For the first time in the better part of a year, the news about the COVID-19 pandemic is trending somewhat positive. The number of people who have received the vaccine is growing exponentially more businesses are reopening, capacity is increasing, and there is at least some sense of optimism in the market. Recognizing that cases and hospitalizations are rising again, the overall trend is still below where we were last winter and there is reason for hope that the darkest days of the pandemic are behind us. Businesses that were closed or restricted during the height of the pandemic are returning to normal. Consumers are feeling far more confident these days, and travel and discretionary spending are ticking up. According to Bloomberg, the consumer confidence index was up 18.7 points from February to March of this year.

It feels to me like I’ve just been through a yearlong storm of some sort. Now I’m at the point winds have died down and I’m coming up out of my shelter—or home office as the case may be—and starting to look around. My neighborhood has survived the storm, but things are different. In the business world I have a similar feeling of having weathered a storm. And, while things are improving, they are not quite the same as they were.

In my opinion, this is the challenge that we are facing at the moment, trying to assess what just happened, what’s different and what will not go back to how it was in the “before times”. The top priority for business needs to be understanding this disruption that has occurred and what the effects are on the business and their customers. Remembering also that disrupted markets always present new opportunities. How quickly they recognize these opportunities and how fast they can take advantage of them will be a differentiator in the next months and year.

Post Pandemic Business Environment

One of the most profound changes for every consumer-facing business today is the massive shift away from centralized hubs for work, to home offices and smaller local offices. A great example of this, the situation in my own hometown, Minneapolis. Downtown Minneapolis is the primary hub for business in the Twin Cities. Among the defining features of the Minneapolis downtown scene are its iconic skyways. The Skyway System is an interconnected network of enclosed footbridges that connect the office towers and commercial buildings across 80 blocks of the downtown area. It allows people to move comfortably to and from buildings on foot without ever having to go outside. It’s a nice feature to have when the ambient temperature on the street is -30 degrees.

The Skyway has enabled a thriving pedestrian mall all along its route, filled with restaurants and shops. Since it also connects to the regional transportation networks and all the major sports and entertainment venues in town, stores and restaurants in the Skyway enjoy significant traffic, especially during business hours and big local events. Suffice it to say that commercial real estate in the Skyway is a premium.

Pre-pandemic, the downtown workforce was nearly 100,000 people. For the past year, however, downtown Minneapolis—like every other major downtown—has been a ghost town. According to the local paper, the Star Tribune, Skyway businesses have been struggling with daily foot traffic declines exceeding 80 percent. Now we have some companies implementing phased plans to bring workers back to the office, slowly. Skyway businesses will appreciate these moves. But many—including downtown’s largest employer, Target—have announced they are not planning to return to prepandemic levels, remote work is cost-effective and many team members prefer it.

Understanding Changes to the Competitive Landscape

Announcements about continuing remote work have a significant impact on the business landscape, and not just in the downtown hubs. Companies like Best Buy have announced that they are changing the way they configure to make them better enabled to e-commerce. They are investing in new ways to deliver products and services to their customers, reacting to market conditions and customer feedback. This will result in changes to their workforce in every market with a Best Buy Store.

Contraction is not the only story. Some businesses—grocery stores, for example—have thrived during the pandemic. The closure of stores across markets has opened new opportunities for others’ expansion. It’s allowing companies to take advantage of a depressed market to bring products and services closer to their customers.

My point is that while the change brought on by the pandemic is significant, it’s not all bad. There are positive and negative implications for business, and it is critical that companies assess and react. To simply hope that things will return to “normal” and that we can get back to operating as we used to is just not going to work.

