Last month, Barnes and Noble (B&N) was recognized in the news for its newfound success in turning around what had been considered a moribund business model: selling books and media. I found it remarkable that small independent booksellers were in the cheering section for B&N. I remember when B&N was the bane of the book market. The perception was that it was out to destroy the corner bookseller and force everyone into a big-box, cookie-cutter version of a bookstore with no local flavor.

Amazon came along and changed the calculus for booksellers. Sometimes it’s hard to remember that Amazon.com started as a bookseller. And as Amazon’s meteoric rise accelerated, it made life miserable for bookstores. Not only Barnes and Noble, but most of the independent bookstores also suffered. At the time, pundits thought it might be the end of the local bookstore. This was true for many national chains, some that I used to like, like Borders and Crown Books.

So what has changed at Barnes and Noble to bring about this remarkable turnaround? According to the reports, Barnes and Noble has pivoted to become a local bookseller first, then a national chain. It has recognized the importance of localization in its planning and merchandising strategies.

Incorporating Localization across an Enterprise

Barnes and Noble has empowered its store teams to make significant decisions about product assortments, store layouts, and store events. Teams have the autonomy to decide what items are featured in their store. Managers are allowed to implement beneficial changes to their stores to meet the needs of the local customer. It sounds simple, but for many retailers, this is a massive change to how they do business.

In a nutshell, what Barnes and Nobles is doing is executing a localization strategy.

Localization has been a bit of a holy grail in retail for decades—and for good reason. The larger a company is and the more outlets it has, the more difficult it is to execute location-specific strategies. The benefits are real, however. We know from studies that local customer experiences build store loyalty and help to drive incremental growth. Incremental sales growth is one critical way for companies to build sustainable growth strategies. Incremental growth is all about doing more with the locations and assets you already have.

Driving Incremental Growth

Before the pandemic, many (not all) of the tier one retailers in the United States had significantly slowed their store expansions. During the pandemic, this slowing growth trend accelerated. We also saw a jump in store closings. Not all closings were bad, however; we saw examples of companies optimizing their physical locations, repurposing them into fulfillment centers and warehouses to support inventory reliability and improve their level of service.

They made these adjustments to react to fast-changing patterns of behavior by their customers. We also saw people become more mobile during the pandemic, leaving urban areas to move out to exurbs and beyond, taking advantage of opportunities for remote work.

For many retailers, available square footage for selling is not expanding. In many cases, it is contracting. At the same time, the demands for growth across financial metrics are as intense as ever. The problem is how do you become more efficient, driving sales and economic growth with existing assets and floor space? How do they drive traffic through existing channels and incentivize their customers to buy more on their trips?

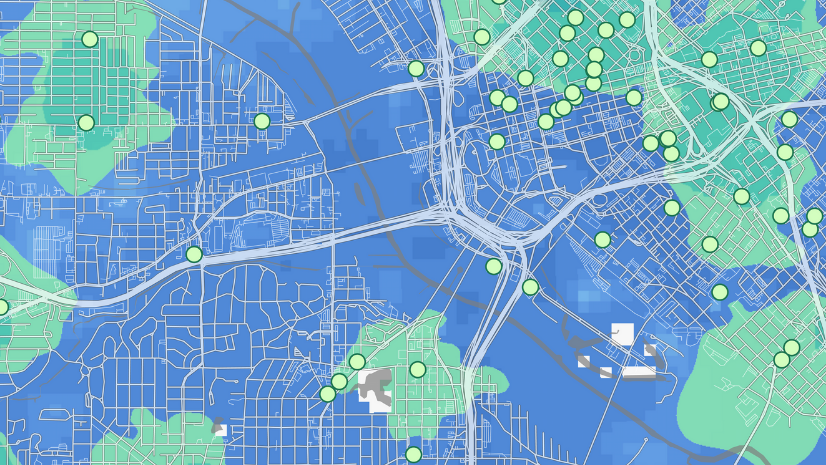

Best-in-class retailers are investing in tactics and technology to acquire new customers. They’re leveraging their customer relationship management’s (CRM) track engagement. As they add new customers, retailers want to understand their preferences and build experiences and product ranges that will keep them coming back. At the same time, they want to understand their existing customers and convince them to increase the frequency of their visits, both digitally and in-store. Barnes and Noble is demonstrating that by making its product offerings in local stores more relevant for the customers in that market. In turn, customers are rewarding the bookseller with sales and loyalty.

