The insurance industry earned a spotlight at the 28th United Nations conference on climate change (COP28) in late 2023. Prominent global figures and business leaders alike spoke to the need for sustainable, equitable access to protection from climate risk. They warned that lapses in personal or commercial insurance could disrupt livelihoods and lines of business—and in turn jeopardize entire economies.

Recent events underscore the challenge. Over the last 30 years, the annual average for natural disaster losses covered by insurance was $57 billion, according to Reuters. In 2023, the total was $95 billion, according to Munich Re.

Insurer Aon pegged 2022’s total at $132 billion. Even more startling: That amount was just 42 percent of total losses—the rest were not covered by insurance. Aon calls that one of the lowest coverage rates on record.

Insurers, already adept at understanding local risk and calculating the costs of protection, will need more precise risk visibility to accurately price policies in regions plagued by worsening climate hazards—from deadly heat events in Europe to property-leveling wildfires in North America.

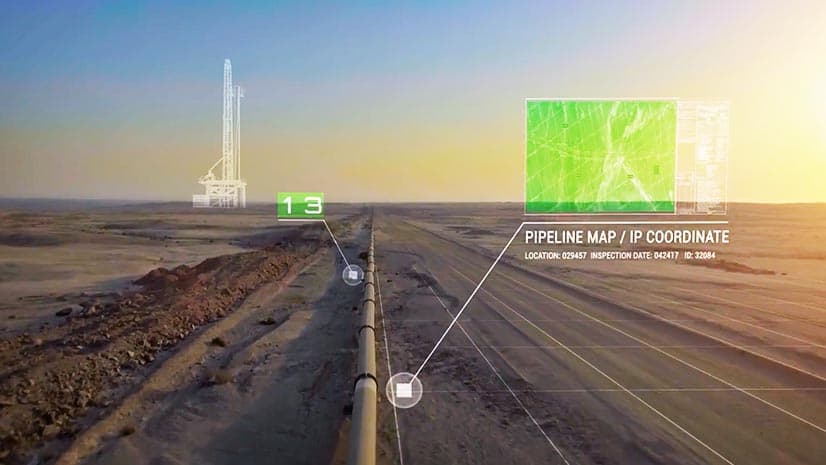

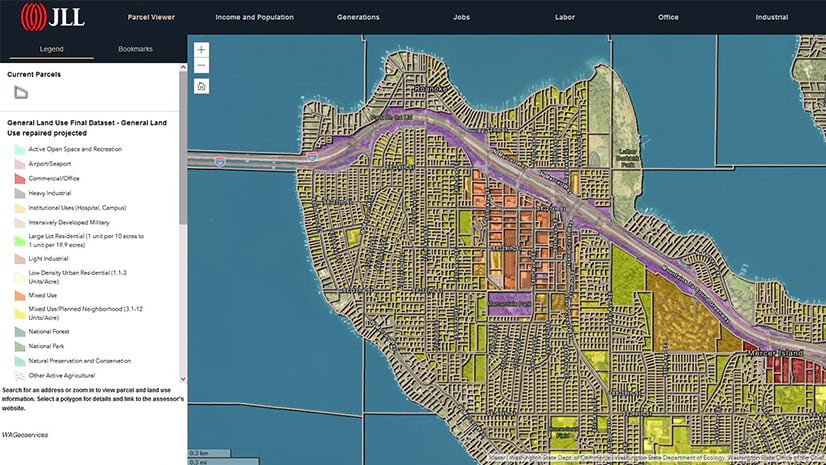

It’s an urgent, complex challenge, but insurers might already have what they need to tackle it: location technology. Geographic information system (GIS) software, already used throughout the industry to digitally map portfolios and assess property conditions, is also a powerful tool for climate risk analytics.

Insurers and a Climate-Driven Future

Climate change is problematic for a business model that puts a price on risk protection. Unattainable, unaffordable policies aren’t sustainable for customers or regional economies, and yet insurers can’t bear the costs of new or growing risks without changing their products.

In Florida, insurers are offsetting flood and storm damage payouts by raising commercial real estate premiums. But as policy prices rise, consequences can cascade. Property owners raise rent for retail customers, which displaces existing businesses, dissuades new retailers from opening, or drives up prices for consumers.

Such scenarios are playing out around the world. In Cambodia, where farmers generate 35 percent of the country’s GDP, crop insurance protects against worsening floods and droughts. But local insurers are scarce, and coverage can be cost-prohibitive for individual growers, leaving a major industry—and the economy it supports—vulnerable.

