In locations around the world, the impacts of a changing climate are increasingly hard to miss. Rain-swelled floodwaters rise over railroad tracks, halting trains loaded with consumer goods. Landslides choke roads, forcing cargo trucks to reroute on the fly. Firestorms threaten data centers that process millions of e-commerce transactions.

Natural disasters and adverse weather events triggered by global warming are not limited to any one region or industry today, but pose threats throughout the supply chain, creating huge challenges for COOs and other business leaders in retail, manufacturing, insurance, utilities, and beyond.

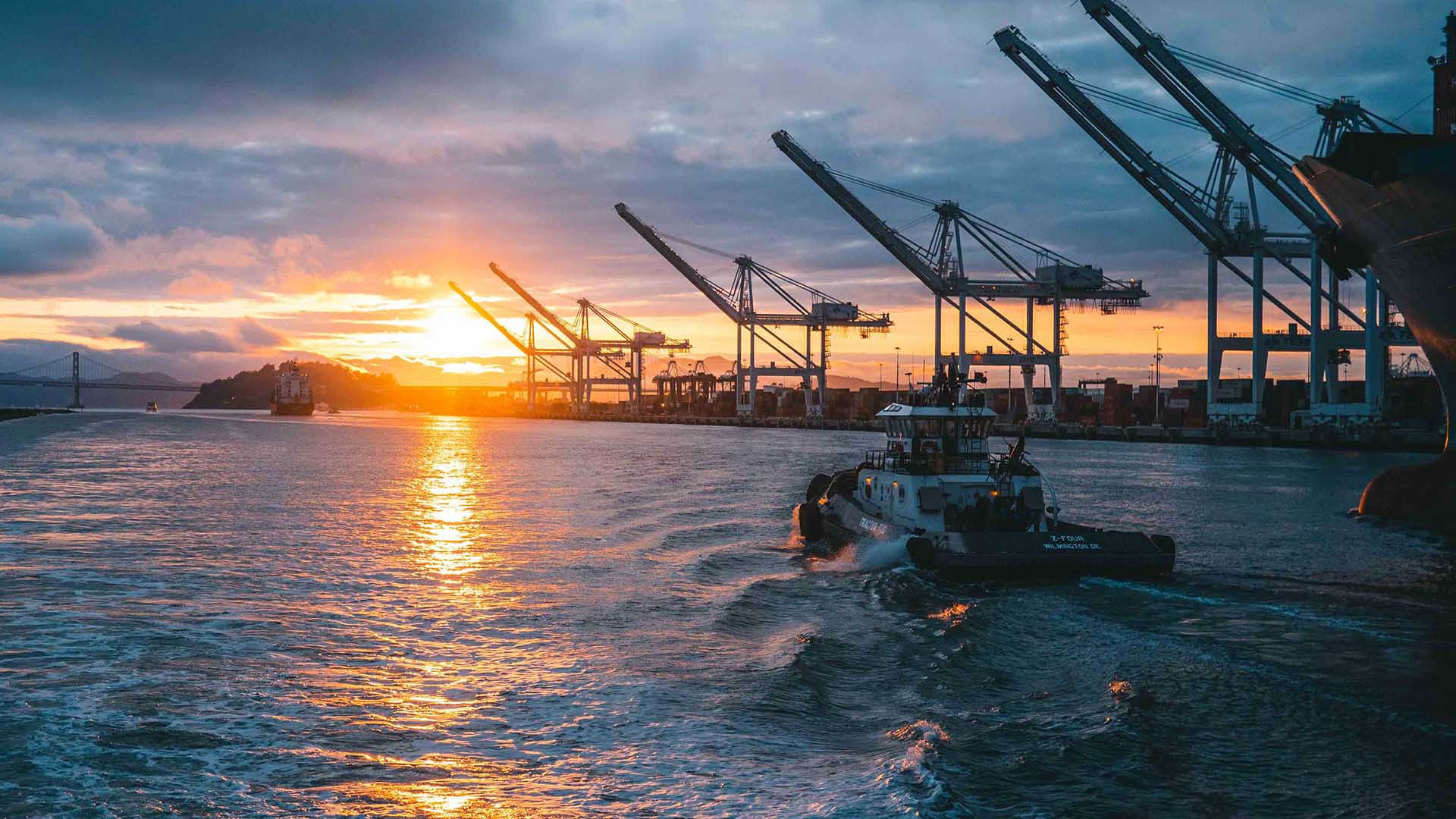

Climate-related interruptions to the international flow of goods—which is worth roughly $20 trillion—slow the delivery of food, medicine, and materials like computer and auto parts, and can result in billions in economic loss. The interconnectedness of the global market means that rising sea levels in Vietnam, for example, can have a direct bearing on the sale of AirPods or Nike shoes in Moscow or San Francisco.

Among forward-looking businesses, a new effort is afoot to navigate disruptions by leveraging data analytics and simulation-based location intelligence that forecast climate trends next season or decades into the future. By studying their supply chains in detail, companies are quantifying how resilient they are. Where they identify vulnerabilities, they are taking preemptive action to mitigate potential impacts and adapt to future conditions.

“Across all industries, we’re getting [the question], ‘What can you tell us about climate change? How resilient are we?’” says Stephen Bourne, a lead resilience modeler, engineer, and project director at Atkins, an engineering, design, and project management firm and member of the SNC-Lavalin group.

Locating Tomorrow’s Trade Danger Zones

Location intelligence—a form of business intelligence derived from a geographic information system (GIS)—plays a prominent role in managing climate risk and supply chain continuity. With GIS technology, analysts can create smart maps that layer climate information, hazard data, and satellite imagery on the regions and networks that compose a business’s supply chain. The insight produced by such maps—like those used by AT&T or the City of Boulder, Colorado—can help business and community leaders make decisions to reinforce or relocate coastal facilities in areas where storms will increase, for example, or allocate more funds for floodplain management.

