In a May 2022 survey, Autolist asked 1,300 Americans why they were reluctant to buy an electric vehicle (EV). The number one reason, cited by 48 percent of respondents, was EV costs—the perception that they’re too expensive to buy or lease.

A study released the same month argues that price tags shouldn’t scare off potential EV buyers. That’s because EV costs in the US are often lower on a monthly basis than those of gas-powered vehicles, the analysis found, although the comparison varies by car model and location.

For companies that offer products or services to EV drivers, the geographic nuances of the EV cost equation offer clues into business opportunities across the country.

A Second Look at EV Costs

Energy Innovation: Policy and Technology, a firm that bills itself as a nonpartisan think tank, found that when comparing the EV and gasoline versions of two vehicles—the Hyundai Kona SEL and the Ford F-150—the EV offering was cheaper to own per month in every state.

For other models, such as the Volvo XC40, the Hyundai Kona Limited, and the Nissan Leaf (when compared to the Nissan Versa), the EV was cheaper in nearly half of states.

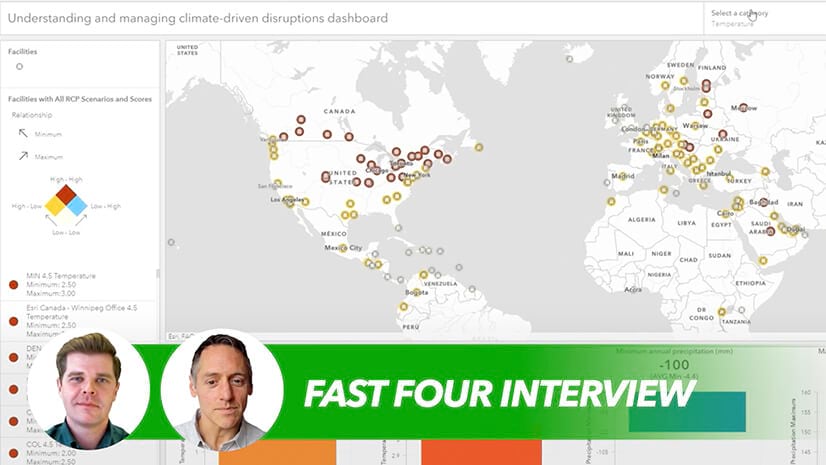

By analyzing these geographic trends in EV costs along with other location-specific data like gas prices, EV charging infrastructure, and customer attitudes toward renewable energy, business leaders can create the location intelligence needed to forecast demand. If buyers discern that EVs do in fact represent a better value, companies need to be one step ahead of those evolving customer choices, or risk being left behind.

For instance, property developers in California—which has the most charging stations of any state in the US—need to forecast potential charging demands before breaking ground on new subdivisions or mixed-use neighborhoods. A real estate COO looking at this study would see that in the Golden State, along with other EV-friendly states like Colorado and Oregon, EV costs for every model analyzed were lower than those of the fuel-powered alternative—suggesting a promising outlook for future adoption.

In regions where market opportunities for EVs are growing, company and community leaders are excited about the advent of apps like Charge4All, a tool that uses geographic information system (GIS) technology to identify the best and most equitable locations for plug-in installation.

A Patchwork of Progress on Green Vehicles and EV Costs

A restaurant or store owner could incorporate this study’s data into a GIS analysis to determine whether offering electric charging in parking lots might attract more visitors. For example, the study found that in midwestern states like Wisconsin, Ohio, and Michigan, gas-powered cars are often still cheaper; there, business planners might take a more incremental approach to EV infrastructure.

A national owner of service shops or automotive parts stores would want to anticipate where customers will be choosing gas- or electric-powered cars. Such location intelligence can inform everything from hiring and training technicians to stocking the right merchandise in stores.

To navigate this transition to cleaner transportation, company leaders need spatially aware technology like GIS that can layer critical information over company assets, furnishing business insight that informs strategic decisions.

Monitoring a Moving Target in Sustainability

To reach their EV cost conclusions, the study authors considered fuel and maintenance costs; financing; state fees and taxes; insurance; and, most significantly, local and federal rebates, including the $7,500 federal EV tax credit. That credit no longer applies when a manufacturer exceeds 200,000 EV sales per year—a cap that Ford and Nissan are likely to hit in 2022.

Auto companies are currently lobbying Congress to lift the cap—making state and federal legislation yet another front that businesses with a stake in EV adoption should monitor. As the EV market matures, GIS-powered dashboards serve as platforms where decision-makers can unify and analyze multiple data streams, gaining clarity on where consumer shifts are—and aren’t—happening, and then secure an advantage.