Wendy Keyes is a data scientist with a doctorate in behavioral economics, so she’s well-versed in the psychology behind business decisions. After 17 years teaching statistical modeling and economic trends, Keyes left academia to become a consultant to some of the world’s largest companies. Now a member of Esri’s advanced spatial analytics team, Keyes blends a keen knowledge of business strategy with a deep understanding of emerging technologies.

Through a mix of dialog, demos, and video, she speaks here with Brian Cross, head of Esri’s Professional Services division, about the rise of GeoAI and the executives who use it to simulate business scenarios and plan smarter investments.

What Is GeoAI?

Brian Cross: Wendy, could you start by helping everyone understand what we mean by the term GeoAI, and how it relates to a Fortune 500 business?

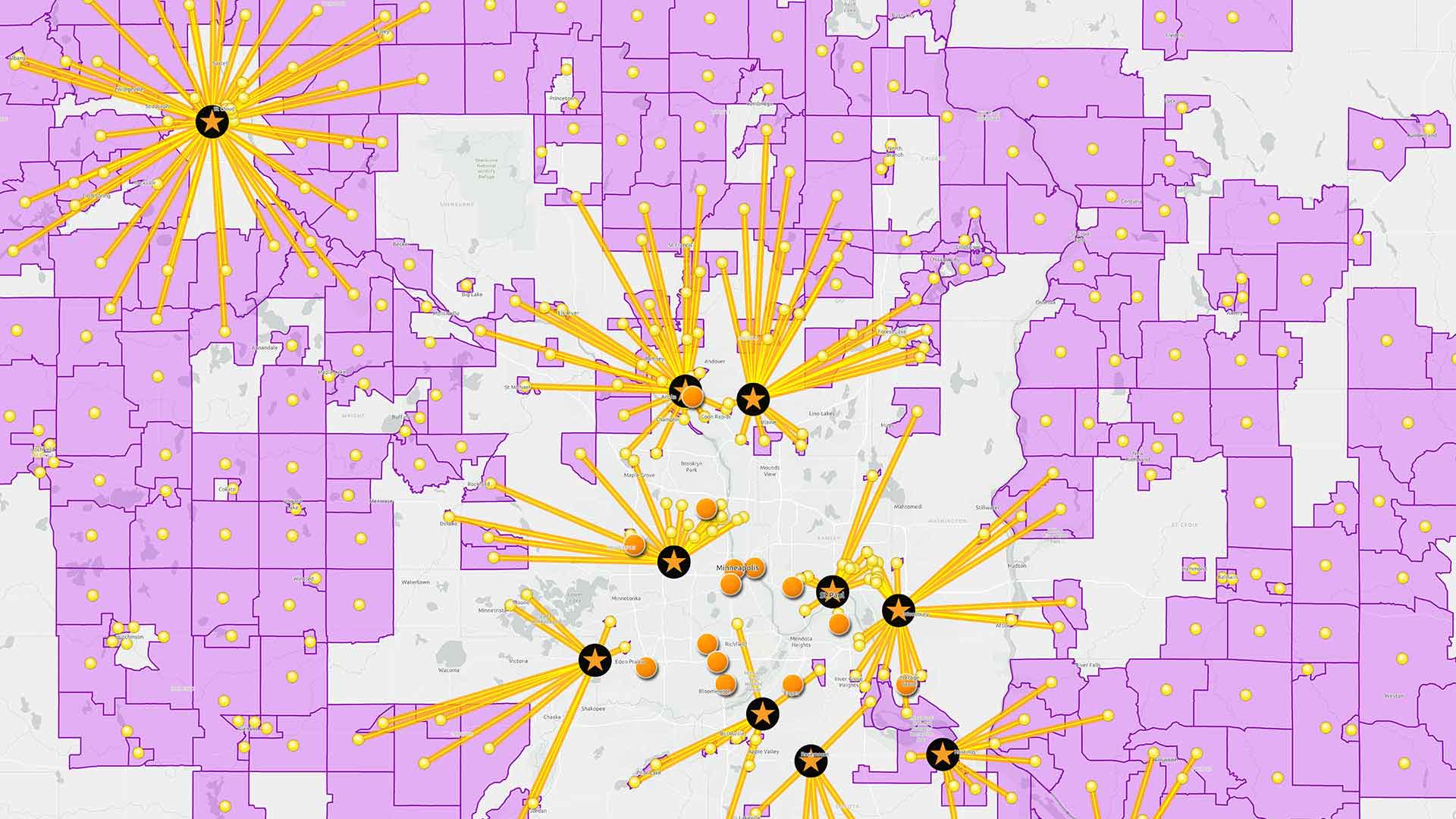

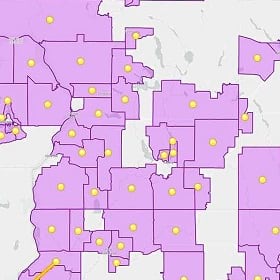

Wendy Keyes: GeoAI is geospatial artificial intelligence, and it’s a kind of artificial intelligence or machine learning that’s used to simulate future outcomes. It runs on GIS technology [a geographic information system], and it often draws on statistical modeling, computer vision, and simulation tools.

Companies using GeoAI might be interested in market planning, site selection, price optimization, product selection, or asset maintenance, and they’ll analyze a variety of data:

- Sales transactions

- Human movement patterns [learn more]

- Demographic and psychographic information [learn more]