Armed with GIS technology and artificial intelligence models that sharpen predictions, some companies are taking this forecasting to new levels of clarity. One such innovation is the Seaport Simulator developed by Atkins. The program applies predictive analytics, powered by global-scale simulation, to historical weather data and the latest meteorological research. The resulting model, Bourne says, creates thousands of climate scenarios across GIS maps of an organization’s supply lines. The simulations yield location intelligence showing how factors such as tropical storms or extreme temperatures might slow or disrupt the flow of shipping containers over sea and land from now through the year 2050.

“One of the most powerful things you can do is show the consequences of decisions a company makes about how it manages its supply chain over the next 30 years,” Bourne says.

The Seaport Simulator does not purport to tell decision-makers the future, but assigns probabilities to a staggering number of possible climate and cargo-flow outcomes. It presents users with the likeliest eventualities, accompanied by an estimated margin of error.

Protecting Supply Chain Infrastructure—and the Bottom Line

The program essentially creates a digital twin of a seaport or trade area, including all the transportation modes linking it to goods producers and consumers around the world. The digital twin uses 3D modeling, remote sensing, and thousands of points along a supply chain to create a dynamic visual of what might otherwise be dry statistics on paper. Its sophisticated simulation models and level of detail are such that a supply chain manager could see how an investment made next year might be affected by spring rainfall in 2030 on a specific section of train tracks.

The GIS-based simulator grounds smart business strategy on a foundation of location intelligence and hard data. In addition to helping protect supply chain infrastructure, the technology can help safeguard a company’s bottom line. A CFO could use the simulator to measure return on investment from capital infrastructure projects—like raised roads or railways or reinforced bulkheads—against the potential cost of not taking action. In a budget meeting, a map-based simulation comparing scenarios could be the difference between achieving and not achieving desired funding for climate resiliency.

