Companies that realize competitive advantage see their customers better than most. Among the most successful businesses, that practice borders on obsession.

These industry leaders understand what customers value and how they prefer to interact with a brand. Such 20/20 vision wasn’t possible before the digital transformation of the economy. Now, with nearly everything and everyone digitally connected, leading companies have a wealth of digital breadcrumbs to explore.

Top executives, managers, and frontline employees harvest every morsel of insight to understand where and how customers shop, how they engage with products, and what they expect from interactions with the brand.

Leading executives use that insight to shape strategy in every aspect of the business—product development and sourcing, the supply chain, in-store experiences, marketing, and after-sale service. In short, the customer drives decisions at every stage of the value chain.

When Customer Insight Leads, Profit Follows

Digital transformation allows for potent new levels of customer insight, but most companies are moving too slowly toward digitization. A recent McKinsey survey found that across industries, the average business is 37 percent digitized.

Those that have digitized across multiple areas of the business show the best returns, McKinsey found.

Executives who use digital insight into customers to drive company strategy have learned that financial results usually follow. One of America’s busiest cosmetics retailers is living proof of this. Inside hundreds of locations, every aspect of the store experience is powered by customer preferences. Product assortments suit the tastes of customers in that geography. Store associates frequently consult with shoppers to learn local tastes. And an in-store salon satisfies customers’ desire for a shopping destination, rather than a place of transactions.

Outside the four walls, the relationship continues through a digital connection. When customers showed a desire to experiment with new products, the company added a feature to its mobile app that lets users apply makeup to their selfies, revealing how they would look in various shades and applications.

Executives have discovered these customer preferences through surveys, social media sleuthing, in-store feedback, and location intelligence. They know details large and small—for instance, that most of their customers are female and willing to spend, and that 91 percent own more than five makeup brushes.

The company’s ability to see its customers in ways its competitors cannot has created a bond that most executives would envy—and financial results to match. From 2013 to 2017, the company doubled sales. Customers in the brand’s loyalty program drove 95 percent of that revenue.

Learning How to Understand

Seeing customers well is not a practice just for retailers, and it’s not as simple as it sounds. A recent conversation with two executives from the same financial institution underscores this point. Asked who their primary customer was, the executives sketched two starkly different profiles.

The remedy is to cross-check intuition with data, and customer-focused executives do this exceptionally well.

Among their trusted tools is location intelligence, a wellspring of customer insight. Generated by geographic information systems (GIS) and the geospatial cloud, location intelligence answers a wealth of customer-centric questions, among them:

- Which of my stores sell the most high-end products?

- Which geographic locations account for the highest mobile sales?

- Which demographic groups drive the liveliest discussions on social media?

- What are my customers looking for in online shopping and delivery?

By analyzing these and other questions on GIS-powered smart maps, customer-driven executives discover insight that helps them plan the business.

Fifty-three percent of companies that do not use location intelligence today say they plan to do so in the future, according to a recent Fast Company article. Among those that do use location intelligence, 97 percent say it is important to the success of their business.

