A Retail Systems Research (RSR) Benchmark Report

Retailers and their vendor partners in the consumer packaged goods (CPG) segment have been working together for decades to create compelling assortments and products for their customers. While the end goal of their partnership is aligned—meeting consumer demands and growing business—the two sides in this relationship often approach this goal from divergent perspectives. They come with different expectations of how they can meet the needs of their customers and each other.

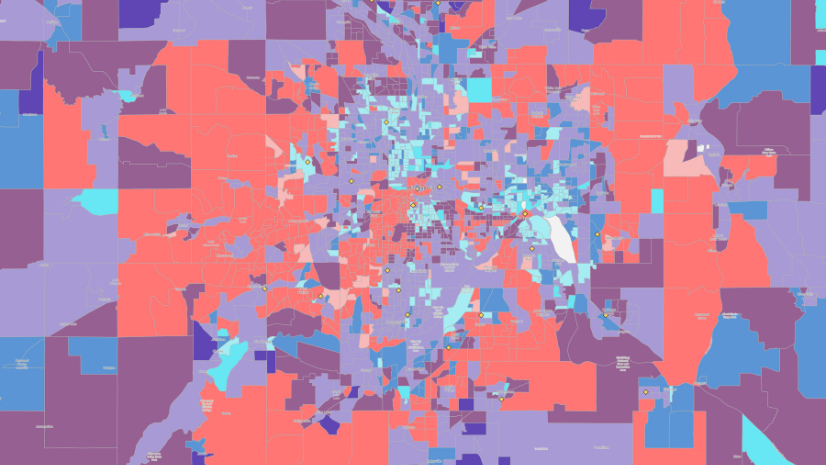

This the newest report from Retail Systems Research (RSR): “Retailers vs. Consumer Packaged Goods Companies: Worlds Apart?”. It explores how geospatial technology is utilized by both retailers and CPG companies to find insights about supply chain management, consumer preferences, product range, and inventory management.

One of the key findings in the report is that retailers and CPG vendors need to share data and work together. Thankfully, there is broad agreement about how important this is to their combined success. That said, there is significant differentiation between which parts of the business each side focuses on, and even more importantly, significant differentiation between where and how successful companies, or “winners” in the report’s lexicon, are investing and using technology to meet their different needs for analytics in order to support their business and serve their customers.

A 2024 benchmark study from Retail Systems Research (RSR) explores how geospatial technology is being used by retailers and CPG companies. Access the report by clicking the image below.

It’s Complicated

The relationship between CPG and retailers is complicated. Retailers, by any metric, own the most important part of this relationship: the actual connection with the consumer—the end user. They need the help of their CPG partners to understand their product, distribution, and fulfillment strategies to put the product in the consumer’s cart and make the sale.

CPG are desperate for consumer insights, including data about who customers are and what they’re buying. They use this to inform their strategies for product development, distribution, and marketing.

This relationship has traditionally required a trusting relationship where data about sales and logistics is shared between the CPGer and the retailer. In the last several years, there have been significant changes in this relationship. And, while the value is still there, some caution around the idea that information exchange is affecting how they work with each other. CPG companies realize that their data may be helping their retail partners develop better private-label products. The concern is that these products directly compete with their products, bringing the retailer richer margins and stronger loyalty. For their part, retailers are concerned about sharing too much customer data, as CPG can use this to develop stronger direct-to-consumer (D2C) channels that bypass the retailer all together.

Both sides need to remember they have the same goals. By sharing data and building stronger product assortments across categories, they’ll both do better. As the saying goes, “a rising tide raises all boats.”

The Power of Location Intelligence

For the last several years, RSR has researched the role of geospatial technology as a critical tool for retailers to understand who their customers are and how they interact with their brands. They’ve tracked a growing correlation between successful retailers and those who recognize the importance of location intelligence to their business. This report finds that the value of location intelligence extends beyond customer engagement and into inventory management and supply chain logistics. The value of an authoritative source of location-specific products’ attributes, shared between CPG and retail, is a differentiator for successful companies. On the contrary, companies that do not value location intelligence over-index in the “others” or not-so-successful company respondents.

Key Findings in the Study

- Overall, retailers and CPG providers recognize the importance of customer data and analytics tools, and how critical it is to invest in their capabilities. However, even the best-performing retailers are critical and suspicious of their supplier counterparts’ actions, and vice versa.

- CPG providers showed a strong drive to use customer analytics as key inputs in merchandise planning. Eighty-one percent of CPG winners expressed a desire to use customer analytics, compared to just over half of retail winners. CPG winners see customer analytics as a competitive advantage.

- Both retailers and CPG providers identified gaps in understanding in stores that hindered their ability to respond to changing conditions. They shared a vision of investing in analytics capabilities to overcome these roadblocks, but CPGers had a stronger version of this vision. Seventy-five percent of CPG winners believed it was the best way to make progress, compared to 52 percent of retail winners.

- The best retailers showed a strong interest in technology enablers. However, retailers did not have the budget allocations for near-term changes. Over 60 percent of CPG winners planned and budgeted changes for optimization technologies (price, promotion, assortment, and space planning) and external data (competitive metrics, market metrics, environmental data, etc.) to improve forecasts. CPGers wanted to be included in information that their retail partners likely already possessed but had not shared openly.

The Bottom Line

RSR has been studying how retailers perceive the importance of location to business success for four years. In that time, they’ve seen a significant increase in retailers’ perception of the value of this data.

They’ve found that trust is critical and, to no surprise, how data quality is essential to success and building a great partnership between these two sectors. One finding indicated that newer brands and product labels are building partnerships with retailers and using new data and location technology. This has successfully positioned them to take market shares from legacy brands using old data and methodology, and are comfortable with the status quo.

—–

You can view a preview of the report before you download it on the reports landing page.