This is part two of a three-part series about the importance of a spatially fluent workforce.

View: Blog 1 | Blog 2 | Blog 3 (coming soon)

Finding Places and Space to Grow

In the last blog, we wrote about how spatial fluency provides team members with insights into optimizing work, using store fulfillment as an example. In this post, we will be talking about how spatial fluency can reveal how critical the context of a location is to business success when strategizing growth and finding opportunities in a market.

Growth and Location: A Perfect Correlation

Market research is critical for every business, especially those with physical assets like real estate or logistics assets. Understanding the impact and influence of location on performance is often the difference between success and failure.

The science of market research is a fast-evolving space. The speed at which innovations in technology and access to new, more precise data are providing analysts with a much better understanding of their markets is opening up new insights into more discrete attributes and correlations in data. This helps them be more accurate in their forecasting and modeling of future performance.

As companies mature and expand, opportunities for organic growth through physical expansion become more challenging. Markets become saturated, competitive presence becomes more acute, and consumer patterns change, especially neighborhood demographics and movement patterns around fixed assets like stores or warehouses.

However, the need to deliver consistent, sustainable growth does not become any less important just because physical expansion may have slowed.

Financial growth typically comes from three sources: acquisition of new business, new locations, and new customers. This can happen through the opening of new facilities or the acquisition of new markets. Incremental growth occurs by realizing more revenue from existing assets and customers. Improved efficiency is the result of reducing expenses and subsequently improving bottom line performance by cutting operational costs or lowering production or product costs. As we will discuss below, location intelligence is critical to each of these tactics.

Acquisition

Any time a company moves to acquire new locations or moves into new businesses, thorough market research is required. Questions about the viability of the business, market penetration, and consumer demand are all critical and heavily influenced by geography. Understanding demand potential in real estate is an excellent example of where spatial fluency is absolutely vital. With the application of location technology, the capability of geographic information system (GIS) software to consume massive amounts of data and for analysts to use that data to quickly create forecasts and model the business potential of new locations is significantly enhanced.

Incremental Growth

Incremental growth comes when businesses generate more revenue from their existing assets. Those assets can be locations, customers, or products. In the retail environment, this often means providing incentives for existing customers to add another item to their shopping cart or make additional store trips. Typically, this is accomplished by providing customers with more curated product assortments to earn their loyalty and additional business. In this example, location intelligence is companies’ primary tool to better understand who their customers are and what they are likely to purchase.

Improved Efficiency

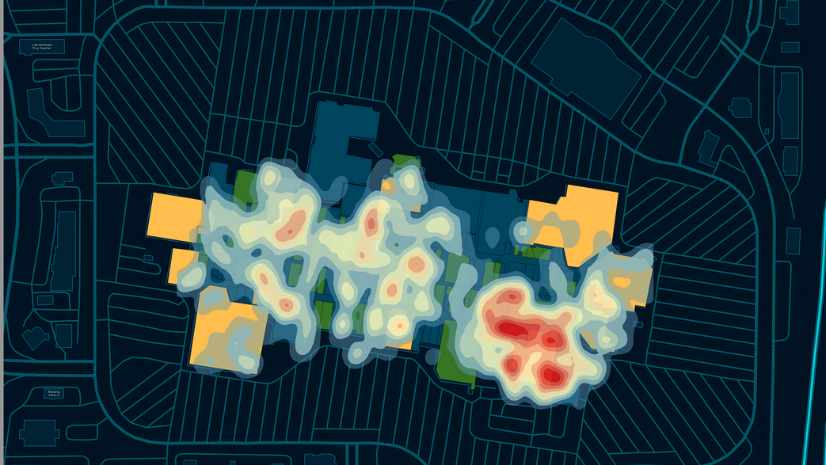

Businesses are always looking for opportunities to operate more efficiently. Cost cutting has a direct impact on the bottom line. The challenge is always how to cut costs while maintaining service levels and the customer experience. There are a number of ways that best-in-class organizations are using location intelligence to manage their operations and costs. Routing algorithms can find the most efficient path through a market, a warehouse, or a store. This saves time and fuel and ensures accurate delivery service commitments, enhancing customer experiences. These companies are also using location technology to manage operations like inventory movement and the allocation of resources to manage high-demand activities when and where they occur. GIS allows them to use predictive analytics to learn what attributes might trigger changes in customer behavior or to mitigate issues in supply due to external events.

Risk Mitigation

Risk mitigation doesn’t fall into the sales growth category of core business capabilities, but having a robust plan to address issues before, during, and when they occur has a direct impact on business performance and, more importantly, customer and team member safety. For decades, location intelligence has been a core technology for organizations with a focus on public safety. Those same capabilities delivering operational awareness to law enforcement and security-focused organizations are also used by companies to protect their physical and personal assets. They provide insights into where issues might arise, and they allow monitoring that enables centralized allocation of resources to migrate issues when they occur. They also facilitate data management as evidence and event data are collected and assessed. This aids in recovery efforts, helps improve understanding and awareness of the geographic attributes that might indicate vulnerabilities, and provides insights into where best to deploy resources to mitigate future events.