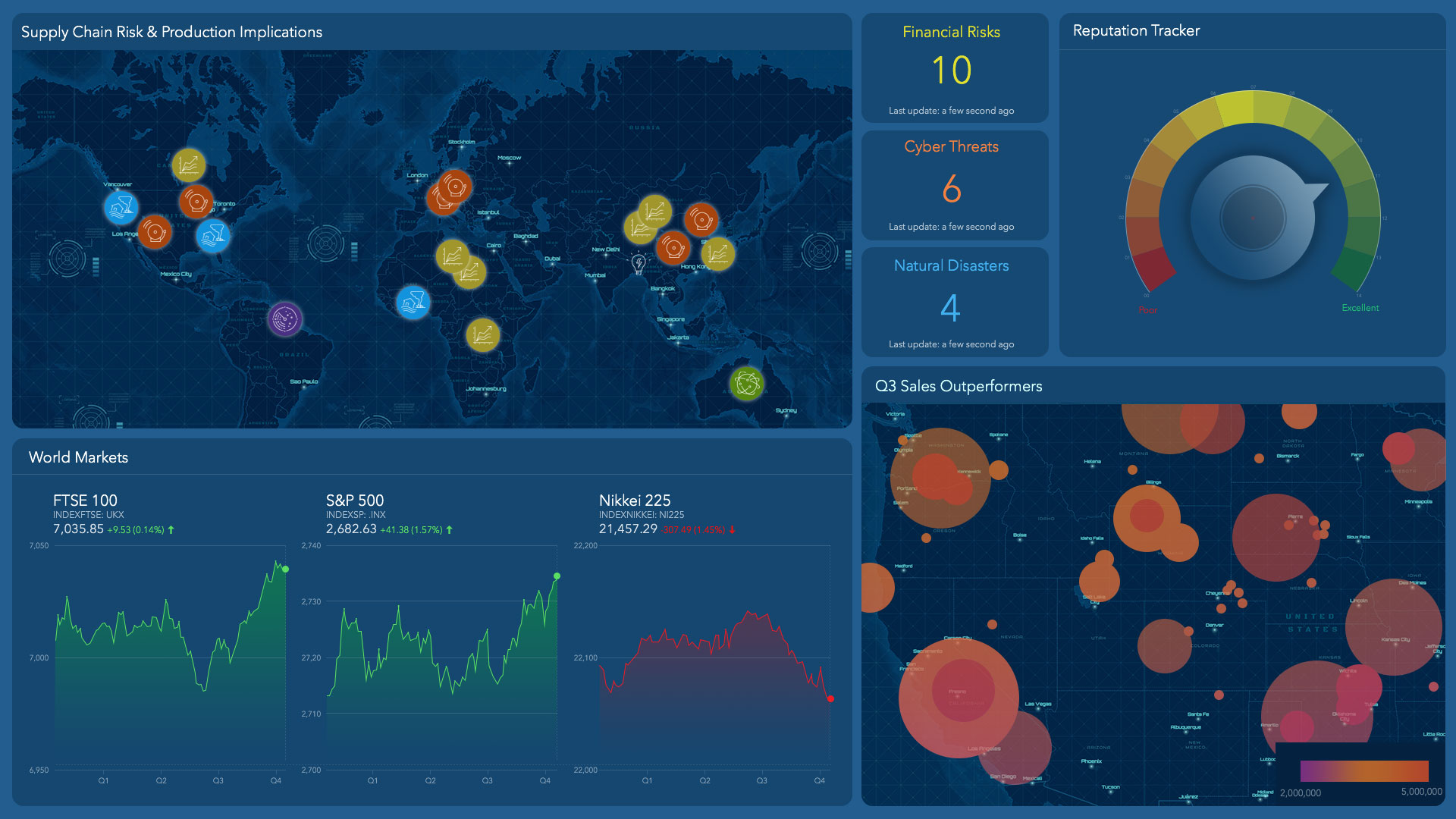

The most innovative businesses use location intelligence to drive decisions not just at the point of transaction, but throughout the value chain.

A Broad View of Decision Support

“The enterprise is an ecosystem of choices,” says Tom Horan, dean of the business school at the University of Redlands. “The more insight and data a business uses to make choices throughout the value chain, the better equipped it is to serve its customers and increase sales.”

Data on customers deserves to be handled with care—for the sake of customer privacy and in the interest of business planning. Leading companies organize this data into a go-to source of insight. In its highest form, the data is a centralized asset that drives innovation in each part of the business.

The world’s largest retailer embraces this model. Walmart has created an internal data café accessible to all its business lines, according to a recent Forbes article. Managers present members of the café with a question—for instance, Where are sales of this product highest?—and receive a prompt answer. Behind the scenes, the system sorts through truly big data—40 petabytes of customer transactions—to discern customer patterns. (One petabyte can hold 13 years’ worth of HD video.)

Walmart calls it a data café; others use the term data market. Regardless, in the best scenario, each part of a company’s value chain contributes to a single customer data model, enriching the model and generating insight to drive daily and strategic decisions. This approach helps fight the traditional business hazards of departmental siloes and conflicting data. And McKinsey data backs it up. The firm found that outperforming companies were less likely to display siloed mentalities or a fragmented view of the customer.

When you look at firms that are really succeeding around the use of data and analytics technologies… they focus on the value, the insights, the information that they can derive from data that is useful to decision-making.

Seeing the Customer across the Business

To date, the drive to see customers more clearly has flourished in certain industries–among them retail and high tech—and certain business functions—notably marketing.

The emerging perspective is that customer insight should drive strategic discussions across all business functions.

For each area of the value chain, location intelligence powered by the geospatial cloud is driving these discussions. Winning companies are using the insight to make smarter, more customer-centric decisions. The following examples reveal how.