Managing the Complexity of Local Regulations and Ordinances

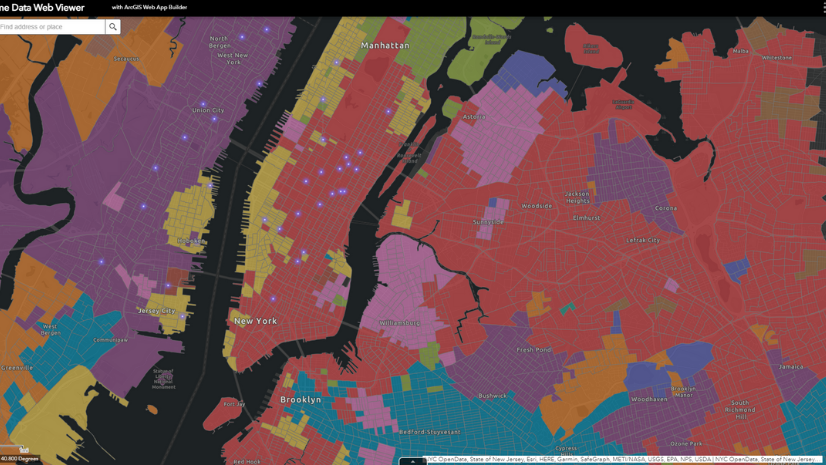

The myriad of local regulations and ordinances imposed on communities in reaction to the pandemic has been especially difficult for business. The inconsistent application of various laws and rules across geographies has created a very complex environment for companies with dispersed operations. Businesses have to understand, at a precise local level, the jurisdictional areas their facilities operate in and what laws apply where. Without an authoritative, geographically focused source for this data—one that is accessible across the enterprise—consistency in compliance across the enterprise is daunting.

There are examples of businesses having to navigate local jurisdictions that we can use as an example. Retailers with regional or national operations, for example, have had to deal with complicated local ordinances about things like product promotions, signage, packaging, and the sale of alcohol and tobacco. During the pandemic, however, things became even more complicated, as a temporal variable was added to the mix. Ordinances were imposed and relaxed and then reimposed based on local virus activity.

Authoritative data can ensure consistency in execution across a company. With a geographic information system (GIS), the precise location of a facility like a store or fulfillment center is joined with data layers that define geographic boundaries like cities, counties, or states. This ensures that laws specific to those geographies are applied in the right locations.

Four Steps to Take Now as Business Improves

1) Put more resources and energy into market research

Market research for business is always important. As the pandemic starts to wane, a top priority for is to quickly understand how the communities where they operate have been affected. To effectively analyze changes at the local market level requires a holistic approach to market research, looking at multiple variables, and their correlations over time. It is critical to understand what the influences are in a market and how they are affecting performance. GIS is uniquely suited to provide these insights because with GIS, location becomes a common reference around which disparate data can be complied and interrogated. Location provides a sort of unstructured join to enable this analysis. ArcGIS, with data tools and machine learning, can expose discrete correlations between multiple geographic variables to inform strategic plans and local tactics. For example, by using human movement data and comparing prepandemic patterns in movement and dwell time with current data, changes in customers movement patterns are exposed. Using spatial analytics and maps, insights about these changes can be visualized and understood and opportunities can be identified.

Another example is updated competitive analysis. Using current point of interest (POI) data will expose insights about how competition has weathered the pandemic. It will show where competitors closed or where new ones may have popped up. With the dramatic decline in commercial real estate prices in many regions, there are going to be many examples of companies, competitive and otherwise, taking advantage of a depressed market to expand their footprint into new areas.

2) Evaluate your current operations from a spatial perspective

It’s not just human behaviors that have changed—revenue streams and income sources have been impacted. Companies have to understand where their revenue is coming from. The effects of the pandemic were inconsistent across geographies. Being able to understand where revenue is strong and where your supply chain is performing optimally is going to be critical to speeding up recovery. With this insight, businesses can refocus resources and optimize operations in areas where they can expect strong returns. They can also see where performance might be lagging and create focused, localized plans to address and mitigate issues in those locations.

Location centric data, like local sales and inventory balance or customer demand, can be combined with geographic attributes like demographic and segmentation data in ArcGIS. This, in turn, can be used to build models and find correlations between performance and geographic attributes. This helps businesses understand why things are happening where they are, and it can inform models to predict performance and anticipate future disruptions.