Localized Enterprise Operations

The techniques and requirements for market research have evolved considerably over the last several years as new data sources and analytics have been developed. These new tools enable practitioners to take a more holistic approach to analysis. Thanks to GIS, they can bring more data into their analytics, including datasets that are often disparate and seemingly unrelated. GIS uses location as a key to create an unstructured joint between these different data sources. This allows practitioners to interrogate these sources and find discrete correlations that can provide unique insights into why things happen where they do. They bring deep insights into market conditions that influence business activities while uncovering patterns in the data that can support the core capabilities needed to drive growth.

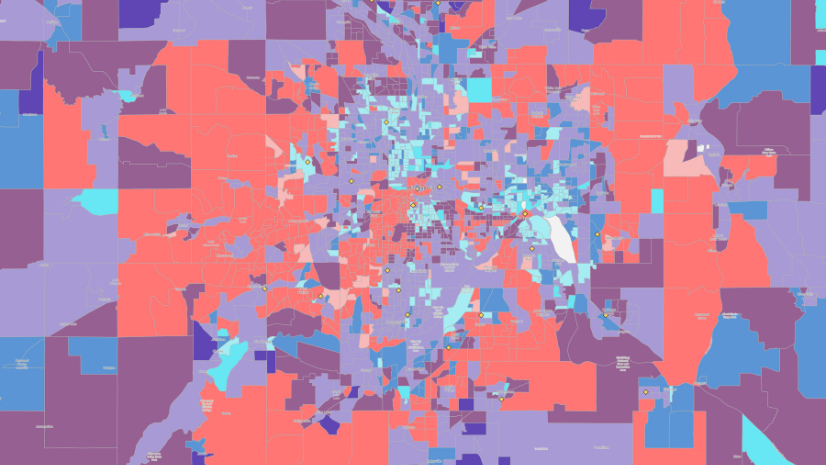

Standard market research typically uses population characteristics, income, and home ownership data. Community-level data about buying habits and preferences is included, as is the geographic proximity of variables like competitors’ locations, transportation networks, and even the location of parks or shopping centers. These geographic attributes are used to try to understand and predict business activities in a given area. Everything from customer behavior to market growth patterns is considered in these analyses.

While this data is still critical, it can now be augmented with datasets like human movement, real-time traffic and weather, and even internally generated data like customer loyalty and transactional data from stores and fulfillment centers.

The correlations that geospatial tools enable analysts to find today once required heavy number crunching combined with sheer luck. Only a few years ago, business intelligence analysts used the standard scientific method approach. They would create a hypothesis about the cause of a business problem or the viability of a new opportunity, pull data, then run the analytics to prove or disprove their hypothesis. But this process was inherently biased because the data scientists were, by human nature, often prescreening the data they were pulling in their analysis. For many, this was a matter of optimizing their calculations, given the limitations of the tools they had at hand.

Now, with AI, the number of data sets that can be used in a given analysis is almost unlimited. Even more importantly, today, the tools don’t just provide confirmation or refutation of a hypothesis. The game changer with modern AI is the tools’ ability to recommend other questions and find answers that even analysts may not have considered in their work.

Find New Opportunities in a Saturated Market

Imagine a logistics and delivery company in the Pacific Northwest looking for new opportunities to grow its business in a crowded market. A simple look at the “dots on a map” of the company’s facilities and competitors indicated that the market was saturated, with no opportunities for new growth.

Taking a deeper look using advanced business intelligence powered by spatial technology, a different picture emerged. When the company’s GIS team looked at how people moved in and around the market—where they traveled to and from as they went from home to work, school, and play. The assumption was that proximity, primarily to home and work, was critical for determining where people shopped and did business. However, the data told them that while proximity to home was a key factor, proximity to other services was also very important for many trips. Their demographic and lifestyle segments highly influenced the type of service or store that motivated people to travel.

Using advanced analytics in ArcGIS, combined with demographic affinities that could be inferred by location, the team found they could build more precise catchment or trade areas for capturing customer behaviors. The company already had built target customer profiles based on its products. They knew from their CRM who their best customers were and where they lived. Using human movement data, they could add aggregated customer trips to their data. This allowed them to do a holistic market analysis focusing on specific customers. That analysis exposed some seams in their market where their best customers were not being served, including examples of locations that would box out competition by providing closer options to a concentration of high-value customers.

This case study shows how applying geography and geospatial analytics, combined with big data, can help businesses grow—even when conventional analysis cannot identify opportunities.

Integrating Spatial Fluency in the Workforce

The last two articles on spatial fluency examined the importance of developing spatial fluency in the workforce. We outlined examples of how geospatial analytics present a transformative approach to understanding market dynamics and driving growth. By leveraging location intelligence, businesses can unlock hidden opportunities, optimize operations, and mitigate risks effectively. The evolving landscape of market research powered by GIS and advanced analytics enables organizations to make data-driven decisions with unprecedented precision. As businesses navigate saturated markets and seek sustainable growth, spatial technology emerges as a crucial tool for uncovering insights that traditional analysis methods may overlook. Embracing spatial fluency enhances strategic decision-making and paves the way for innovation and competitive advantage in today’s dynamic business environment.

The next article will discuss how achieving a spatially enabled workforce is now possible and a requirement for success for small and large businesses.