May 7, 2024

As the nation grapples with a historic shortage of affordable housing, mortgage assistance programs for people with the fewest resources are facing a difficult test.

Only 21.6 percent of homes for sale in 2023 were considered affordable for a typical white US household. But even worse, just 10.4 percent were affordable for Latinx households, and a mere 6.9 percent were affordable for a typical Black household, according to a recent study by Redfin.

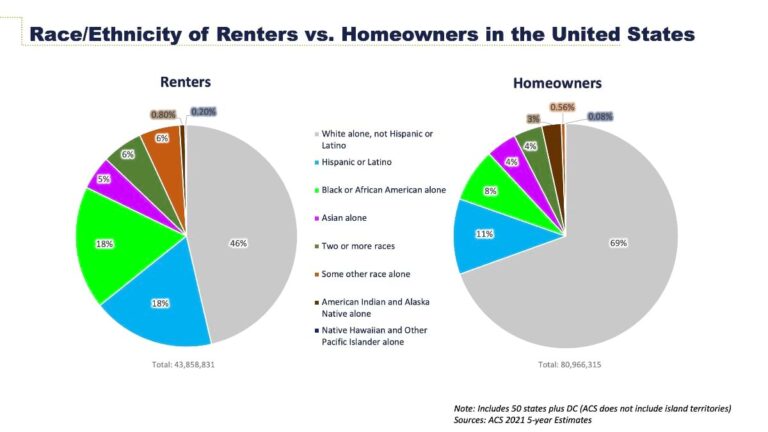

These conditions widened a decades-old gap in homeownership that has left a disproportionate number of people of color as renters, without the wealth-building equity acquired through homeownership.

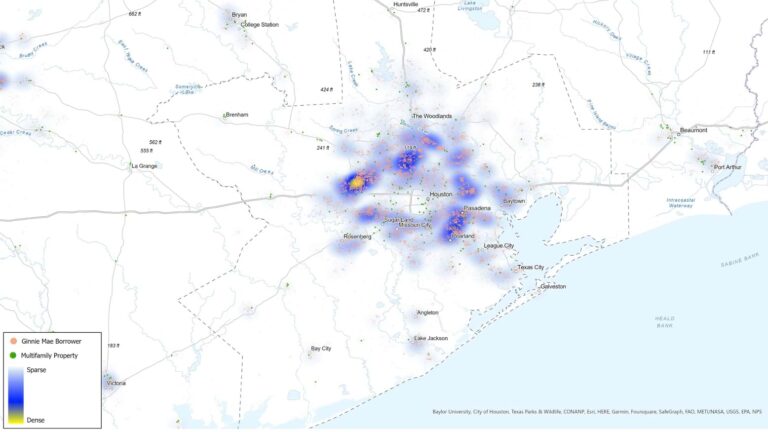

The federally owned Government National Mortgage Association, also known as Ginnie Mae, has worked to find new opportunities for lenders and investors to make loans available to underrepresented borrowers. Data science, using geographic information system (GIS) technology to map and analyze those opportunities, helps guide the work.

Using GIS maps and enriching them with massive amounts of public data, analysts can pinpoint locations where renters reside and estimate their earnings. With this information, Ginnie Mae can identify lenders in the same communities that can promote homeownership opportunities.

At the same time, Ginnie Mae’s strategists use GIS to assess their own organization’s success in making the housing market more equitable. Even at a time when the number of affordable homes for sale is the lowest on record, Ginnie Mae’s social impact work is helping families build wealth through homeownership. For instance, about 31 percent of recently issued loans securitized by Ginnie Mae went to borrowers of color.

Internal analysis found the organization’s research, products, and services are lowering risks for investors, helping borrowers build generational wealth, and improving historically marginalized neighborhoods.

“Rising home prices and high interest rates mean Ginnie Mae’s programs are even more important today for supporting affordable homeownership,” said Seth Marcus, the organization’s director of enterprise data solutions. “Ginnie Mae’s programs help bring scale to the government lending programs, allowing more credit to flow to low- and moderate-income households.”

A 50-year shortage of affordable homes has led to severely limited buying opportunities in the US, according to the National Association of Realtors. The association reported what it calls an “underbuilding gap” of 5.5 million housing units over the last 20 years. This represents a $4.4 trillion underinvestment in housing.

The trend that has left a disproportionate number of people of color living as renters has held steady for more than 30 years.

The homeownership rate for white households was 75 percent nationally in the second quarter of 2022. The rate was just 48 percent for Hispanic households and 45 percent for Black households, according to the US Treasury Department.

Meanwhile, interest rates have climbed and home prices have jumped dramatically, due in part to the limited number of homes for sale. The biggest declines in affordability occurred in smaller cities, which historically were likely to offer alternatives to the higher costs in major urban centers.

Data scientists at Ginnie Mae play a crucial role in advancing the agency’s mission of promoting equity and inclusivity in the nation’s housing finance system. Their work translates into new strategies for increasing loans to borrowers who have lower incomes and credit scores. These applicants typically face challenges in qualifying for home loans.

Where does the work begin? How best to transition low- to middle-income households from rented units to purchased homes under the tightest market conditions in decades? GIS helped analysts at Ginnie Mae answer these complex questions, according to Marcus.

GIS-based data analysis is visual. Detailed information about local populations and communities can be featured on interactive digital maps. Analysts can filter the maps to evaluate market conditions by location. This includes looking at race and ethnicity, income, and other factors to understand how circumstances vary from place to place.

Through this type of visual and location-based analysis, Ginnie Mae teams work with lenders and other partners to identify communities that align well with their goal of increasing homeownership.

“GIS is helping Ginnie Mae connect data in new ways, reveal hidden patterns, and answer questions that previously were impossible to answer,” Marcus said. “It’s an exciting time to be working here. We can literally see the results of our efforts on the map.”

They can, for example, identify neighborhoods with highlights such as lower housing prices and insurance costs, as well as mission-driven banks and other lenders nearby. Potential partners include community development financial institutions, state housing finance agencies, credit unions, and organizations that have social impact goals.

By using data science and spatial analysis to create a portrait of local communities and the opportunities they offer, Ginnie Mae has increased homeownership in underrepresented groups even in a tight real estate market. For instance, about 62 percent of loans recently securitized by Ginnie Mae went to first-time homebuyers.

In fiscal year 2023, Ginnie Mae’s services and products supported more than 1.2 million households. The mortgages went to veterans and active service members, as well as urban, rural, tribal, and underserved communities, according to Ginnie Mae’s 2023 annual report.

“Despite these difficult times, in fiscal year 2023, Ginnie Mae’s month-over-month [issuance of mortgage-backed securities] exceeded the volumes of the government-sponsored enterprises Fannie Mae and Freddie Mac, indicating that government-backed mortgage loan programs remained a critical option for borrowers,” the annual report says.

The report highlights the growing importance of data science and spatial analysis as tools for problem-solving in government agencies and businesses:

“We are leveraging our knowledge, expertise, programs, and longstanding partnership with the Federal Home Loan Banks to increase liquidity for government-backed mortgages and connect the power of the capital markets to the passion and knowledge of community lenders and the neighborhoods they serve.”

Learn more about how GIS helps organizations examine race, ethnicity, and vulnerability so that they can to create programs that address equity and social justice.