Daniel Humm, owner and head chef at Eleven Madison Park (EMP) in New York, had big news this spring. His upscale restaurant—one of only 13 in the US to earn three Michelin stars—would henceforth be strictly vegetarian. It was like BMW announcing it would discontinue car production to focus on its bicycle line.

Few businesses contemplate—let alone implement—such a radical rethinking of product offerings. But any change—whether carried out by a small restaurant, regional brand, or national franchise—requires a close understanding of what customers want and how much change they will tolerate. Companies often can find this insight in data related to consumer preferences and psychographics, viewed through the lens of location intelligence.

Consumer Preferences in Flux

The change Humm is bringing to EMP is undeniably bold. As the Wall Street Journal noted, Humm, like most prestige chefs, built his reputation on meat and seafood dishes. Worldwide, Michelin awarded three stars to just one vegetarian restaurant this year: King’s Joy in Beijing.

But Humm’s announcement, made as the city began to relax coronavirus-related occupancy requirements, was also well-timed. As the world wakes up from the COVID-19 pandemic, change is in the air. A recent Forrester study found that 75 percent of us say the pandemic will lead to long-term changes in our behavior and experiences.

Evidence suggests that interest in plant-based diets could be part of this reappraisal. A study commissioned by Proagrica, an agriculture and animal health technology company, found that nearly 20 percent of people in the UK ate more vegetarian food during the first year of the pandemic, and the same percentage plan to make the habit permanent. An especially intriguing data point for the restaurant industry: nearly 40 percent of respondents said they would consider ordering plant-based meat alternatives in restaurants, including fast-food establishments.

As savvy businesses adjust their offerings to acknowledge these and other consumer changes, they would do well to rely on location intelligence as a guide, because it reveals where important trends and consumers may intersect and can help assess new approaches and strategies.

Sensing Consumer Preferences Geographically

For a retailer, manufacturer, or service company considering bold changes, the first step is to understand what its customers and potential customers want. Just as it would be foolhardy to increase umbrella inventory in a desert region, it makes little sense to sell novel items or experiences in areas where the demographics and psychographics don’t indicate support.

When Carl’s Jr. tries to sell customers on its plant-based Beyond Famous Star Burger, and Del Taco promotes its Epic Beyond Original Mex Burrito, they want to know where such products are likely to be successful. To that end, many companies, including restaurant chains, apply a location intelligence strategy when they optimize their locations and their offerings.

