We are living in truly remarkable times. We’re witnessing a fundamental shift in business culture at the executive level firsthand, with a greater emphasis on sustainability and resilience. Some of the most prominent leaders in the Fortune 500 space, like Jamie Dimon from JPMorgan Chase and Larry Fink from BlackRock, have clearly signaled to their stakeholders that they are prioritizing longevity and sustainability over short-term profit maximization—a stark departure from the old ways of doing business. However, one of the greatest challenges facing companies today is how to become more purposeful in their investments toward a more resilient future. At the heart of this is understanding how business resilience plays a strategic role in creating new value for a company beyond simply managing risk.

The Duality of Business Resilience

You’ve undoubtedly come across the term business resilience, which has become one of the top trending corporate buzzwords over the past two years. At first glance, business resilience invokes conventional risk-oriented workflows like enterprise risk management, security operations, or business continuity planning, and these are all certainly fundamental components—but there’s far more to the story than just risk.

These traditional business functions have historically been viewed as static cost centers within a business, oftentimes struggling to obtain necessary funding for enterprise-wide investments. The simple truth is that many executives have historically shied away from spending money to potentially avoid a crisis, instead focusing on spending money to make more money. So, what’s changed?

The onset of the COVID-19 pandemic highlighted that today’s interconnected global economy is far more vulnerable to tectonic shifts than previously imagined. However, despite the widespread economic impact, many companies started posting record-breaking revenue growth just four months after lockdowns began. These were companies that had proactively invested in resilient business processes than empowered line-of-business leaders to quickly adapt and pivot core business functions to meet new requirements and fulfill new market needs.

At its core, business resilience is a growth-oriented business function, and it’s more than just one strategy or team that achieves it. Business resilience is a continuous cycle of overlapping strategies that enable an organization to effectively identify, analyze, and mitigate the effects of an emerging disruption, whether the source is climate-driven, economic, or political in nature. This is where the concept of resilience transcends the conventional understanding of risk management and mitigation, because although these are fundamental components of a resilient business strategy, they are ultimately worthless if they don’t drive actionable business results.

The Pitfalls of Resilience Theater

You may be familiar with the concept of security theater, where additional investments made to enhance security processes create the illusion of greater safety but ultimately produce little tangible value or even hinder security in the long run. Bruce Schneier notably coined this phrase to describe the state of the Transportation Security Administration (TSA) in the aftermath of the September 11 terrorist attacks and his growing skepticism of technology like full body scanners to prevent future plots against airliners. The same is true today with many investments in business resilience, leading to many companies crafting a false or inflated sense of stability in the face of increasingly frequent and disruptive events like natural disasters. Ultimately, when a crisis or disruption does inevitably emerge, the business is not prepared to quickly adapt its core business functions to thrive in the new environment—creating higher economic costs in the long run.

Resilience theater is more common than many executives wish to admit, and increasing budgets doesn’t necessarily fix the core issue. The reality is that it’s less about the amount that’s spent on technology and capabilities and more about how that technology helps expand on the capabilities of a multitude of teams. In my experience, this is oftentimes the result of three pitfalls: businesses stopping at monitoring and reporting, resilience strategies overgeneralizing and not addressing the hyperlocal impact of disruptions, and risk-driven insights being siloed away from non-risk teams—all of which can be greatly reduced when approaching resilience from a spatial perspective.

1. Monitoring and reporting are a means not an end.

Although monitoring, analyzing, and reporting on risks are essential to the foundation for business resilience, they are not ends in themselves. Organizations need to constantly monitor for emerging disruptions to respond to minimize the impact. Additionally, without analyzing and measuring risks, businesses could not implement mitigation efforts. However, far too often, point solutions for monitoring threat feeds are seen as stand-alone investments that don’t feed into broader executive awareness. For example, nearly every major company utilizes a type of security operations center (SOC), which typically houses risk and security professionals who are monitoring multiple data feeds at once. This crucial step falls short of its main objective if the insights derived from a SOC don’t augment the decision-making process for line-of-business leaders.

