For businesses hoping to cater to millennial customers, new findings suggest they should look south. The cities that rank best at attracting people aged 25 to 39 are all in the American south, with the exception of Denver, Colorado, according to a recent study of census data by the financial website SmartAsset.

Topping the list of millennial magnets in the most recent full year was Austin, with another Texas stronghold, Dallas, ranking third. Denver was the second-most attractive destination for millennials, the study found.

In addition to boasting mostly mild winters and lower income taxes, the top 10 destinations had something else in common: almost none are among the largest cities in the country (Dallas being the exception). The cities with the fourth, fifth, and sixth highest millennial inflows were Raleigh, North Carolina (population 469,000); Jacksonville, Florida (population 955,000); and Henderson, Nevada (population 322,000).

These second-tier metropolises tend to offer more affordable options for people seeking relief from big-city housing costs. Millennials seem to be taking notice.

Where Millennials Go

For a time during the last decade, demographers and economic observers thought millennials might be a generation unlike others before it. Its members weren’t getting married at the rates that previous generations had, or having kids and buying homes. Some pundits attributed this to a protest against traditional norms and expectations.

Subsequent research has shown that these choices were more economic than ideological; young people mired in student debt and the overhang of the Great Recession simply couldn’t afford the standard trappings of young adulthood.

In recent years, wages have improved, and more millennials have begun getting married and settling down. The hitch: As they do so, they’re moving away from some of the largest—and most expensive—US cities, toward locales with lower costs of living.

Among cities that saw more millennials move out than move in, none lost more in 2021 than New York, with nearly 80,000 net departures. The runners-up included heavyweight cities Chicago; Washington, D.C.; Boston; Los Angeles; and San Francisco.

That geographic shift may well be explained by the fact that New York, L.A., San Francisco, D.C., and Boston are five of the country’s six most expensive cities.

