend a huge amount of money on appliances, our design and other characteristics may not necessarily be for you.”

Tapestry data that’s mapped takes into account demographic variables and a multitude of other factors, Kueny said. “By using multiple variables, we start to eliminate certain high income households because we don’t meet their lifestyle profile.”

Who Buys Miele?

Typical customers may be in their forties, have a job that pays well, own a spacious home, and have a lot of disposable income. Or they may be young, urbane, middle-income apartment dwellers with good taste. “No one that rents an apartment is ever going to buy [major] home appliances—but it’s a huge marketplace for us on the floor care side,” Kueny said, referring to Miele’s line of vacuum cleaners and floor care products.

These urbane renters may design a beautiful living space; fill it with high-end furniture and accessories; and therefore, want to keep it clean, stylishly. “That opens up a different perspective to the marketplace,” Kueny said. “[Even though] somebody lives in a modest home or rents a modest apartment, they may have really, really nice stuff inside that apartment—really expensive televisions, really expensive things. Therefore, they become a candidate for one of our really nice vacuum cleaners.”

Tapestry Segmentation reveals the aspirational nature of customers and shows Miele where they live. “Metro Renters [PDF] is one of the big, big segments for us on the floor care side,” said Kueny. “It dominates higher earning Enterprising Professionals [PDF].” Both segments skew young, have a median household income of $51,000 to $77,000 a year, and like to spend money on new technology and gadgets. “They spend it on a value structure that is disproportionate to their actual wealth, and that’s a big variable for us,” he said.

The Lifestyle Factor

Income also isn’t the only determining factor for purchases of Miele products such as ovens, refrigerators, dishwashers, and washers and dryers. Some extremely wealthy people might not be willing to spend money on high-end appliances, but certain groups of senior citizens present a strong market opportunity for Miele.

“You’ve heard the term ‘millionaire next door’—the frugal millionaire? There are people with wealth and income out there who are simply not going to part with it,” Kueny said. “We have other people who are aspirational, who don’t have income at the highest levels, but do want to invest in quality, unique-style [appliances]. Tapestry helps us understand that a lot more effectively and understand where those pockets (of people) are.”

For example, retirees from Tapestry’s Silver and Gold [PDF]segment “still have the same lifestyle characteristics” they did when they were high earners, making them potential Miele customers, according to Kueny.

Tapestry Segmentation helps Miele understand its best customer types and where to find others with similar characteristics.

“Lifestyle really starts to dictate a huge variable for us in terms of purchasing decisions,” said Kueny. “The income snapshot almost becomes a secondary variable.”

The company, therefore, is on the lookout for the type of customer who appreciates Miele design and quality.

“Even if you are going to spend a huge amount of money on appliances, our design and other characteristics may not necessarily be for you,” said Kueny. “Tapestry data takes not only those demographic variables but incorporates those lifestyle variables [into the map layers]. By using these variables, we start to diminish or dismiss a lot of the high-income households because we don’t meet their characteristics.”

Listen to a podcast with Kueny to learn about other ways Miele uses Tapestry Segmentation and Esri software to find customers and decide where to open Miele showrooms.

Miele, Inc., is a subsidiary of the family-owned, German-based Miele & Cie, KG. Its motto is immer besser, which means “forever better.” Learn more about Tapestry Segmentation.