As some companies pull ahead, others fall behind. It’s the essence of competition—and increasingly, data separates the winners from the laggards. Giants like Amazon, Facebook, and Google have propelled themselves to the frontline of the global economy thanks largely to the data they absorb and rapidly transform into operational insights, predictions, and new services and products. Today the data arms race has spread well beyond Silicon Valley into industries ranging from entertainment, where Netflix’s algorithms have made it a streaming colossus, to agriculture, where John Deere has revolutionized the agriculture tech space.

According to a 2018 survey of Fortune 1000 companies by NewVantage Partners, 79 percent of C-suite executives fear disruption from data-driven competitors. An overwhelming 97 percent report that their firms are now investing in big data and AI initiatives to become nimbler in this new business climate.

Successful executives are searching for advantage through unique access to metrics about their markets and customers. The question they’re asking: “How can we turn the information into something we can use essentially to clobber the competition?” said Brian Kilcourse, managing partner at RSR Research, in a recent podcast interview. While a similar struggle has always played out on a smaller scale, in the age of digital transformation, “the battle has been reengaged,” he says.

Market Development through the Lens of Data

Data analysis has countless applications for businesses, from optimizing supply chains, to honing marketing messages, to creating new product lines by bringing proprietary data to the market. But where experts see it yielding the best results is in creating a more textured, binding relationship with the customer. Companies that outperform competitors use location-based data to understand who the customer is, where they’re located, and what their proximity is to the things they want or need.

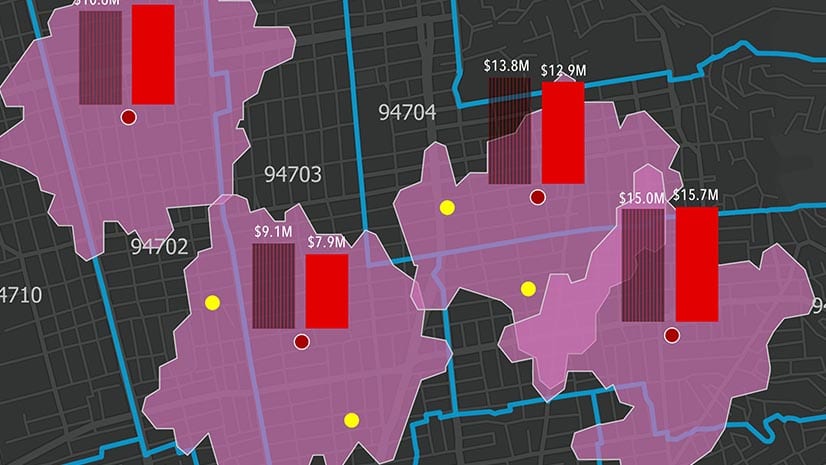

That’s why location intelligence has become an essential tool for market development. With a location-centric view of data, companies like John Deere learn how customers in a given market will respond to various products and services—even how much they will spend. Using an AI-powered geographic information system (GIS), data scientists and analysts at Deere can visualize billions of data points, finding revenue-generating patterns that a human alone could never detect. This kind of predictive view makes it easier than ever to spot unseen expansion opportunities and potential investment traps.

Deere has stayed ahead of the competition by using location data to remove the guesswork from market development.

John Deere in a New Age of Agriculture

In the crowded market for agricultural machinery and heavy equipment, few companies command the brand awareness of John Deere, with its instantly recognizable green-and-yellow color scheme and leaping deer logo. Founded in 1837, it has distinguished itself in the twenty-first century through a commitment to smart data practices.

“As our CEO recently said, we’re a technology company,” said Angela Bowman, a research scientist for John Deere, in a recent interview. “That’s it, first and foremost.” Thanks to sophisticated machines equipped with sensors that capture data on soil, water, and temperature conditions, Deere has amassed incredibly powerful resources. Satellite imagery lets the company’s decision-makers analyze land cover, sizing up how various grasslands, crop fields, or lawns correlate with consumer purchases. A map with 50 billion data points about field conditions and topography gathered from IoT-equipped machines gives the company a kind of intelligent nervous system of America’s farms and lawns. That tech-savvy has caught the attention of people like Jennifer Belissent, a principal analyst at Forrester who specializes in the the data economy.

“John Deere is really illustrating that companies that use data in intelligent and strategic ways are gaining competitive advantage in a lot of different ways and in a lot of different industries,” Belissent says.

In fact, Forrester surveys show that 56 percent of firms are expanding their ability to source external data, and another 20 percent plan to do so in the next year.

One way Deere presses its data advantage is by using location information to assess potential markets and predict growth opportunities. In essence, the company has turned the art of market assessment into a science, forming action plans based on the location intelligence it distills from sales data, demographics, land-cover and satellite imagery, and competitive insight.