2. Business resilience must be democratized throughout the enterprise.

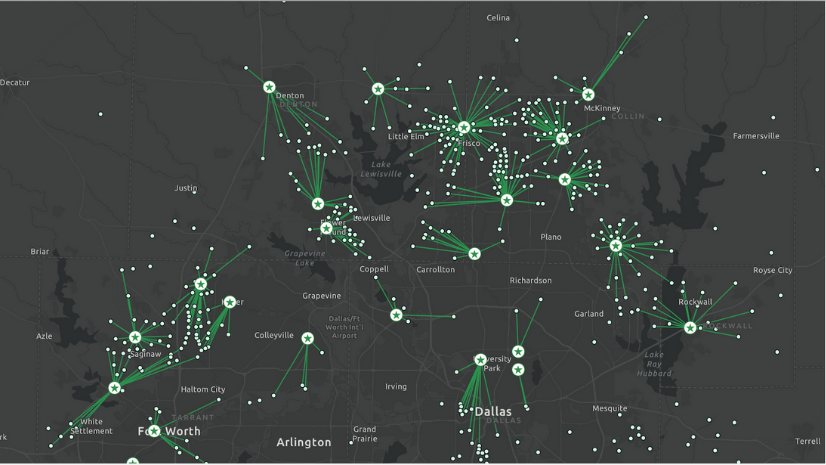

The true value of risk-driven insights comes when they are democratized throughout an organization, embedded directly into the operational planning and management of core business strategies—from market planning to production and fulfillment. During the COVID-19 pandemic, for example, a major US-based retailer utilized location intelligence to stand up a threat dashboard that analyzed the spread of the virus in relation to core business activities. Although the primary objective was to increase health and safety, non-security leaders in the company began utilizing the information to guide their own decisions, providing greater context to their market intelligence.

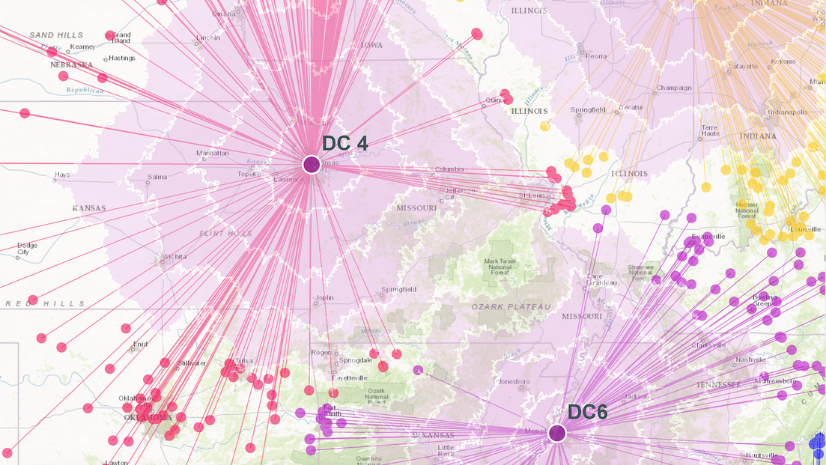

3. Understand the hyperlocal impact of an event.

The adage for sustainability of “think globally, act locally” has a lot to say about understanding the need to scale a resilience strategy down to individual business sites. Risk-derived insights need to address the hyperlocal impact of a business disruption, guiding greater contextual insights for decision-makers who need to understand how their operations will be impacted. In one such example, a global manufacturer needed to understand how various climate change models would impact its supply chain and where key checkpoints could emerge from sea level rise or larger scale tropical storms. By addressing the problem from a spatial perspective, the manufacturer could visualize which areas would be impacted the most by climate-driven disruptions, revealing vulnerabilities that would have otherwise been missed. This enabled the company to invest in site-specific mitigation efforts that would have a greater impact on the longevity of its entire supply chain.

Harnessing the Power of Location Intelligence

Location Intelligence is the language of contextual analysis, an enterprise-wide strategy helping decision-makers extract meaningful insights from massive amounts of disparate data sources. With respect to business resilience, spatial thinking can reveal previously hidden risks that are inherent in core business processes, contextualizing how customers and programs are impacted to guide more effective decision-making. This was a key element to success for many companies during the COVID-19 pandemic, leading to a more competitive market position by empowering businesses to meet the new demands of affected markets before the competition.

Over the next few decades, businesses will continue to face increasingly frequent and severe events, from climate-driven disruptions to political and economic shifts. The only way businesses can thrive in that climate is to redevelop core business strategies to be more inherently resilient, establishing an adaptive foundation based on an enterprise location strategy. By doing so, businesses will get ahead by seeing the potential impact of risk on their customers and projects in a way other firms can’t.