- Economic conditions—inflation rates, business expansion, unemployment

- Asset maintenance records

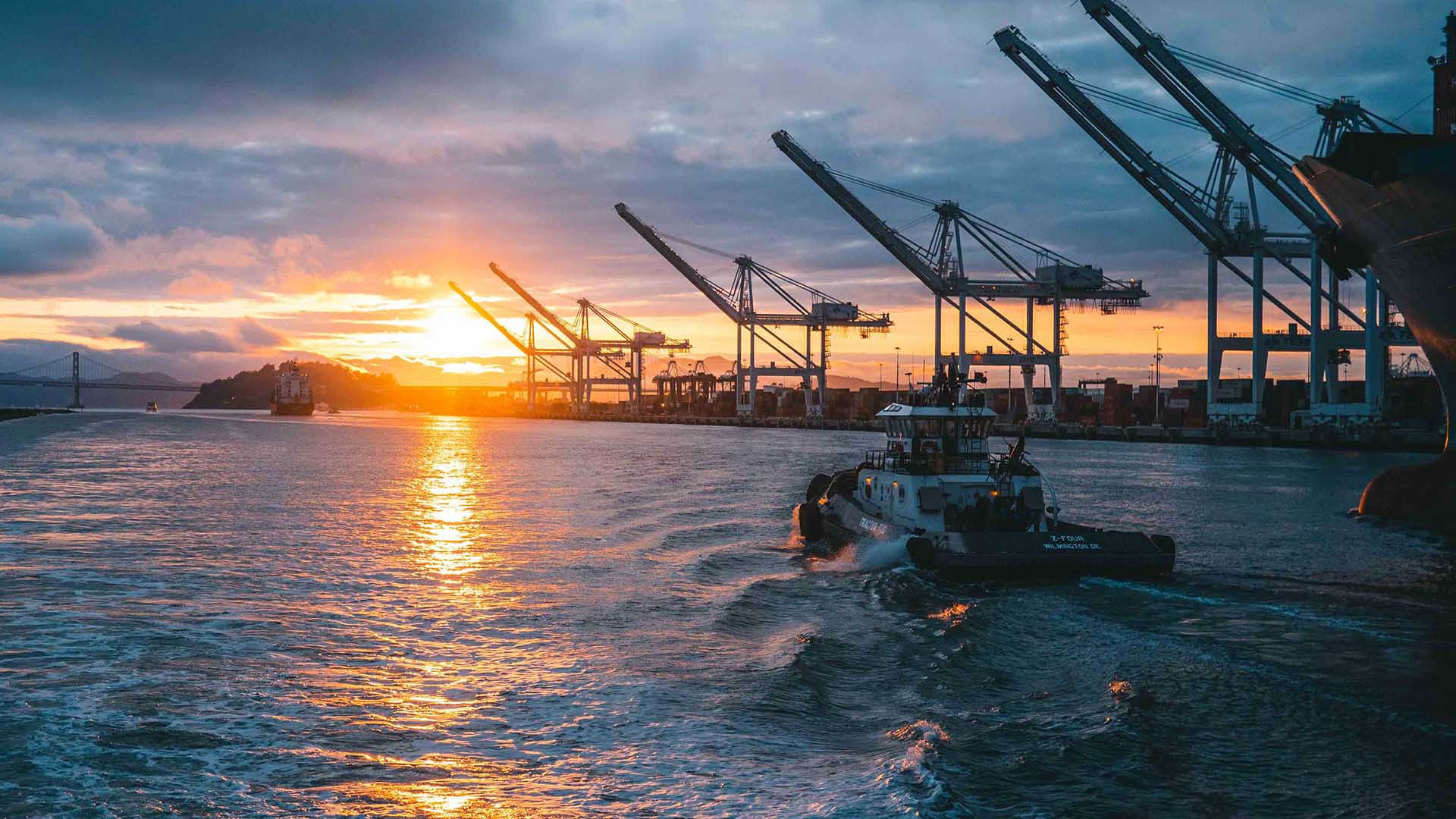

- Natural resources usage—water, energy, raw materials

- Emissions from vehicles, factories, offices [learn more]

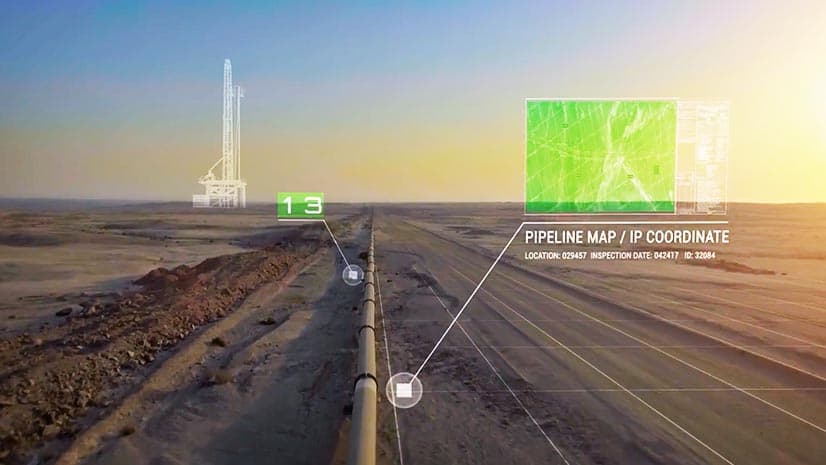

- Sensor readings and aerial imagery of pipelines, machines, power lines, facilities, roads [learn more]

The scenarios can be fairly simple—how many patients can we serve if we place an urgent care clinic in this location? When should we schedule maintenance on this section of railroad track?

They can also be complex—how much revenue could we expect if we opened two stores in this market? What are the right geographic locations for our quick-service restaurants across the entire country?

Today we have the computing power and GIS has the geospatial capabilities to simulate those scenarios. It’s a powerful way to anticipate the future.

Once business executives simulate outcomes in GIS, they might build a new store or close an existing one; perform preventive maintenance on a pipeline to manage risk; or change a product's pricing strategy in particular markets.

Cross: Are you seeing certain industries apply GeoAI more often than others?

Keyes: We’ve worked with companies across the board—retail; finance; [and] asset-heavy industries like utilities, natural resources, and railroads. The distinction seems to be in the company’s outlook, rather than its industry. If executives are open to new ways of analyzing the business, they tend to welcome GeoAI, and they want us to push the limits of GIS to help them improve the business.

Location Data as the Engine of GeoAI

Cross: For some business leaders, a geographic approach really changes how they see their company. Can you talk more about the role of geography in GeoAI?

Keyes: Location is an essential element of so many decisions—where a store goes, where a pipeline or a power line needs maintenance, how goods are distributed. If you look at data without factoring in location, you can’t understand all the important dimensions of the problem—or the opportunity.

Visualizing an Example

Avoiding Flawed Simulations

Cross: The science and technology of GeoAI have come a long way, but it’s not fit for every purpose. What are some of the pitfalls of this kind of simulation?

Keyes: One of the dangers is not fully understanding the limitations of your data, or not using the right data. For example, a company I worked with recently wanted to forecast sales for the next 10 years, but they only had 10 years of past data to train the GeoAI model. The problem was that the data was collected during a strong economic expansion, which limited how effective the model would be in forecasting sales during times of economic instability or recession.