Value Chain Stage: Product Development and Manufacturing

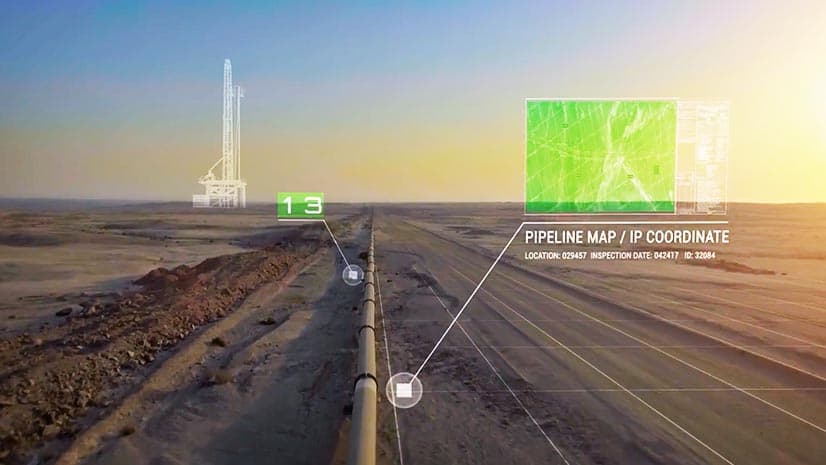

For centuries, manufacturers developed products and then lost sight of them once they left the factory. Today, a digital cord composed of IoT sensors and always-on wireless connections keeps those companies in touch with products in the field. It also allows companies more flexibility to personalize products after the sale. Cars, home alarms, software—even clothes and toys—send data on how and where they’re being used, giving product developers a valuable window into how they might design future products and create new after-sale customizations.

One global automaker is using IoT data from its cars to make future models more responsive to customers’ needs. The company uses the geospatial cloud to model the driving conditions in each of more than 170 customer locations—sifting insight from data on altitude, rainfall, temperature, humidity, and driving behavior. Those conditions differ depending on the location, and that insight allows product developers to design automobiles optimized for specific locations.

The same customer insight can drive decisions about which add-on features to offer in which locations—traction-control upgrades in mountainous locations, range extensions in rural locales, or Waze integration in metro centers, for instance.

Value Chain Stage: Sourcing and Sustainability

A generation ago, the raw materials used to create consumer and food products were the least interesting part of a company’s story. Today, many brands lead with that chapter. It’s all in response to consumers who want products that are grown, harvested, and mined responsibly. Industry standouts are using innovative digital tools to tell that story.

Nespresso is a compelling example. The Swiss maker of single-serve coffee is closely attuned to customers who value fine products made with sustainable practices. Nespresso communicates its sourcing practices to customers with the help of location intelligence technology.

“When we need to explain something to [customers], a map is much more relevant than a report,” says Yann De Pietro, the company’s manager of operations and sustainability technology for coffee. Nespresso’s sustainability dashboard features information such as the location of the farms it works with, farmers’ profiles, and the dates when farms were last visited by a Nespresso agronomist.

“We can always say we work with 100,000 farmers in the world, but if people don’t see it, they won’t believe it,” De Pietro says. “That’s the big win that we have with GIS. It’s sharing, communicating, and making people understand.”

Value Chain Stage: Supply Chain

At one of the biggest produce companies in the western United States, customer obsession drives decisions across the value chain—from the planting fields, through the supply chain, to the grocery store. Company leaders seek to identify the freshest, best-tasting produce—products that will create customer delight.

They’re not alone in seeking that goal. Companies across the economy have jettisoned the yardstick of customer satisfaction for the more immersive, loyalty-inducing measure of customer delight.

(Visit this Forbes article for more examples of companies that use location intelligence to delight customers.)

In its pursuit of that goal, the produce company uses the tracking capabilities of RFID and the geospatial cloud. The process begins at hundreds of cooperatives that feed the supply chain. Through GIS-powered smart maps, company leaders see where fruit with the highest customer satisfaction rankings originated. They then work with other farms to replicate the conditions that produced that fruit. Some food manufacturers plan to create even greater transparency into how products reach consumers via geoblockchain—a combination of GIS and blockchain technology.

Supply chain resilience is another key aspect of responding to customer demands, and some of the best-known companies in the world use location intelligence to enhance theirs. At GM, “even an hour’s worth of downtime at one of our plants can impact deliveries to our dealers and the overall customer experience,” says Paul Rossi, a member of the company’s strategic risk management team.