3) Track changes that are happening in the market

Geography is the science of understanding the world around us. Scientific organizations work to understand things like climate change, ocean currents, and air quality, just to name a few. GIS is the technology they use to do this work. For business, the need to understand the world is no different. GIS offers businesses the same capabilities to capture, measure, and find insights in and about their economic and physical environments. The application of spatial analytics through GIS provides local insights for business that are not available any other way.

For example, a common question for consumer-facing businesses is this: “What are the traffic patterns around my locations?” Traffic data is captured as a numerical value—cars traveling a road, pedestrians walking through a center, or customers passing a spot in a store. It is often aggregated with a temporal value to understand the flow of traffic at a given location over time. As interesting as this data is, it probably wouldn’t be extremely useful to anyone if it were provided in a table format. Unless the audience had memorized the addresses and streets in a market, it would be very difficult to put that information into a useful context. By showing that same data on a map with values reflected in the context of geography and symbology, it becomes much more accessible as an information product.

Example of GIS Combining Location Attributes and Temporal Data

With GIS, analysts can take this a step further and create analyses that go far beyond dots on a map. Here’s an example. A hardware store chain is planning for the spring barbecue season. Staff probably know that spring is the high season for barbecue sales. They also know that local demand peaks during the first few warm weekends of the year. That’s when folks decide to grill outside for the first time and realize that their old grill has become a rusted wreck over the winter (speaking from experience).

The question is, how can the store staff best manage their available inventory and space on the floor to ensure that inventory peaks in the right store at the right time. For a company with stores across the country, this is a bit complicated because spring does not arrive in all regions at the same time. One approach to inventory planning is to front-load inventory in all stores across the chain on February 15. The idea is that we know that in that four-month window, spring will come to every store and the merchandise will sell. Surprisingly this is a pretty common approach in the market.

This solution works, but it is a very poor use of a retailer’s most valuable asset: floor space. If retailers could intersect climate and local weather data with inventory demand, they could stage those bulky units somewhere other than in the store. This could free up selling space for something more relevant to the local market conditions, maximizing turnover and driving sales of more seasonally appropriate items.

ArcGIS can uncover these discrete relationships between location and performance, informing strategy and tactics like seasonal sets—in this case, being able to see how seasonal weather across the country is happening now and compare it to historical weather patterns. Retailers can understand where inventory is selling, and where it is staged, so make smarter decisions about how to peak inventory locally to support seasonal product assortments.

4) Automate the process of informing stakeholders and decision-makers

Disruptions in business are almost constant. To be prepared for disruption and mitigate the effects of disruptions on business, leadership needs to be informed. Using spatial analytics to create triggers and location centric dashboards, stakeholders can have access to exception-based reports that inform and alert when key performance indicators (KPIs) and local conditions indicate something important is happening. GIS can provide real-time, or near-real-time feeds of critical business data. This not only allows teams to plan and manage operations in response to changing local market conditions, it also allows leadership to quickly consume data in a geographic context. Maps, charts and infographics can quickly and accurately relay operational data , improving overall situational awareness and supporting strategic decisions.

Preparing for the Next Disruption

At the end of the day, we all have been a bit shell-shocked by the pandemic. The business world was turned upside-down over the last year. The absolute wrong approach would be to suggest that we can get back to “normal” and continue as we were. While the depth, breadth, and duration of the COVID-19 pandemic was greater than anything I have ever experienced (and, hopefully, will ever experience in the future), disruptions in some form affect businesses constantly. Best-in-class businesses understand this. They build strategies and analyze data that allows them to react quickly to market changes as they occur. For these businesses, change is an opportunity. With the right tools, like GIS, they can capitalize on disruption and drive growth, even when their competition can only react.

Explore more about spatial technology and business resilience. To minimize costly disruptions and thrive when the stakes are high, organizations must use spatial technology to enhance resilience.