A seismic population shift portends immense economic change across the globe, and the most forward-thinking business executives are searching for ways to position their companies ahead of these changes.

By 2030, one in five people in the U.S., 20 percent of the nation, will be over age 65. Globally, the trend is similar.

The so-called silver wave will influence many parts of the economy. Retailers and service providers will seek out seniors residing in age-defined communities that create clusters of older consumers in one location. Housing providers will be testing the market to gauge demand for independent living, assisted living, and skilled nursing care.

Many other options also are being developed for those who want to age in place at their current residence, and those who want something in-between, such as smaller apartments with shared living, kitchen, or recreation facilities.

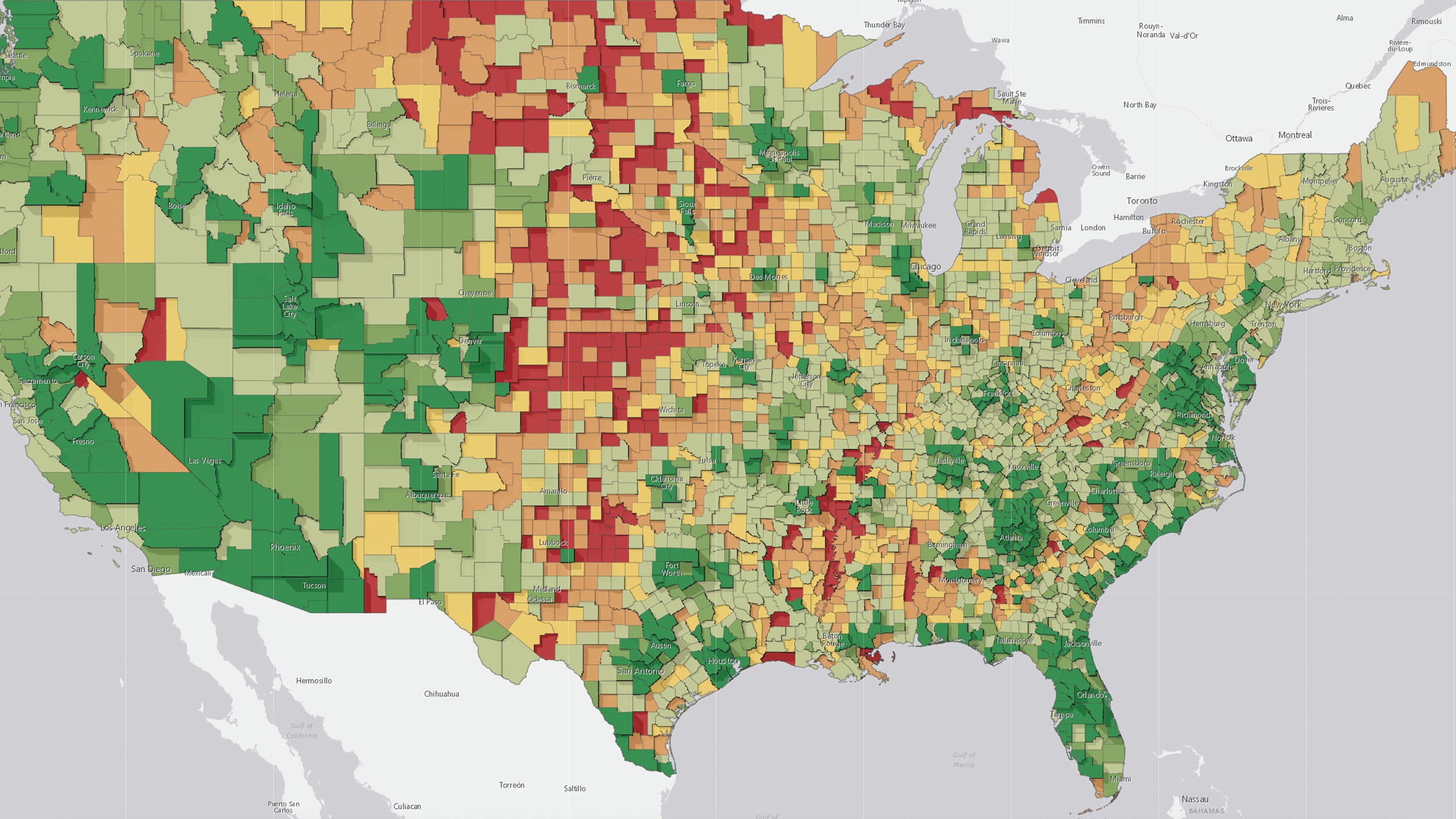

As this complex market grows, some businesses already have turned to geographic information systems (GIS) to predict where growth of older populations will be concentrated and which economic choices and personal interests those residents will pursue. With sophisticated location analysis, GIS software can forecast patterns of migration, consumer behavior, and housing preferences, including who is likely to move and where.

Choices Grow for Senior Living Options

The larger the over-60 segment grows, the more varied its interests and needs will be—and the more informed a business must be to win those customers.

While many seniors may choose to live near their adult children or stay in the area where they raised families, many others are willing to relocate to find the community and climate they want. Knight Frank, a global real estate firm headquartered in London, estimates that although just a third of seniors consider moving into dedicated senior housing, that population will be so large that investors have shown interest in building residential units to suit older consumers around the world.

According to a United Nations report, the number of people age 60 or older is expected to more than double to 2.1 billion in 2050. If just a third of those seniors seek to move to a new home, that’s still a market of 700 million potential customers.

