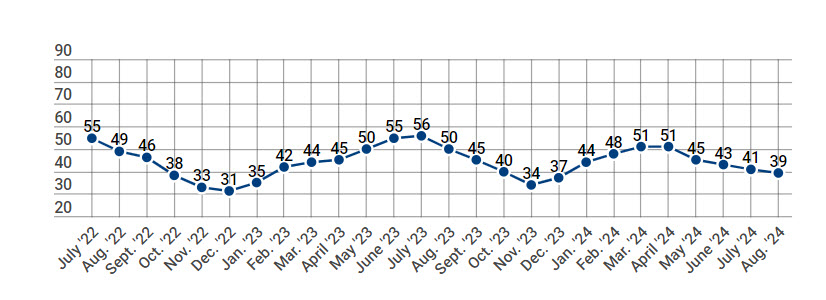

For decades, the U.S. Census Bureau has published monthly reports about residential construction statistics. There is another metric that has been getting increased notoriety in taking the current pulse of America’s housing market. Since 1985, The National Association of Home Builders has published the Housing Market Index (HMI) on a monthly basis, which reflects overall builder confidence in the housing market.

The HMI is derived from a monthly survey of single-family residential builders who are asked to evaluate three key aspects of the housing market: the current sales of new single-family homes, the anticipated sales of these homes over the next six months, and the level of traffic from prospective buyers of new single-family homes. These three HMI components are rated in an index with a threshold of 50. In August, builder confidence fell to a rating of 39, the lowest number in 9 months. This also marked the fourth straight month that rating has declined. Current sales conditions dipped to 44 and traffic of prospective buyers declined to 25. For more than the last two years, these readings have been on a roller coaster, but the HMI has rarely gone above 50 and has only maintained that threshold for a maximum of four consecutive months (out of the last 26).

For perspective, during the six months leading up to April 2020 (first month after the pandemic hit the U.S.), the HMI ranged from 71 to 76. The HMI was flourishing in 2021 and the first half of 2022 peaking at 84. Since July of 2022, it has never exceeded 56.

The Smoking Gun(s)

It does not take a world-renowned economist to identify that the key culprit of buyer (and developer) hesitation is the elevated interest rate. That cannot be the only problem, though. Housing affordability was a critical issue before interest rates rose a couple of years ago. Much of this was driven by lack of supply and supply chain issues brought about by the pandemic.

So, as a planner, community development director, or municipal leader, you cannot fall into the trap that today’s housing affordability crisis is strictly an interest rate issue and, therefore, out of your hands. When interest rates drop, the lack of supply, as seen in the anemic housing starts and building permit numbers for well over a year, will rear its head again. This is likely to cause a similar spike in prices as we saw in 2021 and 2022 when supply cannot keep up with demand.

Affordable Housing Policy Starts with Location

Planners and municipal leaders are directly involved in housing policy for their city or county. Policies and zoning ordinances that were put in place in prior to the 2010s are unlikely to meet the needs of current and prospective residents. Today’s generation of homeowners typically do not want access to exclusively single-family homes on large lots. The appeal of a middle housing alternative, such as townhomes, duplexes, and cottage courts, is strong because of both lower cost and maintenance.

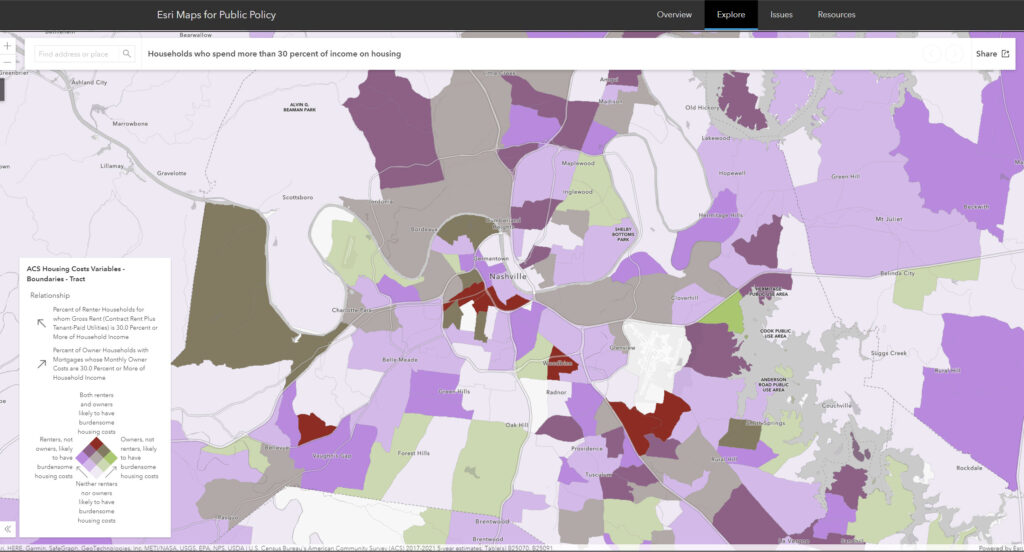

The first step in policy development is to gain an understanding of community needs. A free resource available to help determine this is the Esri Maps for Public Policy app in the ArcGIS Living Atlas. With over 800 curated maps, including 200 focused on housing, this app is an invaluable resource in taking a data-driven approach to policy development. Some of the questions these maps help answer include:

- Are college-educated householders more likely to rent or own their housing?

