Out-of-home (OOH) advertising is having its Hollywood moment, thanks to the Oscar-winning Three Billboards Outside Ebbing, Missouri. But in the digital age in which consumers receive targeted offers and messages on their smartphones and within their browser windows, OOH advertising might seem to be a bit of a throwback.

Nothing could be further from the truth.

OOH advertising—the category includes billboards, point-of-sale displays, bus/vehicle wraps, and street furniture (bus shelters, newsstand kiosks, city information panels)—is enjoying a resurgence. The adoption of new measuring techniques and location intelligence is empowering OOH to keep pace with advertising on digital channels like Facebook and Snapchat. Now, OOH advertisers can better understand who is viewing their ads, which helps them target content more precisely than ever before and better measure the ads’ impact.

A richer array of data sources is at the heart of the revolution in OOH advertising. The ability to measure where and how people move anonymously and in aggregate, combined with demographic data, enables the creation of profiles that are extremely useful to advertisers and brands when planning campaigns.

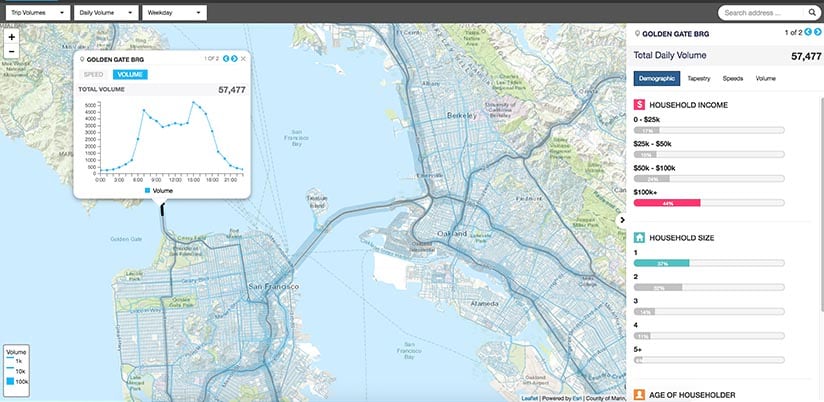

Geographic information system (GIS) technology delivers location intelligence by integrating many types of data into visualizations using maps and 3D scenes, revealing patterns and relationships that foster deeper insights and drive better decisions. In the case of OOH advertising, that deeper understanding of aggregate patterns, volumes and demographics lets advertisers fine-tune their messages, making it more effective and attractive to their desired audience.

Brands and advertisers are getting the picture. The growth in OOH advertising revenue is now outpacing growth in other traditional media globally, according to the Outdoor Advertising Association of America (OAAA). In the United States, OOH ad spending has risen nearly eight years in a row to a total of $7.7 billion, according to the OAAA. As the heroine of Three Billboards Mildred Hayes learned, billboards can be devastatingly effective. And thanks to the new high-powered measurement techniques, the vehicle is taking its place next to the most advanced advertising methods.

Beyond Demographics: Audience Segmentation Gets Granular

The OOH advertising market looked quite different back in 1933 when the Traffic Audit Bureau for Media Measurement Inc., now known as Geopath, was founded to help advertisers rate the effectiveness of their billboard ads. Back then, the tracking method involved deploying people in the street with a clicker counting how many cars went by.

Now, it is possible to match anonymous location data with other data sources through powerful GIS-driven analytics to gain a much clearer understanding of who is viewing the ads. Previously, the best information advertisers could obtain was an audience profile with basic information like age, gender and ethnicity. Now, advertisers can learn much more about who’s passing by, where they’re going, and what makes them tick.

Data from mobile devices, GPS, and connected cars can be fed into a modern GIS to produce a massive population movement dataset that gives a 360-degree view of audience movement without accessing or storing personally identifying details. Leveraging data from these sources yields fine-grained targeting that advertisers and brands have long sought.

Rather than just using OOH media to target a message for females aged 28–44, for example, brands and advertisers can target a specific segment called “soccer moms” (with a host of associated demographics down to what the women in the category spend money on and their education levels). Or, a luxury car brand can now home in on locations for five billboards that will touch 80 percent of the population. Even more refined segmentation is possible—high-earning Millennial professionals who own an iPhone X, for example—and catching on.

Having this level of granularity makes it possible for advertisers to be more strategic in their planning and connect to other media channels including online or addressable TV or mobile advertising. They can examine the movement of product by ZIP code or social engagement and discover correlations that would not have been possible to see before. The Holy Grail: Tying this data into actual sales of the products being advertised. Those close to the industry say that day is coming.

Powered by Location Intelligence

One company offering this type of insight with the help of GIS is Citilabs. Through partnerships with data providers, Citilabs creates location intelligence by running high-powered analytics on cellular data, GPS tracking data, and demographics. The result, according to Michael Clarke, the company’s president and CEO, is an advanced audience metric system for the OOH industry. Citilabs provides a critical component used for creating unique audience profiles in the US OOH industry through Geopath.

