In a Hemingway-esque decline—the kind that gathers almost imperceptibly before bursting into the open—China is now in the throes of economic malaise.

In August, China’s producer prices declined for the 23rd month in a row, according to the National Bureau of Statistics. The protracted slide, combined with sluggish consumer prices, has stoked deflation fears as consumers curtail spending.

The economic swoon has sparked government intervention, including stimulus spending aimed at boosting demand. But while the government tries new forms of support, Chinese shoppers are finding innovative ways to cinch their leather belts.

Some shoppers accustomed to luxury purchases are now looking for bargains through the practice of daigou—a form of price arbitrage that allows the purchase of luxury goods like handbags for significantly less than retail, according to a recent Wall Street Journal article [subscription].

It’s the kind of trend that can start small and fly under the radar until it becomes a drag on a company’s top line. It’s also a phenomenon companies can track with the right location intelligence.

Daigou as an Early Indicator of a Problem

In the practice of daigou, independent sellers purchase items—often at wholesale—in a country where prices run relatively low, and resell them at a discount in higher-priced markets. On average, a luxury good sold in China is 24 percent costlier than the same item sold in Europe, according to Bernstein data cited by the Wall Street Journal. In the US, the markup is around 16 percent.

For a luxury goods manufacturer or retailer, a drop in China sales might be the first indicator of a problem, but diagnosing the origins of a downturn can be challenging. Like any business performance issue, understanding the root cause—the consumer habits behind the headlines—requires data.

The data might be publicly available through government agencies or trade groups, or available at a cost. These days, CIOs and CAOs oversee multimillion budgets for data that gives them an edge over competitors. In contrast to IT leaders of previous generations, who cared mainly about the tech stack, today’s tech execs focus just as intently on the information stack—and location data is a key component of that asset.

