Imagine 330 million identical marbles placed on a rigid map of the United States, each corresponding to the precise location of one resident. The point on which the map can balance perfectly without losing any marbles is the nation’s population center. Based on 2020 census data, that point is next to a creek in the Missouri Ozarks, 14 miles outside the town of Hartville (pop. 600).

A map charting the population center’s progression—starting on Maryland’s Eastern Shore in 1790, with big leaps west in the mid-19th century, a slight northerly drift during Reconstruction, and a 20th century southwesterly slide toward the Sunbelt—offers a concise social history of the country.

The decennial unveiling of the population center is a small example of what data analysis can reveal about the country. Business executives depend on a deeper form of analysis for the location intelligence that helps them decide where to invest and how to outmaneuver competitors. The speed and granularity of that insight have improved markedly in recent years, driven by advances in geographic information system (GIS) technology.

Examining Population Centers in Real Time

Companies now have access to anonymized movement data from cell phones and other mobile devices, often in near real time. Projected onto GIS-powered maps and dashboards, this data yields detailed insight into where various types of consumers prefer to access products and services.

The COVID-19 pandemic heightened interest in real-time movement analysis, as researchers sought to answer questions such as where social distancing directives were most effective.

Businesses are increasingly adopting a similar form of location intelligence to answer questions related to “human weather.” A business considering sites for a store can analyze travel patterns in a city to get a sense of reachability—the distance customers are likely to travel to a location by car, bike, foot, or public transit. GIS technology analyzes those queries with artificial intelligence that detects patterns and hot spots in large amounts of data.

The Granular View

Unlike the population center concept, in which every marble is the same except for its location, companies must understand countless variations in demographics and even psychographics to find likely customers. But some still take a high-level view of their audience, despite what the data offers—a phenomenon noted in a recent WhereNext article:

[Retail analyst Stephen] Roach considers that a common unforced error, since location intelligence can help companies dig deeper and compare the diverse preferences of people within a ZIP code or even one section of a city. Flooding a large [market] with one-size-fits-all messaging for a product or an issue is not an efficient or particularly effective way to spend marketing budget, Roach says.

The anonymized quality of movement data and the analytical capabilities of GIS unleash insight from massive stores of data, helping companies connect with customers interested in their services. With that insight, Roach could show clients precisely which demographic groups frequented the area around their stores—as well as which customer types visited competitors’ locations.

Location intelligence is the insight gained from a careful analysis of spatial relationships. Since most data has a location component, location intelligence is a way to study many variables and how they interact in the world.

Location Intelligence for Smart Routing

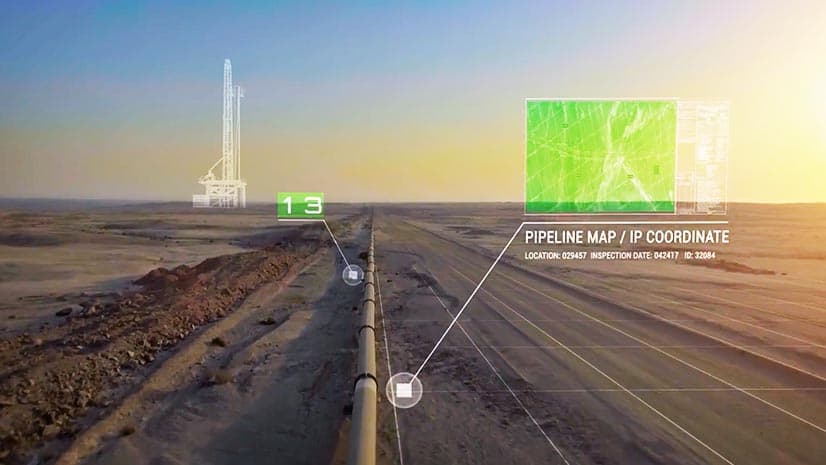

The same technology that shows companies where customers and goods are located also helps identify better methods for getting them where they need to be. This form of location intelligence has become especially valuable over the last few years with the massive increase in retail e-commerce and recent supply chain disruptions. Many companies have used GIS to make routing more cost-effective and to pinpoint supply chain trouble spots. Such analyses factor in traditional goals like speed and efficiency while accounting for more nuanced business considerations like customer preferences and service availability.

One health services company that offers home visits used location intelligence to improve the way its nurse practitioners and physician assistants were assigned to patients. Although the primary objectives were to minimize travel time and increase productivity, those weren’t the only factors.

“We are not a delivery product—we focus on human interactions,” the company’s vice president of analytics told WhereNext. His team of analysts used GIS to design an automated routing system that understood, for example, whether a patient preferred a male or female clinician, rather than just determining which care provider was closest.

For companies analyzing home visits, global supply chains, or spending patterns across demographic groups, GIS provides a nuanced view of customers and processes. With population shifts occurring not just once a decade but every day, companies with the right form of location intelligence stand to make smart decisions at the right time.

The Esri Brief

Trending insights from WhereNext and other leading publicationsTrending articles

December 5, 2024 |

July 25, 2023 |

November 12, 2018 |

February 1, 2022 |

July 29, 2025 |

July 14, 2025 |