Simulation modeling allowed us to build in some assumptions and say, “What if the market dipped by this much? What if GDP slowed by this much?” We could test out those combinations and simulate what kind of impact that might have on the forecast.

Deciding whether GeoAI Is the Best Approach

Cross: There’s a related topic that you and I have talked about before—the phenomenon where organizations get excited about a new technology like GeoAI and get a little ahead of themselves.

Keyes: We’ve had a number of companies say, “We have a directive to use machine learning for this project.” And while we know there’s a lot we can do with GIS and GeoAI, we always want to be sure it’s the right approach. We talk through whether the company will get a good return on its investment, and if there might be a lower-tech alternative that solves the problem just as well.

The best thing a company can do is develop a geospatial strategy and define what success looks like and what problems they need to solve. Then we can figure out if GeoAI is the best technique to accomplish that.

Cross: When companies simulate scenarios with GeoAI and big data, there are often multiple communities involved—data scientists, developers and computer scientists, GIS professionals. Can you talk about the intersection of those communities—or lack thereof?

Keyes: I think you hit on it there—the lack of intersection tends to be the problem. GIS professionals now have access to analytical tools well beyond the classic capabilities they trained on. And most data scientists haven’t been trained to understand spatial analysis.

To make things more challenging, each group uses a different language, and even when their vocabulary overlaps, the words often mean different things. So it can be difficult to really understand what the other team is capable of and how they might integrate.

Cross: I’ve seen a few situations where a data science group and a GIS group in the same organization didn’t know each other, but when they came together, it was like fireworks. The data scientists said, “Wow, you can look at this spatially, and you can do that kind of analysis?” And the GIS professionals were saying, “I’ve never had the compute power to solve that problem.”

But they have to walk across the chasm first. Which means business executives with GIS and data science teams in-house should get those teams together, because the magic tends to happen when they start collaborating.

Improving Field Service through GeoAI

Cross: I know retail strategy and store planning come up often in your consulting projects, but you recently worked with a company that’s using GeoAI for something totally different—workforce management. Can you explain what happened there?

Using GeoAI to Support Sustainability

Cross: Today’s executives are thinking about sustainability, environmental and social justice, and other areas where they want to be better as organizations. How does GeoAI factor into that work?