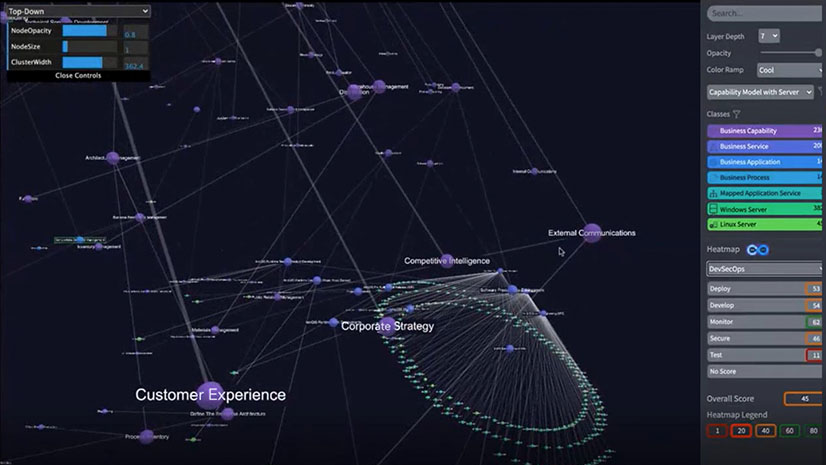

Insurers need a new level of precision in risk analysis to customize policy prices and coverage offerings for hyperlocal markets, even individual policyholders, based on the climate hazards they face. This work is made possible with GIS analysis and modeling.

