In March, the Securities and Exchange Commission (SEC) adopted the US’s first national climate disclosure rules, requiring public companies to report climate-related impacts and risks to business operations and strategy.

The controversial ruling, which attracted the most comments in SEC history, has ended up in court. However the case plays out, the verdict is already clear for many CEOs: climate risk transparency is the new reality.

The SEC initiative comes on top of the European Union’s 2023 sustainability reporting rules, as well as California’s climate disclosure bill, signed into law the same year. Executives are taking notice of the trend and adding tools and talent to their organizations to strengthen climate risk analysis and reporting capabilities.

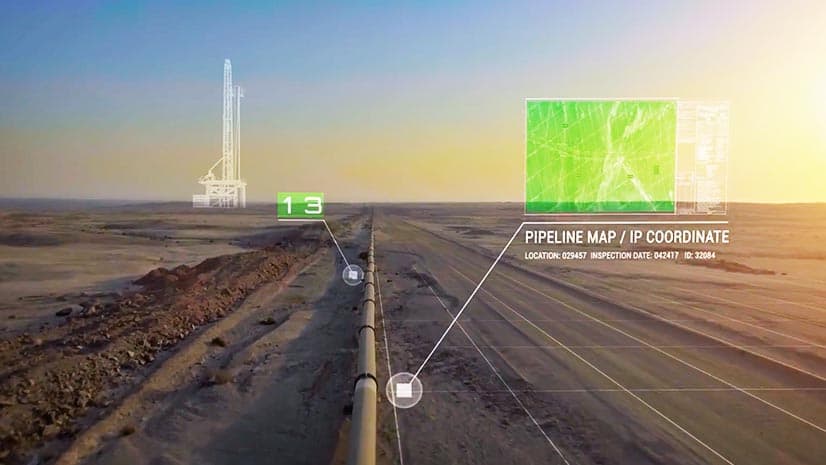

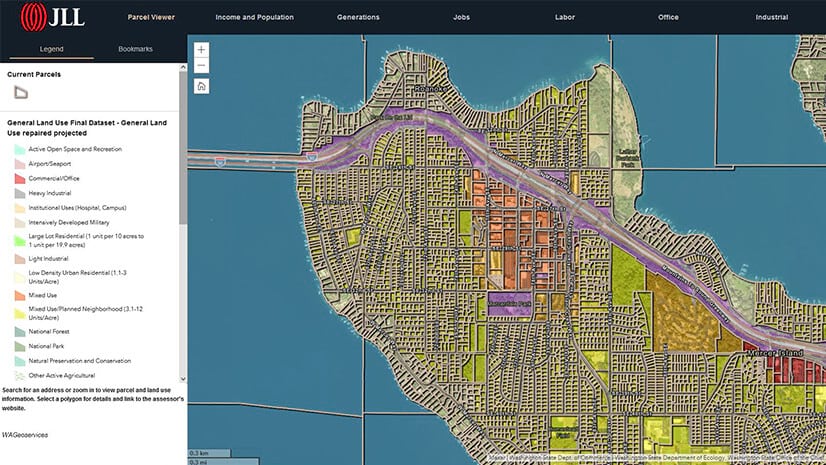

Evaluating climate risk requires a strong grasp of geography. It’s impossible to measure a cell tower’s level of exposure to coastal flooding, or a retail store’s vulnerability to hurricanes, without analyzing and understanding critical datasets about the location of those assets and threats. Geographic information system (GIS) technology is helping business leaders gain the spatial perspective needed to anticipate the impacts of climate hazards.

Combining a centralized system of data collection with the visual medium of maps, GIS gives compliance officers quick access to accurate information for reporting requirements.

Comprehensive Climate Disclosure, Across Space and Time

For many businesses, GIS-driven location intelligence already guides efforts to mitigate climate impacts and increase resilience—another element the SEC would require firms to disclose to investors.

If the rules go into effect, affected companies will have to disclose costs incurred from climate-related damage, Scope 1 and 2 emissions, plans to mitigate climate risk, and related costs such as renewable energy systems or carbon credits.

For business leaders anticipating the outcome of the SEC rules, GIS analysts can create dashboards that layer climate data over a basemap of company assets and operations. Such a map might show warehouses, equipment like heavy machinery, shipping routes, retail stores, or vehicle fleets, as well as trends in extreme weather like flooding, wildfire, or excessive heat.

Using location technology, a compliance officer could select a past year from a drop-down menu and view specific incidents of storm damage at company facilities. Clicking a link in the map could take the employee to data and information about financial losses caused by those events.

Businesses would also need to report information gleaned from predictive models of climate risks. Companies ranging from major telecommunications firms to a government-backed mortgage buyer use GIS to chart how climate threats may impact their operations in the future. Such models can distill many factors—climate projections, location, event histories from comparable areas—into a threat outlook that simplifies the process of disclosing risk information.

Tracking Resilience and Reduction

In addition to risk reporting, the pending rules require certain companies to disclose their impacts on the climate through Scope 1 and 2 emissions. Under that regulatory microscope, business leaders might feel pressure to ramp up reduction efforts.

For businesses using maps to guide the placement of solar arrays or discover energy efficiencies on a corporate campus, GIS is a single source of truth for information on mitigation efforts—data that can be easily gathered and communicated to regulators.

As companies adjust to rules like the SEC mandate, there will be growing pains. Business leaders may need to upskill employees and dedicate new resources to tracking climate change’s effect on operations.

The goal of most executives is to ensure compliance without incurring significant costs. That makes GIS—which is already in use at many firms—a valuable technology for analyzing and sharing climate risk data internally and externally.

The Esri Brief

Trending insights from WhereNext and other leading publicationsTrending articles

December 5, 2024 |

November 12, 2018 |

July 25, 2023 |

February 1, 2022 |

March 18, 2025 |

May 28, 2025 |