Seeing the Future of Farming and Retail

Farmers have always relied on some form of predictive intelligence, turning in the past to bird flight patterns, cloud formations, or the folksy divinations from the Farmers’ Almanac to forecast in what can be a precarious trade. Against that backdrop, John Deere has been an innovative force since its namesake founder’s pioneering work helped to invent the American steel plow. As large-scale farming has become more sophisticated and technologically advanced—turning it into what is often called precision agriculture—Deere has placed itself at the edge of progress. The company become something of a data sage in the process, able to help customers forecast crop yields and needed machine maintenance, while giving dealers a boost in determining which markets will perform best.

“All farmers must be technologists in today’s technology-driven world,” Bowman says. “Today in modern agriculture, it’s extremely complex.”

To outsiders, the success of a Deere dealership might seem like a matter of luck, a product of good or bad weather. But Deere has remained ahead of the competition by using location data to remove the guesswork from market development, supporting retail dealer investments with a foundation of objective analysis.

“The work I do for market planning would be impossible without location intelligence,” says Mattias Wallin, a data scientist with the market research group at John Deere. Using GIS technology, Wallin delivers market intel to Deere’s Dealer Development office, whose professionals advise dealers with data-based investment predictions.

For many of these dealers, opening another location would be one of the biggest capital expenditures of their professional lives—a potentially risky bid for growth that they pursue only a couple of times in a career. With location intelligence, Deere can boost the odds of dealer success by making market assessment less about gut instinct and more of a calculated chess move that factors in all variables.

“The whole point is to remove uncertainty,” Wallin says. That grants dealers the confidence that they made the right decision expanding to a particular location—or not. That approach has given Deere a healthy retail network, worldwide revenue of $37 billion, and the status of world’s largest agricultural equipment maker.

Tools of the Data Trade

During the early stages of a market analysis, Wallin and his team might sift through thousands of variables. In the end, they typically need just 20 to accurately predict the commercial value of a potential area, usually measured in census blocks. These blocks generally include about 3,000 people and range in size from a city block in urban locations to hundreds of square miles in remote or rural regions.

The cornerstone of Wallin’s work is sales data—the hard numbers on what products sold where, and when they sold best. With GIS technology, Wallin can carry out an AI-powered regression analysis on a potential new market. This entails looking at other currently active markets with similar characteristics of land cover, customer sales, and demographics, and projecting potential revenue for the new area based on past performance. If the market characteristics are different—lawns instead of crop fields, or higher or lower income levels—the GIS-based AI model examines how those variables affected revenue in other areas, then folds that into the analysis of the potential site. These insights allow dealers to see opportunities at a granular level, gaining important insight that the competition often lacks.

To demonstrate the power of location intelligence in quantifying markets, Wallin will first apply the analysis to the dealer’s current region, treating it as if it were a new market and sharing the results with the dealer—often to their surprise. “A dealer in the Pacific Northwest said, ‘Wow, Mattias, your tool captured everything that I’ve learned about my markets and customers for the last 30 years.’”

Psychographics: Insights into Customer Lifestyle

As with any market analysis, demographic information is essential, but psychographic data—a sophisticated view of consumer behaviors and tastes—can guide precise store siting and even influence the store’s product mix. This is an important advantage for a company like John Deere, whose products can range in cost from $1,600 to $600,000, leading to a widely segmented audience.

“I really see the value in psychographics as a way to visualize or bring some context around, who is your customer? What do they look like?” Wallin says.

A GIS-powered analysis of a market’s psychographics might reveal, for example, that an exurban area is home to high-income, white-collar professionals with a taste for the farming lifestyle. These individuals could own a few acres of grass and be willing to spend more money on a high-end lawnmower or small utility tractor.

A John Deere dealer aiming to court this customer segment might use GIS to pinpoint sites with clear traffic lanes to exurban areas and comfortable proximity to direct competitors. The data could also shape which products the dealer stocks and which it makes visible from the road. Online and direct mail marketing campaigns could be targeted at more affluent consumers in ZIP codes linked to higher-acreage homes. These are all decisions a data-driven company can make confidently, based on details likely to yield substantial gains in the long run.

Who Gets There First?

John Deere’s successful use of location intelligence and psychographic information underscores the central insight of analysts like Belissent—that the most effective ways to build data into a business model often center on the relationship with the customer and serving their needs. “The number one thing we’re seeing in terms of driving the use of data is improving customer experience,” Belissent says.

Companies that crunch data to improve operational efficiency alone tend to progress at a slower rate. Those that pull in external data—whether it’s weather patterns, satellite imagery, or demographic and psychographic profiles—tend to better understand the markets they hope to serve, and place supply closer to demand. Developing that location intelligence quickly in a fast-paced business environment increasingly depends on savvy use of data.

“If somebody is asking for insight that requires some advanced analytics capability and it’s taking months or years, somebody else is going to get there first,” Belissent says. “The competitor is going to get there first.”

To hear more about how John Deere gains advantage through location analytics, listen to this podcast with Mattias Wallin.

The Esri Brief

Trending insights from WhereNext and other leading publicationsTrending articles

December 5, 2024 |

November 12, 2018 |

July 25, 2023 |

February 1, 2022 |

March 18, 2025 |

May 28, 2025 |