Clarifying Climate Risk

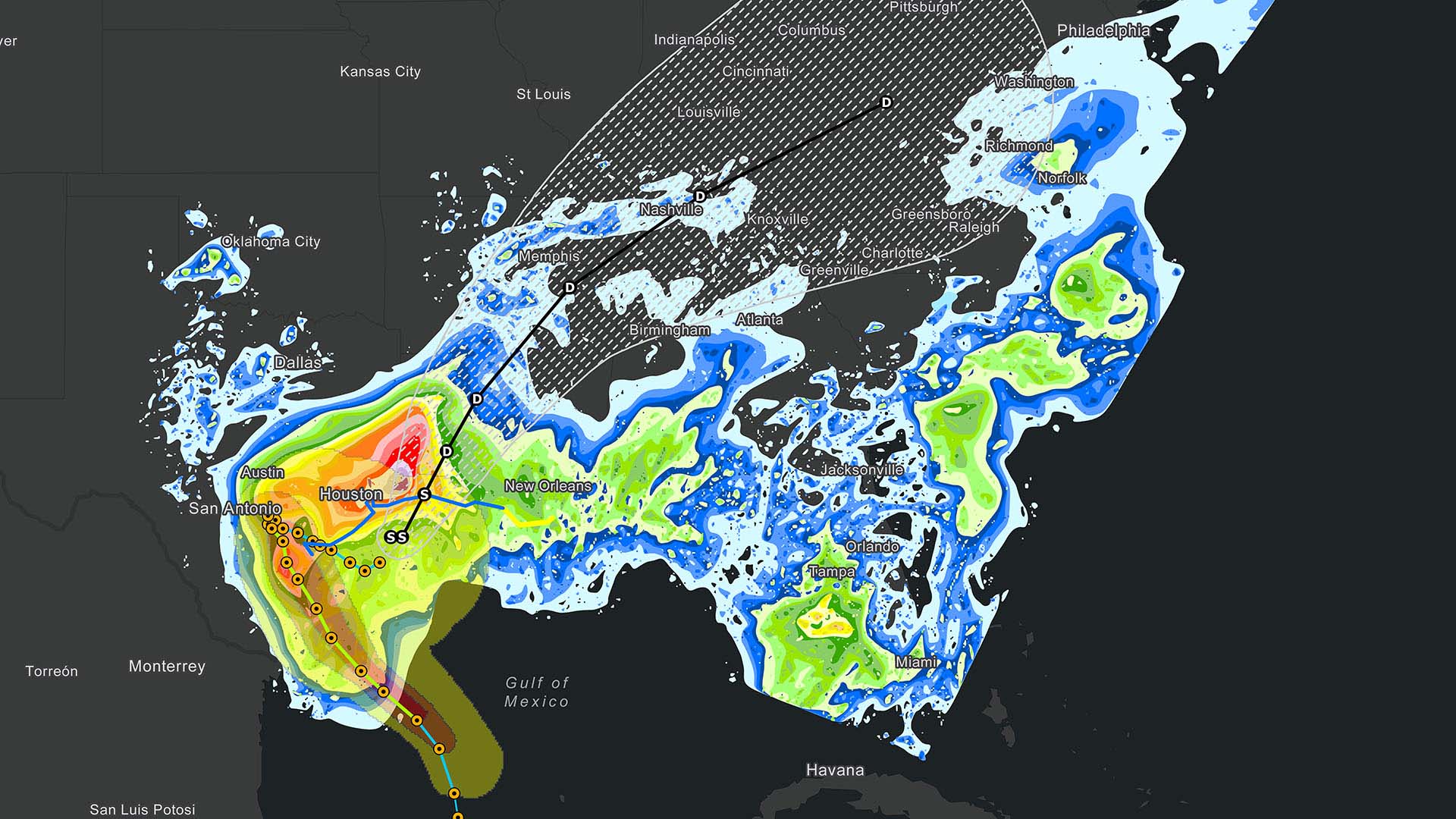

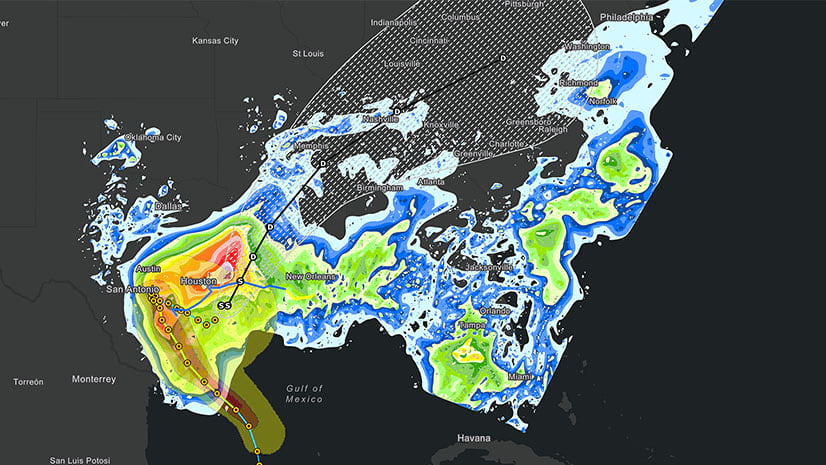

Precise climate risk analysis starts with climate data—increasingly available from public and third-party sources. GIS-based predictive analytics, which models climate data over space and time, can reveal the likelihood of specific threats in specific places and what might happen if disaster strikes.

Savvy insurers combine climate data with asset data to understand risk down to an individual property, such as comparing a structure’s age and building materials to the type of storm damage it’s likely to face, or evaluating a farm’s annual water usage against heat and drought models.

As Munich Re’s then head of geospatial solutions told WhereNext in 2019:

More transparency means a better understanding of what the industry is insuring these days. We have to learn more [about building] construction types, occupancies, the age of buildings—a lot of additional data. We have to bring it together to have the full transparency when we are doing risk assessment.

Insurers then translate these details into a better customer experience. For one, hyperlocal analysis can produce individualized risk scores, informing coverage and policy pricing that’s tailored for each business and property. It also provides transparency, giving customers information they need to take appropriate mitigation steps—reducing risk for insurers and potentially lowering premiums. Finally, anticipating specific risks and potential damages—and using GIS to track incidents in near real time—helps insurers speed response times on claims.

Taking Local Action against a Global Challenge

Climate change has global impacts, but those impacts don’t look the same everywhere. Innovative insurers are thinking hyperlocally as they plan and price policies. They are analyzing what kind of climate risks exist, where, and what’s at stake for regional customers if hazards do occur.

In a keynote at COP28, Howden Group CEO David Howden spoke of the need for governments and insurers to work together to model risk, calculate the costs of protection for the most vulnerable places, and make insurance more accessible and affordable. With GIS technology to analyze and contextualize hyperlocal data, insurers can inform decisions that protect clients, business longevity, and healthy economies.

The Esri Brief

Trending insights from WhereNext and other leading publicationsTrending articles

December 5, 2024 |

November 12, 2018 |

July 25, 2023 |

February 1, 2022 |

July 29, 2025 |

August 5, 2025 | Multiple Authors |