“Executives look at this as a treasure trove of information that they can use to make decisions much better than they’re currently making [them],” Bourne says. “The more information you can get to them, the better.”

A Port Simulates Its Future

The first client to use the Seaport Simulator was the Port of Prince Rupert—Canada’s third busiest seaport, responsible for almost 40,000 acres of landholdings and harbors along British Columbia’s North Coast. Shipping over 32 million tonnes of import and export cargo per year, the port is connected to railways and shipping routes from Canada and the US to China, South Korea, Japan, and beyond. The supply chain hot spot is also subject to rugged weather conditions: the surrounding region sees the second-highest rainfall in North America, multiple hurricane-force storms a year, and a 25-foot tide swing.

With the help of funding from Transport Canada’s Transportation Asset Risk Assessment (TARA) initiative, the port contracted Atkins to help pinpoint where infrastructure in the port and cargo movement across its global network would be most exposed to climate risk. With insight from the location intelligence generated by the Seaport Simulator, they could make better decisions about their own operations, and pass those insights on to their stakeholders, including the terminal operators, shipping companies, and transportation conglomerates that rely on the port.

“International transpacific trade is critical to our economies,” says Jason Scherr, manager of environmental sustainability at the Prince Rupert Port Authority, who worked with Bourne and Atkins to tailor the simulator’s algorithms to the seaport’s needs. “Climate change and potential future impacts are always on our minds. Everyone is thinking about it, whether you’re a shipping company, a port, or someone running a trucking company. Our intent with the project is to look across our entire port complex and into the future to gain a better understanding through the data analysis and modeling.”

Potential climate-related impacts could be related to sea level rise, rainfall, winds, extreme temperatures, and tropical cyclones along ocean trade routes. Conceivably, all those variables could affect a single journey of cargo. A ship departing from Hong Kong might be delayed or have to reroute because of hurricanes whirling across one stretch of the Pacific Ocean, and forced to speed up to outrun similar storms in other waters. Sea level rise and high winds could interfere with port operations and docking procedures as the cargo ship approaches Prince Rupert. And finally, once the containers have made it onto trains heading toward cities like Chicago, their progress could be interrupted by ice and freshets (flooding from melted snow), landslides loosened by rain, and rail operations slowed by extreme high and low temperatures.

You can create a scenario where you elevate a track and then rerun the [model], and you can measure, ‘What is the impact of doing that?’ and start to estimate your return on investment and make the case for why you should act now instead of waiting for it to be a problem.

A GIS-Enabled View, from Harbor to Continent

Bourne’s team at Atkins used weather forecasts from the latest global climate models and findings from recent climate research efforts to drive the simulation. Based on those inputs, the GIS digital twin identified points along the cargo journey where weather or climate-related events might interfere.

The team then used powerful multi-core computers to run massively parallel simulations to determine the probability that climate activity like storms or floods would increase or decrease at those critical locations over the course of the next 30 years. By using simulation technology to model tens of thousands of such runs, the simulator established the range of possibilities that the seaport should be concerned about.

The Atkins team also used overhead lidar imaging to capture 3D images of the port’s buildings, roads, docks, and rail lines—ultimately building a highly detailed representation of the port in GIS. This digital twin made it possible to study how climate projections would affect port operations on a facility-by-facility basis. A high level of accuracy was essential to ensuring that the model could tell seaport administrators specifically where they may have trouble spots and what they needed to do to mitigate and adapt.

Interestingly, the analysis revealed several bright spots for the port, showing that global climate change dynamics may actually result in fewer impacts for the port’s supply chain, and that the operational style the port has developed to tackle its current climate has prepared it well for the specific impacts it is likely to face. “Climate change impacts are very location-dependent,” Bourne says. “There’s no sort of general statement you can make about how climate change will affect all places.”