- What is the predominant number of units per housing structure, not including single-family detached homes?

- Where are the owned, rented, and vacant housing units in a specific neighborhood?

- What is the relationship between median housing age and cost-burden housing?

- Where are the households who spend 30 percent or more of income on housing?

A Geographic Approach to Implementing Affordable Housing

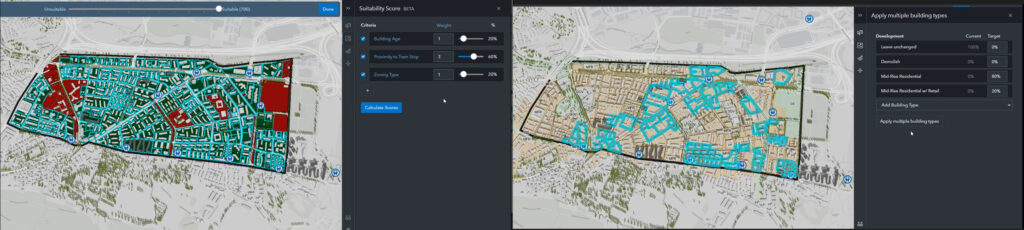

With an understanding of residents’ needs and struggles, planners can move to suitability analysis for affordable housing. Again, a data-driven approach is necessary because even the phrase “affordable housing” can trigger an unhelpful political discourse. In other words, the specific sites for affordable housing cannot be derived from anecdotal evidence or your feelings as a planner as to where it should be.

Tools within ArcGIS Urban allow planners to run parcel suitability analysis for a neighborhood or entire city. Which factors are involved and how the suitability is measured is up to each municipality. Some common suitability metrics could include access to groceries, retail, education, and health services, transit options, ideal zoning regulations, parcel size and structure, and vacant lots with potential for purchase agreements.

This data-driven geographic approach changes the narrative in a municipality. The discussion changes to one that can definitively state, “We need affordable housing units in these locations, because of proximity to jobs, transit, neighborhood revitalization, etc.”

Policy is fine…but what will it look like??