Every Category Can Benefit from Localization

The book category ranks very high on the category of categories where localization is essential. I would argue that every business has unique opportunities for incremental growth and that only a location-centric localization strategy can provide the insights needed to realize these opportunities.

Using store teams to inform localization for Barnes and Noble has been successful. Full disclosure: I don’t know what other tools B&N uses to manage its business, but I can say that it will have trouble scaling its efforts if it doesn’t support this new strategy with data and location intelligence. I have enough experience in the industry to know that relying only on store teams to provide local intelligence isn’t enough.

We tried this approach when I worked for a tier one retailer earlier in my career. We quickly found issues with consistency in executing our plans at the local level. Not every manager has the same skills when understanding what might be suitable for their location. I remember a store manager who constantly petitioned the buying office for more swimwear and beach toys because it was “a beach store.” This was a bit of a head-scratcher; the store was in the middle of Iowa. The manager assured us that his town drew a large tourist population in the summer and that the local lake had some very popular beaches. He was sure that the store would sell whatever was sent to it. In hindsight, the store had a few very vocal customers who gave the impression that everyone in town wanted beach stuff. They convinced the store team this was the case, but the end-of-season markdowns on beach and swimming products proved otherwise.

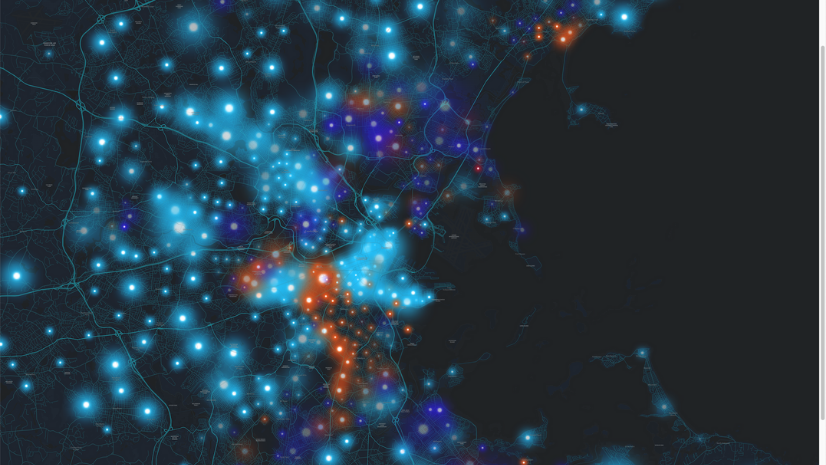

If we had access to location technology, we could have compared the store to similar ones in the chain. We could have tracked local sell-throughs and evaluated product set and movement data. We also could have used human movement data to understand more about the number of people who visited the town during the summer and where they were coming from. This insight would allow us to evaluate demand with data instead of going with what many businesspeople turn to often: their gut feeling. I can confidently say that without data and geospatial analytics, store-based recommendations will be more reactive and less predictive than is needed to sustain long-term growth.

A Data-Driven Approach with Location Intelligence

Every company with multiple locations will have challenges in understanding local markets and their customers, especially to the level needed to drive growth over time. Whether it be 100 stores or 10,000, the challenge is the same. Without an authoritative source for location-specific data and the analytics to interpret it at scale, these businesses will struggle to personalize and localize their business. These days, that’s critical for keeping up with the competition. Barnes and Noble has demonstrated that even modest improvements in gathering local data and reacting to local market conditions can bring significant business improvement. How much more can be realized if geospatial analytics is applied to help drive localization even further?

Bottom Line

I’ve talked a lot in my time at Esri, and even my time at Target, about the importance of localization for retail. We know from study after study that consumers like to have personalized experiences when they shop, regardless of channel. We also know that by aligning products and facings with local demand signals, inventory positions can be more reliable, and customer satisfaction improves significantly.

What I really liked about the Barnes and Noble story is that it validates just how important store-specific merchandising is to drive incremental sales. With the support of location intelligence and authoritative local data, the potential becomes much more significant.

![[Video] Unlocking Customer Insights with the ArcGIS and the CRM](https://www.esri.com/en-us/industries/blog/wp-content/uploads/2021/05/blog826CRM.png)