To optimize the supply chain, should companies opt for a just-in-time or just-in-case model? Leanness or redundancy?

Writing in Supply Chain Management Review, Jennifer Blackhurst and Andrew Balthrop argue that the correct choice in an era of large-scale disruptions is somewhere in between. Blackhurst, a business analytics professor at the University of Iowa, and Balthrop, a researcher at the University of Arkansas’ Sam M. Walton College of Business, emphasize the need for a flexible approach to supply chains—one that avoids operating so lean that a disruption triggers massive bottlenecks, or with so much buffer that inventory costs become untenable.

In practice, supply chain agility demands operational awareness—a way to monitor geographically spread-out operations in real time, react to unexpected incidents, and make sound predictions. Such awareness comes from an expanding form of business insight called location intelligence.

Supply Chain Agility Evolves

Just-in-time manufacturing—characterized by finely choreographed production schedules and minimal inventories—gained supporters following Toyota’s pioneering work in the 1970s. The practice allowed manufacturers in many industries to run lean, lowering operational expenses and increasing efficiency. But when the COVID-19 pandemic disrupted the global flow of parts and components, just-in-time’s acolytes were left with thin inventories and stalled production lines. Many revisited their practices and added buffers, swinging the supply chain pendulum toward just-in-case.

Blackhurst and Balthrop see both just-in-time and just-in-case as reflections of a prepandemic drive for efficiency. They say a better response to today’s volatility is to prioritize supply chain agility. This means supply chain managers must find the sweet spot between just-in-time and just-in-case.

Focus on agility, this argument suggests, and efficiency will take care of itself. And as many of the world’s largest manufacturers know, supply chain agility calls for location intelligence—the specialty of geographic information system (GIS) technology.

Industry Leaders in Action

IT heavyweight Cisco provides an interesting example. The company relies on a network of local and global vendors who manage 1,300 warehouses and thousands of engineers who service Cisco’s customers.

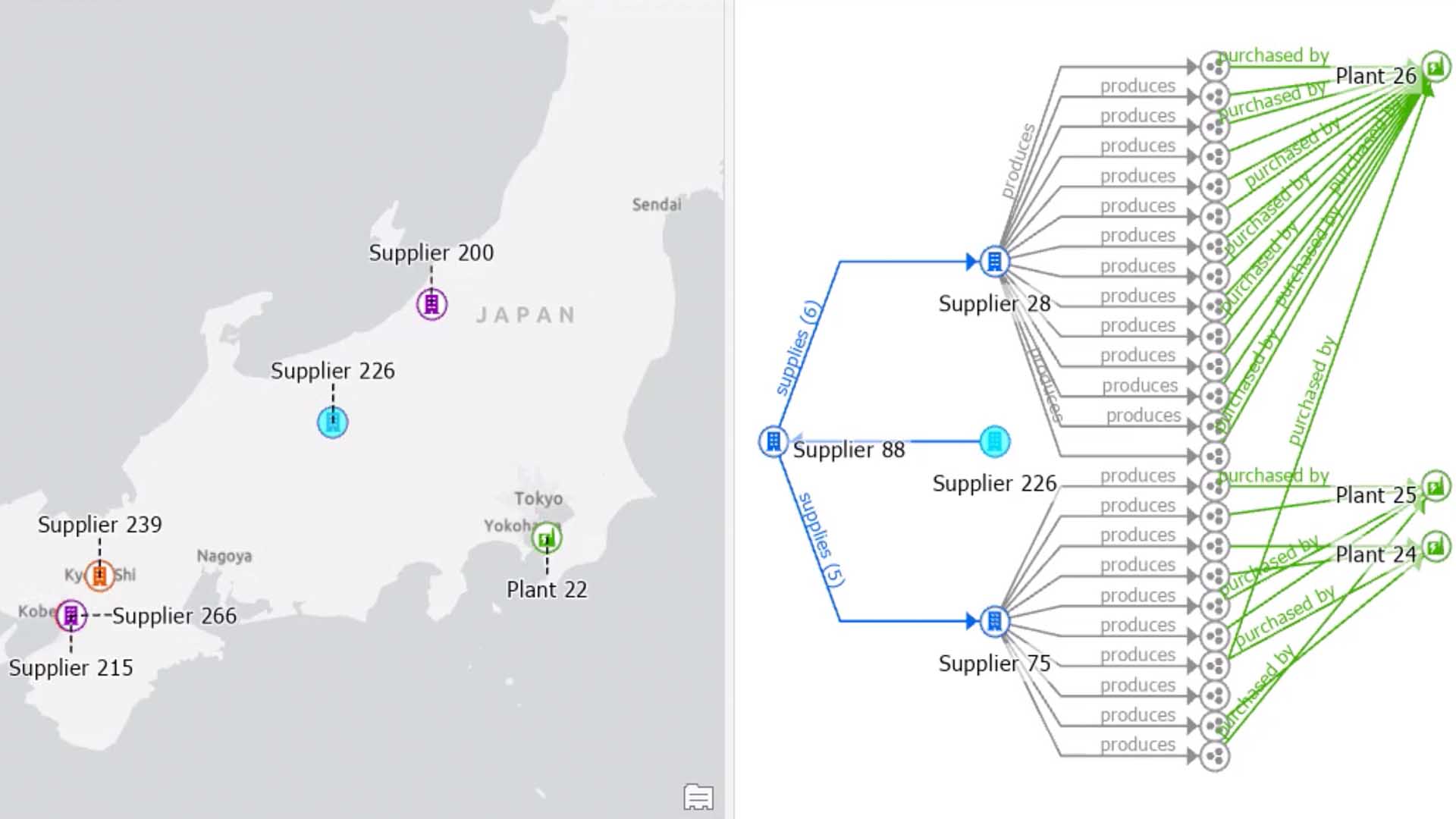

Cisco uses a GIS-based digital twin of its service supply chain to orchestrate logistics, field services, order management, and sales support. The real-time nature of the system keeps Cisco agile, connecting engineers and warehouses with the parts needed to service customers.

Automaker GM uses GIS to maintain agility in its supply chain, which includes multiple tiers of suppliers spread across the world. By using GIS maps to track global incidents like weather disturbances and factory fires, GM analysts spot problems in near real time and shift production schedules to keep vehicles moving through the manufacturing process.

GeoAI and Global Agility

To achieve supply chain agility, business leaders must focus on mitigating risk and predicting demand, Blackhurst and Balthrop say.

Another key, according to the researchers, is to explore AI-based solutions. The complexity of global supply chains means that humans can’t always see patterns and hot spots. Furthermore, calculating risk requires understanding past events and modeling outcomes. To answer those challenges, supply chain managers increasingly rely on GIS technology and a machine learning technique called GeoAI to set the foundation for supply chain agility.

“This combination of AI and spatial analysis has already changed how companies see and plan their operations,” Esri data scientist Wendy Keys told WhereNext last year. “We’re not predicting the future yet, but we are getting much better at anticipating outcomes and making better decisions based on that insight.”

The Esri Brief

Trending insights from WhereNext and other leading publicationsTrending articles

December 5, 2024 |

July 25, 2023 |

November 12, 2018 |

February 1, 2022 |

July 29, 2025 |

July 14, 2025 |