This next level of analytics represents a breakthrough, Clarke says. Until very recently, OOH customers received a traffic count that was typically done by a state or local department of transportation; it would take many days or even weeks to determine how many cars went by. Those counts were often not taken near the relevant OOH panel, and they quickly became obsolete.

With that limited data, advertisers were missing the story line, or location intelligence, of the people who passed by the panels—including such contextual insights as where were they traveling, where were they coming from, and whether they were going shopping.

Now, advertisers who opt for advanced audience measurement receive a host of information about those vehicles and the people in them. “We give them hour-by-hour information, what neighborhoods people live in, where they are going from and going to,” Clarke says. The data includes the type of day (Monday through Thursday is one bucket, Friday is another and the weekend is a third). There is a lot of information about what is happening by location.

“We get the latitude and longitude and a time stamp as people move around,” Clarke says. That data is then matched with where these people live at the aggregated, anonymous U.S. block number (so no personal addresses are retained). The system also collects all the available traffic counts from government sources, which currently number over two million. Being able to leverage this data is very important to the industry, which wants to know, “How many eyes have looked at this panel?” he adds.

A Sophisticated Way to Measure Value

New measurement techniques and the wealth of information they yield represent a breakthrough in what OOH advertising companies can to offer brands, according to Mark Costa, chief digital officer, for outdoor advertising giant JCDecaux North America.

“This is a new way of describing the value of our asset,” Costa says. Historically, the OOH market would use location as a proxy for where advertisers should buy and whom they should target. At a basic level, they wanted to be sure they had ads running on screens in front of their competitors’ stores or their own stores, as an example.

“That strategy worked well for years, but now we can add in additional audience layers—for example: where the target audience lives, where they work, and other activities they may do, that roll up into segments with good synergy for a particular brand. The key is respecting privacy and leveraging data that isn’t personally identifiable,” Costa says.

By leveraging GIS data, advertisers can match defined personas, such as an eco-minded consumer. It is now possible to pinpoint where that type of consumer group lives, works, how they travel, what they do after work. “The next step is to scale it up. Scale matters for advertising,” says Costa.

The key is to leverage reliable data sets – privacy and integrity are crucial. “If you are working with partners that have data sets that you can stand behind, you can make a compelling story for your clients,” he says.

Keeping Private Data Private

Consumer data privacy concerns are paramount. Providing rich data to advertisers must be balanced against the individual’s right to privacy, those close to the OOH industry say.

“JCDecaux employs a diligent and rigorous vetting process in its data acquisition strategy”, says Costa of JCDecaux. “With mobile location data, we want to know, how are you acquiring the data? Are you giving [consumers] notice you are collecting that data? Are you giving them a choice to opt in or opt out? We work to ensure that everything we do sticks to the framework of group-based, aggregate, anonymous sets of data that cannot compromise the individual,” Costa says.

Even in the digital age, OOH is not a one-to-one medium, he adds. “We don’t want to know if Jane Doe is in front of the screen; we want to know if there is a high index of Millennials in front of the screen.”

Toward Hard ROI

Being able to prove the value of OOH advertising has always been a challenge, as is the case with advertising in general. But advanced audience measurement techniques based on GIS and other rich datasets are beginning to ease the task when it comes to OOH.

“We are leveraging data to prove the value of the medium based on the brand KPIs, and that is a new phenomenon,” Costa says.

Fundamentally, brands want to know their campaigns are reaching the right audience. By analyzing and understanding consumer movement and behavior in the physical world, advertisers can identify the audience groups that have been exposed to an ad. Combining that information with mobile surveys, they might also be able to tell if consumers had some level of brand or ad recognition, or intended to visit a store to make a purchase.

“As a brand, if I have my own brick-and-mortar stores, I’d like to understand if advertising on OOH screens drove people who are exposed to the advertising to my stores better than people who weren’t exposed to the advertising,” Costa says. “Footfall attribution,” as the practice is known, is not yet widespread, but its use is growing.

What’s more broadly in practice? Applying data to target the right screen and the right location for an ad. But Costa cautions some age-old OOH best practices still apply. “You’ll never get results if the messaging isn’t contextualized to the medium,” he says. “You have to speak to the audience appropriately.” That lesson could have come from Three Billboards’ Mildred Hayes herself.

For a fascinating look at how brands and advertisers are changing their outreach in the age of the customer, listen to this podcast.

The Esri Brief

Trending insights from WhereNext and other leading publicationsTrending articles

December 5, 2024 |

July 25, 2023 |

November 12, 2018 |

April 1, 2025 |

April 29, 2025 |

February 1, 2022 |