Simulating Climate Risks and Opportunities

Bourne stresses the importance of accuracy and detail in studies of sea level rise. Due to the complex hydrodynamics of the port, and depending on the time of day, the water level on the north side of the island where the port is located is generally about eight inches higher than the water level on the island’s south side. That detail might sound insignificant, but depending on flood inundation levels, eight inches might end up determining whether a port remains operational or has to shut down. Fortunately for the Port of Prince Rupert, the simulations showed minimal future impacts from sea level rise. Location intelligence is the only practice that delivers this insight.

“We need to zoom in to the port and get 3D, accurate depictions of the structures so we can understand what their flooding levels are,” Bourne says. “It’s a matter of looking at the data at the right scales. On one hand, we need centimeter-level accuracy around the port itself. On the other, we need to zoom back out to the whole globe to understand oceanic and continental impacts. It would be very hard to convey what we’re doing in this project if we didn’t have GIS to show those scales in context.”

During a base run that modeled climate effects if no actions were taken, the Seaport Simulator offered some largely reassuring results, indicating some positive opportunities. A research study showed that tropical storm activity was actually expected to decrease in the western Pacific, making for a freer flow of cargo along certain shipping lanes than currently exists. The simulator also showed that with the expected sea level rise of 0.2m at the port by 2050, docks and rails that play a key role in cargo processing would likely be unaffected.

The findings did establish that there is a potential for future changes in weather patterns including wind and rainfall, as well as an impact from extreme cold weather on rail lines and winter cargo fluidity. In response, the Port of Prince Rupert is looking at opportunities to harness real-time and predictive weather data to assist with operational planning. This includes continuing to build on knowledge of the regional marine ecosystem and understanding the potential impacts on infrastructure that can be addressed with mitigation measures.

Simulations modeling the seaport’s potential actions could help guide investments, like hardening shorelines or adding adaptation planning for future projects to protect physical assets like buildings and roads. When port planners, engineers, or decision makers see those scenarios mapped in GIS, they’re better able to understand the financial and operational implications of their decisions.

I don’t think I’ve ever seen a better use of GIS than this project.

The Global Supply Chain’s Complex Future

The Seaport Simulator has already begun generating interest with other clients, which hasn’t surprised Bourne. He says the choices that supply chain executives need to consider today cut across complex swaths of geography and data, and location intelligence can help those business leaders make and defend difficult decisions.

For example, threats from climate change have already persuaded some companies to begin paring down their suppliers, working with leaner networks they can trust and collaborate closely with. While there is wisdom to that strategy, a network that is too geographically concentrated is also more easily knocked out by a region-wide weather event. However, companies that employ a more geographically diverse supply base may have less sway over those partners in addressing climate resiliency. A balance must be struck to achieve efficiency, safety, and influence, and smart maps created by tools like the Seaport Simulator can help organizations achieve that balance.

The predictive analytics behind the Seaport Simulator might also be put to work to help executives meet other goals, like reaching net-zero carbon emissions by a certain date. Shipping simulations could be run along specific supply chain routes, testing for varying levels of frequency and speed to determine how carbon-related choices contribute to clean energy goals.

The technology shows promise as well in cracking the code of complicated issues like multi-port analyses. Cargo traveling from Asia to the US might have nine different ports to choose from, and a GIS-based analysis could illuminate which port will be more efficient and cost-effective. While some routes may become too volatile due to climate change, others may be opened by trends such as retreating ice cover in the Arctic, creating new transportation corridors.

GIS makes it possible to assess all these contingencies in a way that a spreadsheet can’t. “You really would not be able to grasp all the different influences and disruptors that are at play unless you looked at a map of them,” Bourne says. As the threats of climate risk intensify, the need for innovative, location-specific strategies to support supply chain resilience will only grow.

The Esri Brief

Trending insights from WhereNext and other leading publicationsTrending articles

December 5, 2024 |

July 25, 2023 |

November 12, 2018 |

February 1, 2022 |

July 29, 2025 |

July 14, 2025 |