A Hyperlocal View of Millennials

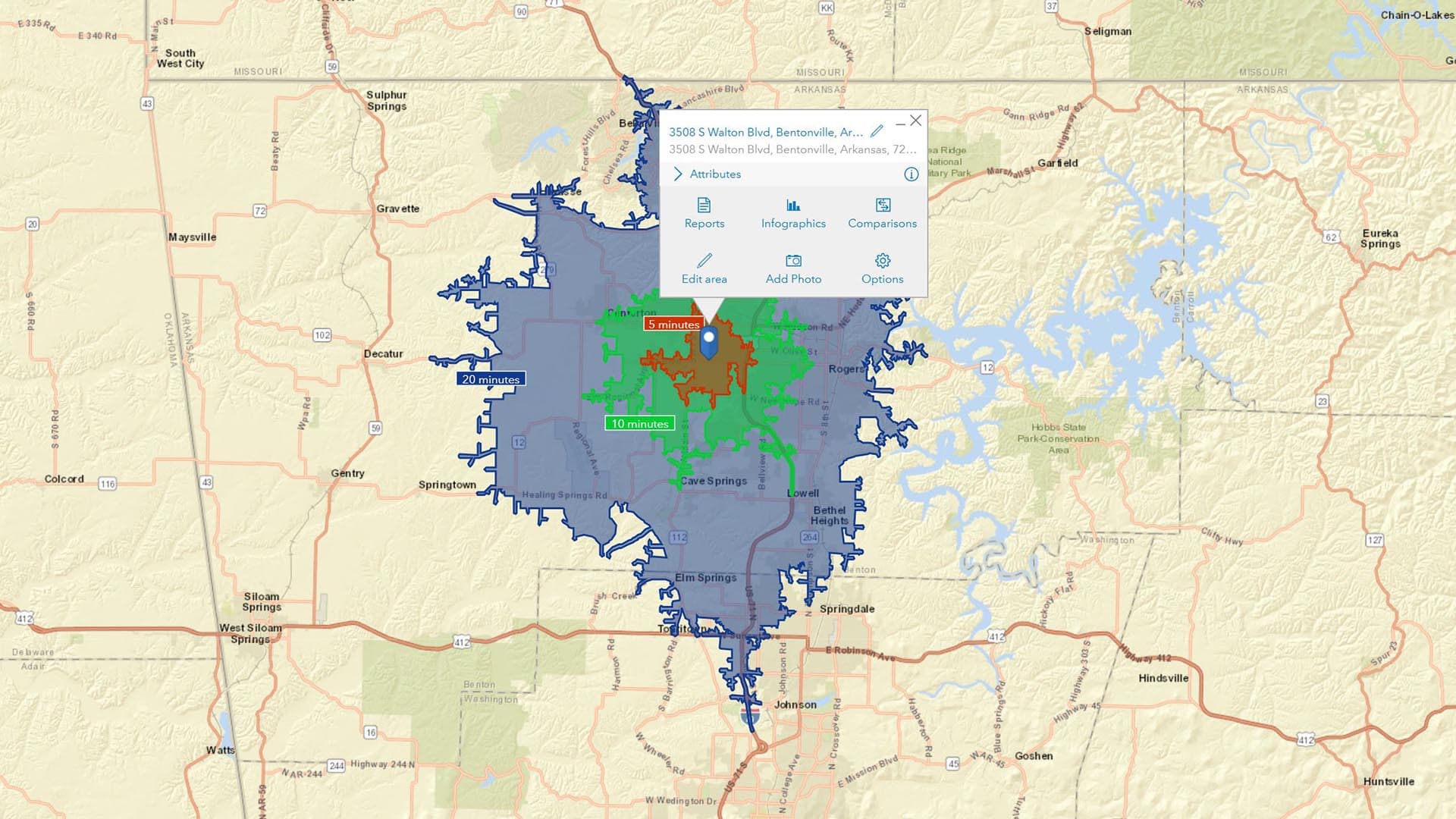

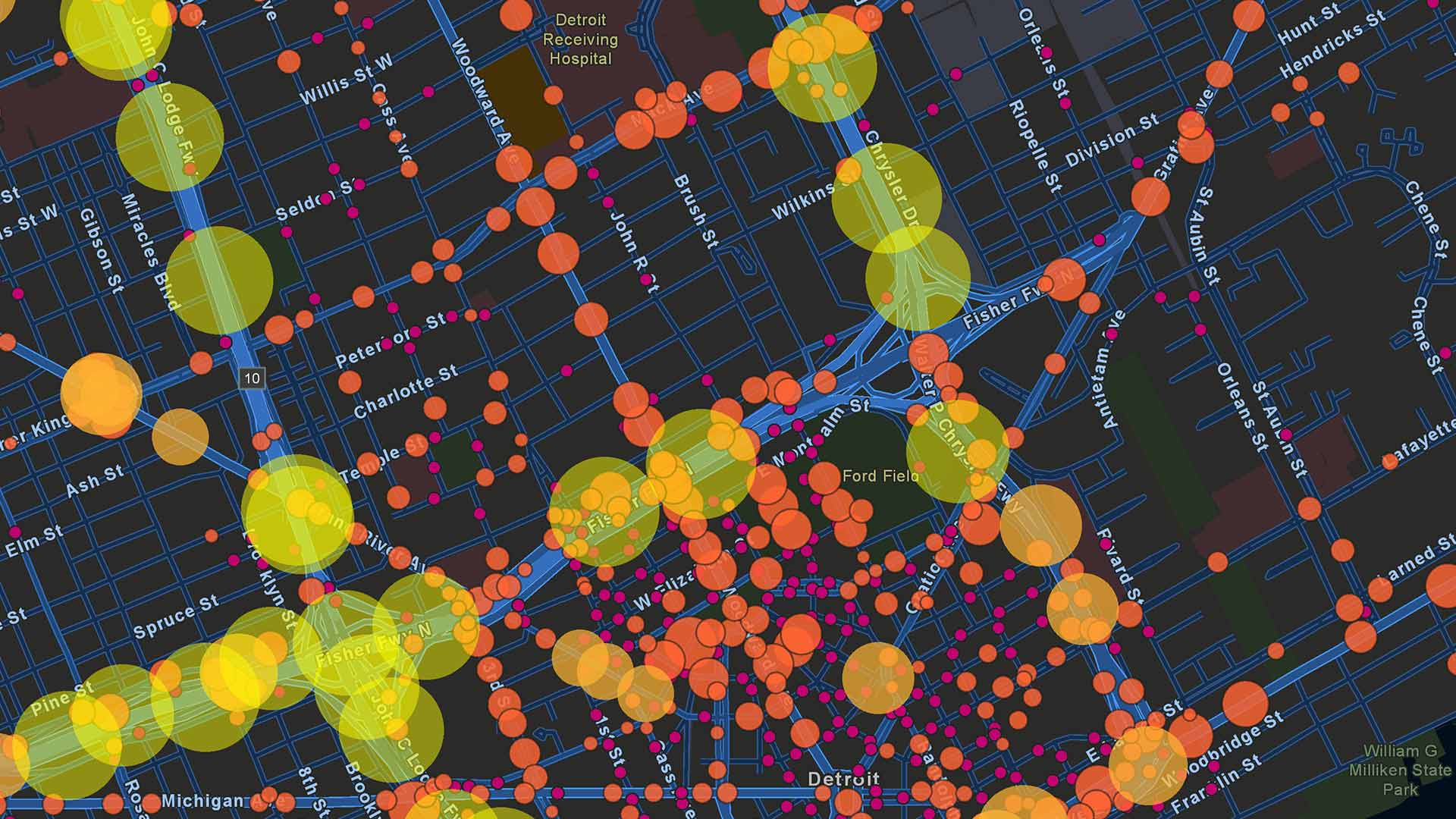

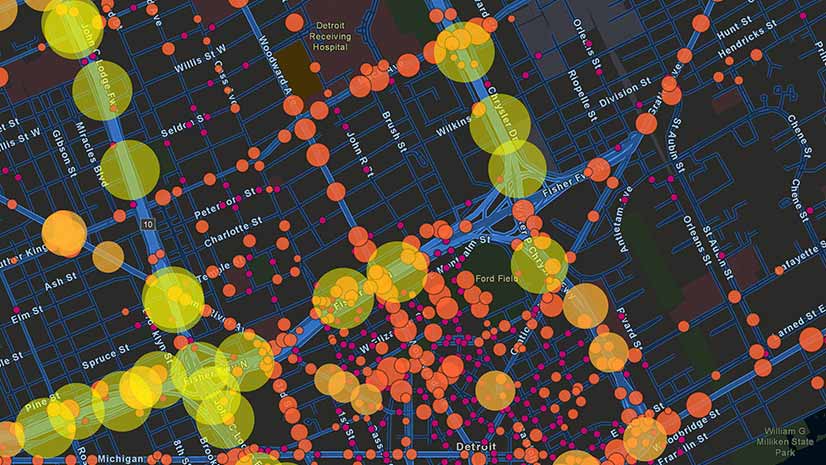

For business development executives, store planners, and marketers, knowing that millennials are moving to certain cities is an intriguing trend in search of context. What decision-makers really want to know is that millennials in a particular neighborhood prefer credit cards to debit cards, earn 10 percent less than the national average income, and favor organic food. Or that certain neighborhoods should expect an increase in 25- to 39-year-olds who have two incomes, an appetite for DIY home improvement, and spend 34 percent more than the national average on clothes and services.

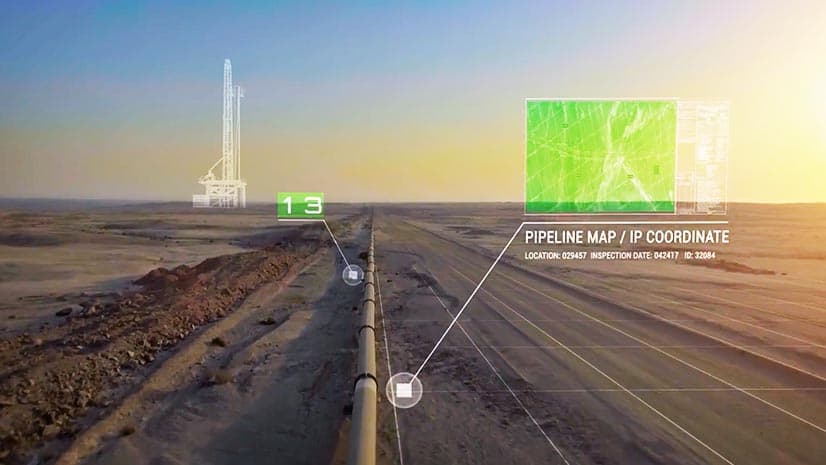

Such demographic and psychographic insight comes from a modern geographic information system (GIS), and plays a prominent role not only in where companies establish their operations, but what they offer customers and how they reach them.

In fact, industry leaders combine data from their CRM systems with GIS data to deepen demographic analysis. The resultant location intelligence creates a hyperlocal view of consumer interests in certain areas.

As the head of location intelligence at a major bank told WhereNext. “At the end of the day, using [our] skills and [GIS] technology, we’re able to understand our customer.”

If GIS analysis shows that customers in certain neighborhoods like to visit brick-and-mortar branches, the company will invest accordingly, he explained.

“But if what we determine from knowing our customer is that it’s really a bunch of millennials who want to [bank] on their phone, we’re going to do that, too. We’re going to know our customer above all else. This technology allows us to do that.”

The Esri Brief

Trending insights from WhereNext and other leading publicationsTrending articles

December 5, 2024 |

July 25, 2023 |

November 12, 2018 |

February 1, 2022 |

July 29, 2025 |

July 14, 2025 |