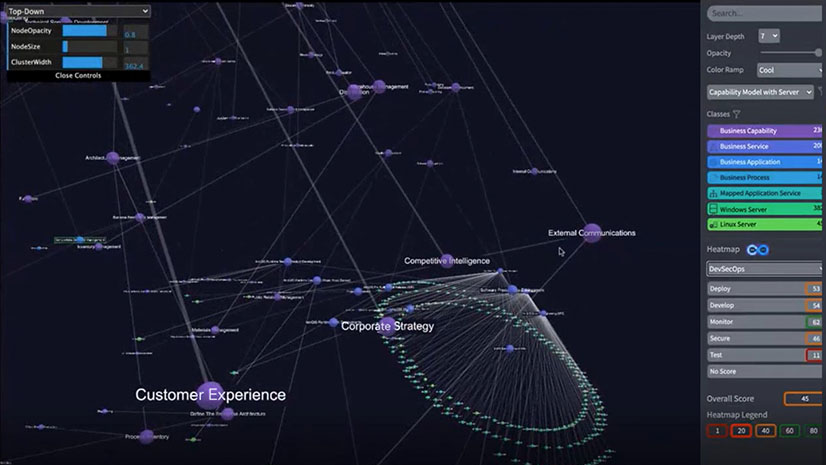

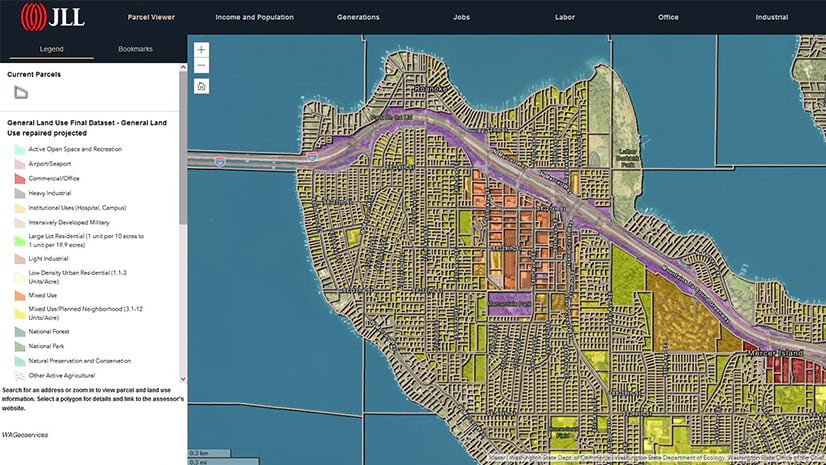

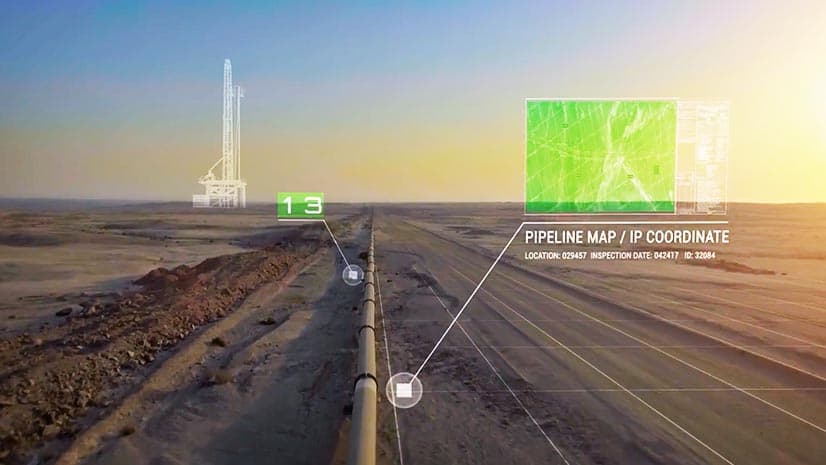

For instance, using a geographic information system (GIS), some companies analyze anonymized social media data to understand consumer preferences in certain locations. A chain planning where to introduce vegetarian options might use GIS to identify geographic clusters of people who voice support for animal rights or plant-based diets. Human mobility data—similarly anonymized—can reveal consumer preferences and patterns much as it revealed social distancing practices to public health officials during the COVID pandemic.

On the Move

Not only are tastes and habits shifting in ways that can be hard to grasp without the help of location data, but people’s physical locations are as well. Overall, the number of people making permanent moves has increased modestly since the start of the pandemic—but certain metro areas are experiencing dramatic shifts in population size or makeup.

As companies contemplate major changes in the postpandemic environment, they’ll want to delve into these demographic shifts to better understand market potential.

Using GIS, companies can analyze the demographic breakdown of urban, suburban, and rural markets and, through smart maps, visualize the location of certain buyer personas. They can even enlist the AI capabilities of GIS capabilities to uncover consumer clusters that are not immediately apparent.

Strategic-minded brands round out that analysis with psychographic insight on consumer preferences. Psychographics can be useful in discovering geographic locations with high concentrations of people concerned with wellness lifestyles, for instance. The same techniques could reveal areas where healthy eating is a primary concern. Savvy GIS analysts create maps showing these patterns, providing product marketers, merchandise planners, and real estate executives with useful intelligence for near-term and strategic plans.

As the world emerges from what we can only hope is the worst of the pandemic, shifts in consumer preferences are likely to accelerate. Companies can make the most of these changes by anchoring data in a coherent framework of location intelligence.

The Esri Brief

Trending insights from WhereNext and other leading publicationsTrending articles

December 5, 2024 |

July 25, 2023 |

November 12, 2018 |

February 1, 2022 |

July 29, 2025 |

July 14, 2025 |