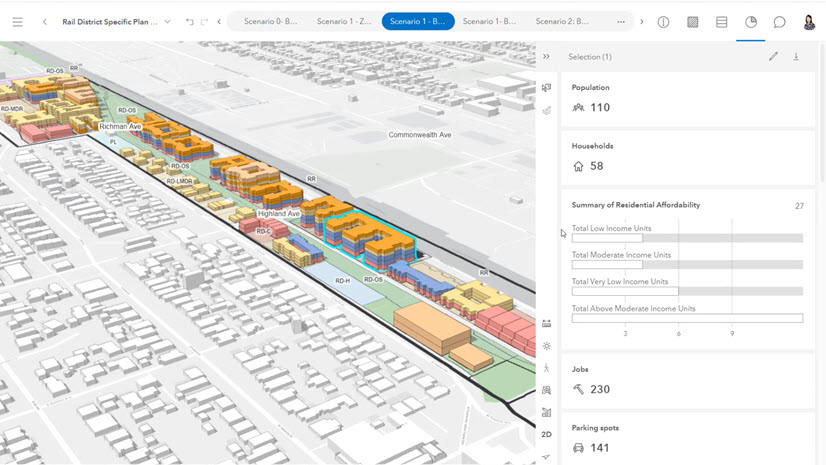

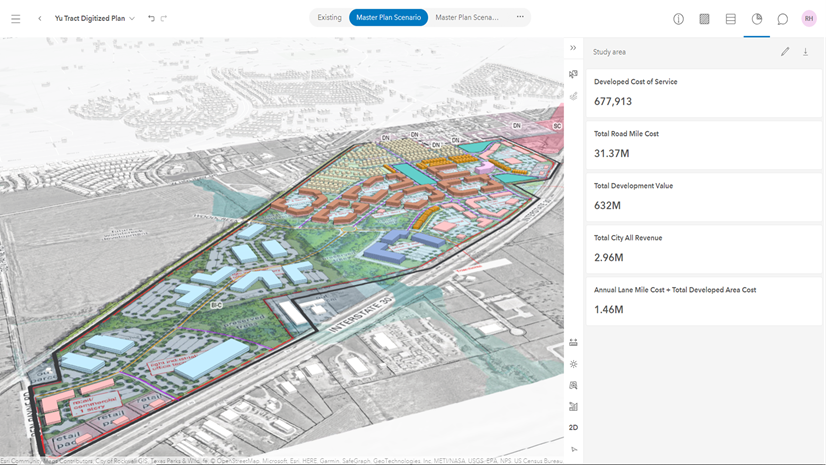

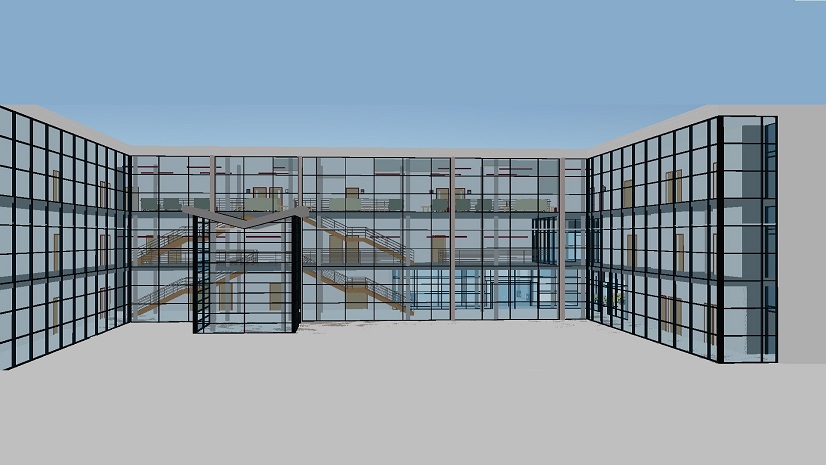

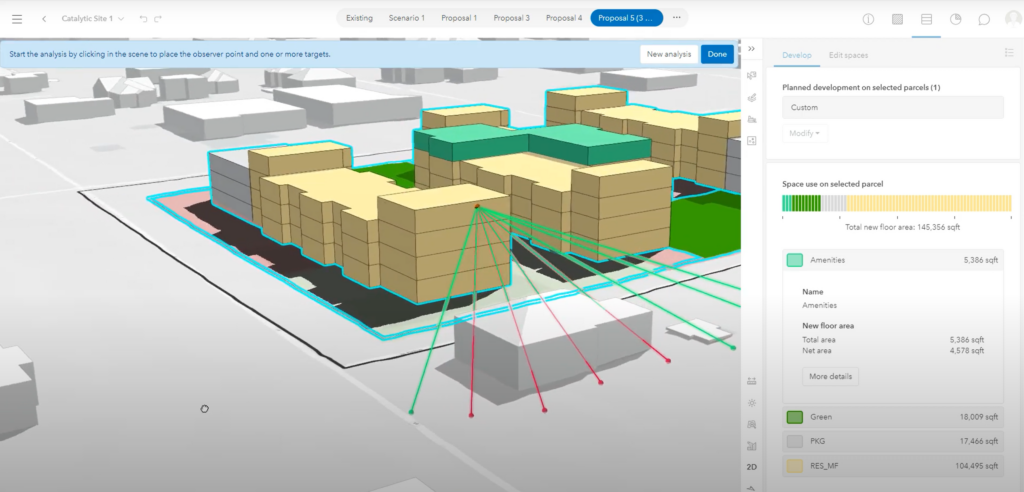

Finally, the design work can begin. Using ArcGIS Urban, planners can collaborate with developers to design housing and mixed-use developments that meet the needs of residents, while also being feasible and profitable for developers. This iterative scenario planning is a quick and cost-effective approach for planners and developers. They can both rapidly view the results of subtle or large changes and answer questions such as:

- Do we have the zoning regulations in place to accommodate mixed-use or more compact, walkable communities? If not, what parameters (e.g. FAR, parcel coverage, permitted uses, building height, etc.) would that zone need to have to accommodate developers’ and residents’ needs?

- If we add a single floor to a development, how many more residents will this add? How many jobs from office? From commercial?

- What is the impact for a proposed development regarding tax revenue, utilities, transit, etc.?

- Will the development have issues involving line of sight and/or shadow impact that will negatively impact resident sentiment?

- How many potential units can we create if we require 10% of new homes in a district to be designated as affordable units? What would the fiscal impact be on the developer?

Conclusion

There is no simple fix for addressing affordable housing. There are also parameters that are outside the control of planners, city administrators, and elected and appointed officials. However, these same leaders must put policies in place now that motivate and incentivize developers to meet the needs of residents. By leveraging GIS, planners and administrators can take a data-driven approach to identify suitable locations for affordable housing and work with developers to design developments that meet both community needs and market demands. This geographic approach not only helps in making informed decisions but also changes the conversation around affordable housing from one of uncertainty to one backed by evidence and sustainable strategic planning. As the housing market continues to fluctuate, proactive, informed policymaking will be essential in ensuring that communities can thrive and remain accessible to all residents.