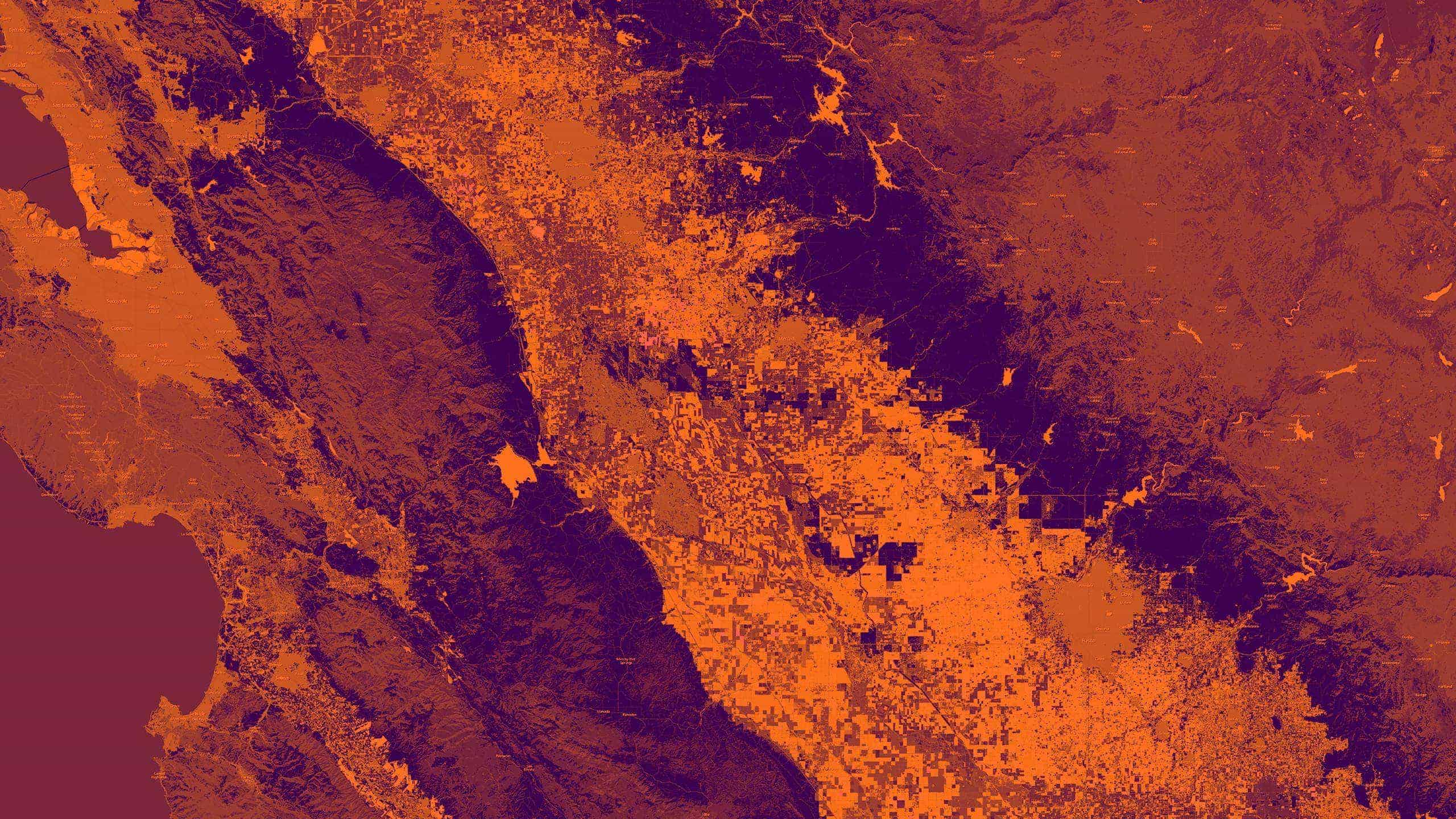

Keyes: Companies want to know how to use limited resources, how to protect themselves against climate risk, and how to minimize their carbon footprints. We use a modeling approach common in economics called linear programming, or constrained resource optimization.

We set up a GeoAI model to focus on a particular goal—that could be minimizing emissions, maximizing equity, or minimizing weather risk. Then we define the other factors involved—customer satisfaction, revenue, profit, etc.

This is where the power of simulation comes in. Instead of trying something in real life and waiting to see what the outcome is, we get to simulate multiple scenarios, and we observe the likely outcomes. It’s a great way to pull different levers and model the results.

For a business executive, it’s a good way to perform cost-benefit analysis on an ESG initiative or other strategic goals.

Cross: I think a lot of executives are looking for guidance on how to grow their business in a sustainable and socially responsible way. But without some way to look at the future, it can feel almost impossible. So while a simulation may not be perfect, it’s much better than deciding just on instinct.

We built a GeoAI model for one of the world's biggest retailers to test the impacts of opening, closing, and relocating stores. They called it groundbreaking, and they used it to improve their planning process.

Where Next for GeoAI?

Cross: Where do you see this technology going, and what kind of use cases will we be talking about in the next few years?

Keyes: It’s evolving in fascinating ways. We’re starting to look at bringing GeoAI indoors to simulate the flow of customers through a store. With that kind of spatial modeling, retailers can choose the best store designs and improve the customer experience.

I’ve talked with decision-makers in the health industry about optimizing locations for health-care centers—not only to comply with regulatory requirements like patient-to-doctor ratios, but to figure out where people need them most. You can simulate locations for a cardiologist practice where there are higher rates of cardiovascular disease, for example.

Some asset-heavy industries like railroads and utilities are experimenting with GeoAI for predictive maintenance. They’re using data on wear and tear and weather patterns to predict where they might experience a track failure or a pipeline break, and address the underlying conditions. And I think a lot of companies will be using GeoAI to model their exposure to climate and weather threats in the years to come.

This combination of AI and spatial analysis has already changed how companies see and plan their operations. We’re not predicting the future yet, but we are getting much better at anticipating outcomes and making better decisions based on that insight.

The Esri Brief

Trending insights from WhereNext and other leading publicationsTrending articles

December 5, 2024 |

July 25, 2023 |

November 12, 2018 |

February 1, 2022 |

July 29, 2025 |

July 14, 2025 |