To identify the right mix of age, income, and personal interests for the investors, developers, and business executives it consults, Knight Frank relies on GIS software that can analyze markets in the context of location. The firm can locate concentrations of seniors bearing a trait that distinguishes them from previous generations: economic clout at retirement age and beyond.

Many boomers will turn 65 while continuing to earn a good salary; many others already will have started drawing from substantial retirement plans. Naturally, some segments of seniors may face difficult circumstances—and some have not saved enough for retirement. But the boomer generation as a whole remains an economic dynamo. Already the wealthiest generation, they are expected to control 50.2 percent of net household wealth in 2020.

Investor Interest Rises with the Silver Wave

Where once older people often had limited housing options, now consumer-savvy and financially secure seniors can demand flexible, customizable choices.

More and more, seniors will look for living arrangements that suit their individual needs. That could mean a wellness community that emphasizes healthy living and recreation, a housing development with multilingual staff, or top-of-the-line housing for those seeking luxury in their golden years.

In recognition of varied tastes, some edge-seeking businesses and investors are investigating ways to predict where and what kind of senior housing developments will be needed.

Knight Frank uses GIS-powered location intelligence to map out possible business opportunities. “Spatial analysis finds us the right balance of market and demographic conditions, uncovering opportunities particularly suited to individual clients,” says Ian McGuinness, head of the geospatial team and a partner at Knight Frank.

Investors are interested in a range of senior housing projects, including higher-end developments that are essentially subdivisions—or even small cities for seniors. Places such as The Villages, based in Sumter County, Florida, have been highly successful at attracting residents. In fact, a 2018 U.S. Census Bureau report found that The Villages ranked first among all U.S. metropolitan areas in percent population growth. The senior-living development grew from 93,420 residents in 2010 to 128,754 in 2018—an increase of nearly 38 percent.

Once a developer identifies geographic areas where the senior population is expected to grow, the next step is often to use GIS to locate potential properties and determine whether the sites should become communities, apartments, shared dormitory-like accommodations, or even mixed-age developments near a college campus.

GIS-based analysis mixes demographic and commercial market data with predictive algorithms to guide developers to where seniors will be.

Policy Guides Investment

As business leaders and investors explore the strengthening senior living market, some governments are creating guidelines to accommodate this demographic shift, in the same way some areas have imposed rules for including affordable housing in development plans.

In Europe, where 25 percent of the population has already reached 60, the European Union has announced initiatives to prepare for further growth. And in London, governmental authorities have begun developing benchmarks for the amount and type of senior housing that should exist in the city and surrounding boroughs. The New London Plan aims to ensure that a certain percentage of each residential project includes housing for seniors, based on the characteristics and needs of the locale.

That official focus on future needs has helped stimulate interest in senior housing from both operators and investors around the world, including in China and the Middle East, in addition to Great Britain and the U.S. “Finally, it seems that at least a few people have woken up to what’s going on,” says Tom Scaife, who heads up the senior living team at Knight Frank. “We know from colleagues across our network that there’s an impending need in some other countries as well that’s only getting more accentuated.”

To explain the phenomenon to potential investors, builders, and retiree services companies, Scaife and his team plot the results of location analysis on intuitive smart maps.

They use GIS software to analyze and map the relationships among hundreds of pertinent data points such as expected growth of older populations in a region, country, city, or neighborhood. These smart maps can collate predictions with available space to model development, surrounding retail and recreational opportunities, price points for various groups of retirees, and cost of construction and staffing.

Finding a Place to Call Home

The location intelligence produced by GIS also guides seniors on decisions about their own future.

“We can analyze cost of care within these housing situations versus cost of care delivered into your own home,” Scaife says. “If you add in other costs like running your home and upkeep, then you can start to build a picture, make an analysis and compare the cost/benefits of relocating at that point in life.”

GIS-based analysis also can include the availability of wellness programs, public transportation, and demographic traits of a neighborhood such as sex, race, ethnicity, family size, and the lifestyles that seniors enjoy. Results forecast where and how significantly the silver wave will impact not just housing, but other sectors as well.

With predictive capabilities, companies across the business world are using location intelligence to see what competitors have missed, and gain an edge:

- Retail companies are using powerful AI to anticipate where new stores will boost their online sales.

- Oil and gas companies are analyzing weather forecasts to understand how to shift resources for maximum efficiency and return.

- An internet service provider is capturing demand signals in GIS and using them to anticipate growth markets.

Tools for New Insight

The European Space Agency recently showed a way to plan for senior housing through location intelligence and a predictive algorithm. Its analytic program looked at census data, economic traits, and land-use patterns to reveal relationships between people and the places they are likely to call home as they age. When applied to a midsized test city, the program predicted the location of older residents with an accuracy of 95 percent.

Given continued advances in cloud computing, ever-more precise data sets, and artificial intelligence, these predictive models will only strengthen—and just in time. Because as seniors in growing numbers assert their consumer muscle, leaders from a wide array of sectors—retail, healthcare, entertainment, government services, and housing—will seek new ways to serve them.

“We’re in a phase where there’s now enough data available for funders to feel more confident about entering the market,” Scaife says. “But at the moment, there’s more capital than opportunity out there.”

However, with an increasing demand for senior housing and powerful research tools to understand how to service it, more businesses may rise on the silver wave.

The Esri Brief

Trending insights from WhereNext and other leading publicationsTrending articles

December 5, 2024 |

November 12, 2018 |

July 25, 2023 |

February 1, 2022 |

July 29, 2025 |

August 5, 2025 | Multiple Authors |