To safeguard customer deliveries, GM monitors conditions around its plants and supplier locations worldwide. When untoward events occur—earthquakes, fires, storms—GIS helps GM analysts quickly understand and mitigate the potential impacts.

Value Chain Stage: Market Development

The Shopping Center Group (TSCG) is the largest real estate firm of its kind in the US, advising top-tier retailers on corporate real estate opportunities. Its executives and professionals have a keen eye for market opportunities, and that vision is enhanced by location intelligence.

TSCG uses GIS-powered location analytics to assess the potential of geographic markets, and helps clients plan the right location to best serve their customers.

“Our customers are retail customers, and if they’re off by an inch, they’re off by a mile,” says David Birnbrey, co-CEO of TSCG.

To gauge markets with such precision, TSCG uses location data to understand not only its clients—the retailers planning new locations—but the shoppers who will make or break each retail store.

As COO Bob Wordes explains, “Demographics are important, but the psychographic—really understanding who the customer is that’s coming to a particular shopping center—is critical.”

That brand of insight flourished as consumers underwent their own digital transformation over the past decade, embracing smartphones, social media platforms, and online shopping. Now companies in industries from media and entertainment to restaurants, retail, and software can access more insight than ever into what consumers value and which brands they trust.

As TSCG’s experience underscores, that analysis gives executives a boost of confidence as they open new locations in the physical and digital economy.

Retailers understanding what their value proposition is to consumers informs how they approach the consumer in the digital domain and how they line the physical store up to support that.

Value Chain Stage: Logistics

Since their inception, logistics providers have been paragons of efficiency. They use data to optimize routes, pack more goods into smaller spaces, and generally reduce the friction of transportation. That quest has intensified in recent years, as consumers have grown to expect their packages, rideshare cars, and coffee to arrive on demand.

Location intelligence has been their boon companion. It helps the providers ensure on-time delivery by revealing where goods in transit are located in real time, as well as where they’re headed.

For FedEx, location awareness permeates every corner of the value chain—including airplane maintenance.

The company uses GIS-powered maps to view the maintenance status of hundreds of planes and coordinate replacement parts and technicians’ work. It’s an aerial ballet that executives monitor closely, and it would be virtually impossible without the GIS-based smart maps at the heart of the FedEx tracking system.

Last year, as a result of that location intelligence, just 60 FedEx flights out of approximately 240,000—or .025 percent—failed to take off within 15 minutes of scheduled departure time because a replacement part wasn’t available soon enough.

That helps FedEx deliver stay in time with customer demands.

Value Chain Stage: Service and Support

Service has become a core component of most sales. Businesses that service products after the sale lock in a recurring revenue stream and can—with effective execution—establish an enduring relationship with customers.

One of the world’s largest vendors of technology hardware recognized the value of service contracts early on. To meet high expectations for timely service, the company stocks replacement parts and posts skilled technicians at more than 1,000 depots around the globe. The company signs service-level agreements to supply customers with replacement parts within a specified timeframe: two hours, four hours, or the following business day.

Before it turned to map-based analytics, the company had been operating in the dark about how many resources it needed to provide world-class service. When the company implemented GIS to analyze the service network, executives realized how many redundancies they had maintained. GIS revealed where and how fast the company could serve customers. Based on that science, the tech vendor closed superfluous depots and phased out unnecessary inventory—while meeting its existing SLAs and adding more.

With a spare parts inventory valued at more than $8 billion, the company’s realized significant savings through these reductions while maintaining world-class customer service.

The Value of Information across the Business

“Winners tend to do some different things,” Brian Kilcourse of the analyst firm RSR said in a recent podcast. “One of the things that they do differently is they have a very different view of the value of information, and they tend to view information strategically rather than tactically.”

Today, only a few true industry leaders apply customer-based location intelligence to every facet of the value chain. But the race for competitive advantage spurs them on every day, toward a better understanding of their customers.

“As we’ve digitally transformed our businesses,” said James McCormick of Forrester on a recent podcast, “we have opportunities for understanding . . . customers’ engagements in ways that we never thought possible.”

That’s what’s clear about market leaders. When it comes to letting customer needs drive strategy throughout the value chain, they’re not afraid to redefine what’s possible.

The Esri Brief

Trending insights from WhereNext and other leading publicationsTrending articles

December 5, 2024 |

November 12, 2018 |

July 25, 2023 |

February 1, 2022 |

July 29, 2025 |

August 5, 2025 | Multiple Authors |