Converting Data into Next Steps

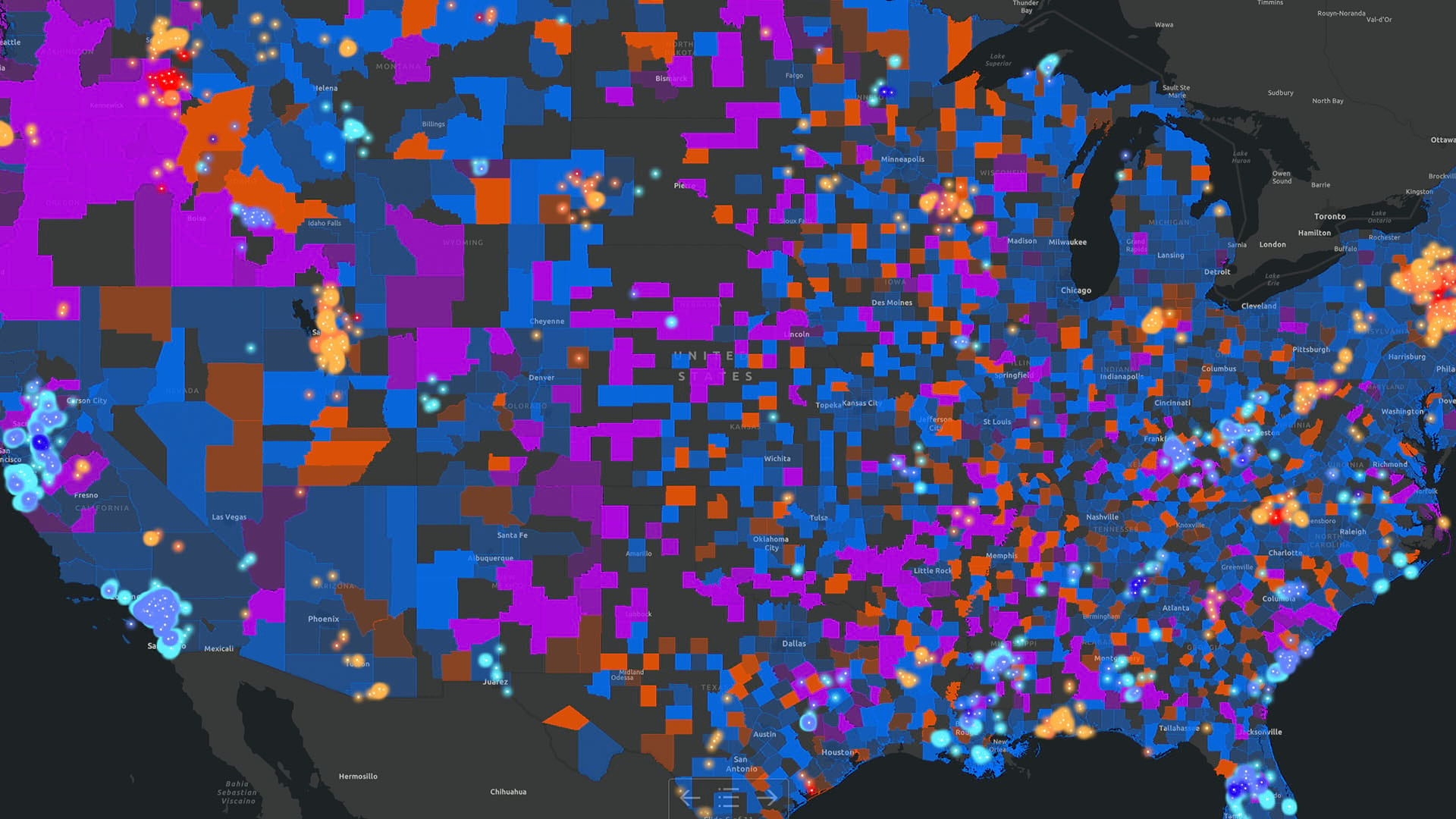

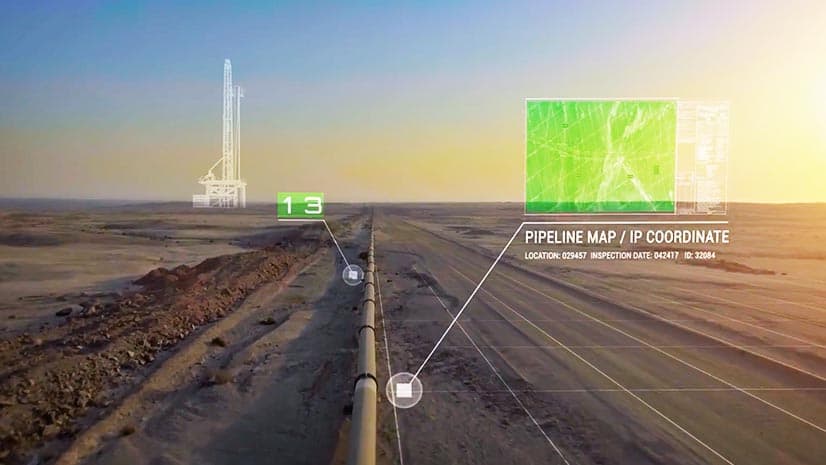

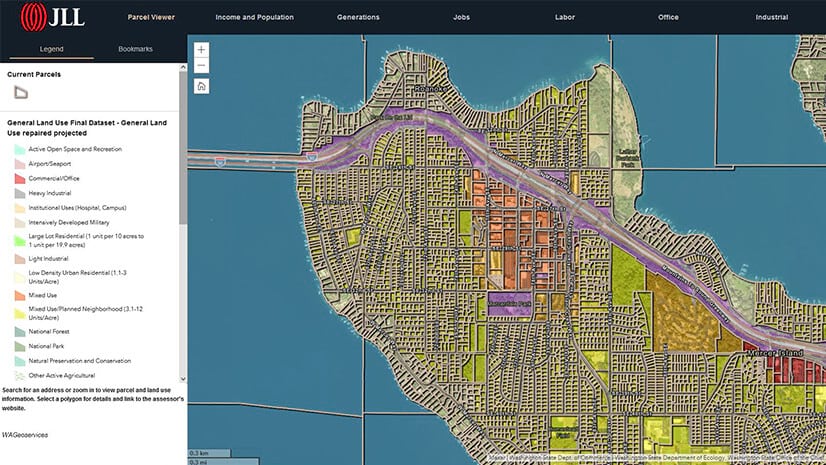

With location data in hand—on where sales are happening, through which sellers, and at what prices—a company can turn information into analysis. Many of the world’s best-known brands use a geographic information system (GIS) for this research, complemented by data science and a growing library of AI tools.

With GIS analysis, companies create maps and dashboards that answer a range of business questions, including where counterfeit products enter the supply and which omnichannel strategies offer the best balance of online sales and store locations. Business leaders use location insight to tailor marketing plans, address underperforming sites, and identify profitable markets for their products.

In a WhereNext essay highlighting retail trends, a global manager at luxury brand Swarovski wrote, “Many brands fell behind because they failed to connect customer data with location intelligence.” In a companion essay, he detailed the role of GIS. “Location technology,” he said, “can highlight microtrends specific to one city avenue where a shop is located, or industry-wide changes that shape an entire national network.”

Location intelligence is key to spotting economic conditions and customer habits that can change almost imperceptibly. Today, multinationals may be wrestling with the complexities of daigou. Tomorrow, a new buying trend will emerge in another location, and companies with reliable location data and effective GIS analysis will make sense of it before it threatens the bottom line.

The Esri Brief

Trending insights from WhereNext and other leading publicationsTrending articles

December 5, 2024 |

November 12, 2018 |

July 25, 2023 |

February 1, 2022 |

March 18, 2025 |

May 28, 2025 |