In January 2021, telecom giant Comcast Corp. will open a $50 million, 3,500-seat e-sports venue—the largest video gaming arena in the US—in its home city of Philadelphia, Bloomberg reports.

Comcast certainly isn’t alone. In 2018, a who’s who of big names—from Michael Jordan to Drake to Mark Cuban—invested in the e-sports market, joined by established companies and venture capitalists.

As businesses worldwide plan ventures in new and established markets, they start by gauging demand and market potential. Much of this groundwork is done using technologies powered by location intelligence, IoT data, and AI.

Segmentation Insight

The cable giant’s foray into e-sports comes as the market surpasses $1 billion in global revenue, according to analysts at Newzoo. About 10 percent of that revenue came from merchandise and tickets, and Comcast’s announcement appears to be a bet that such revenue will rise.

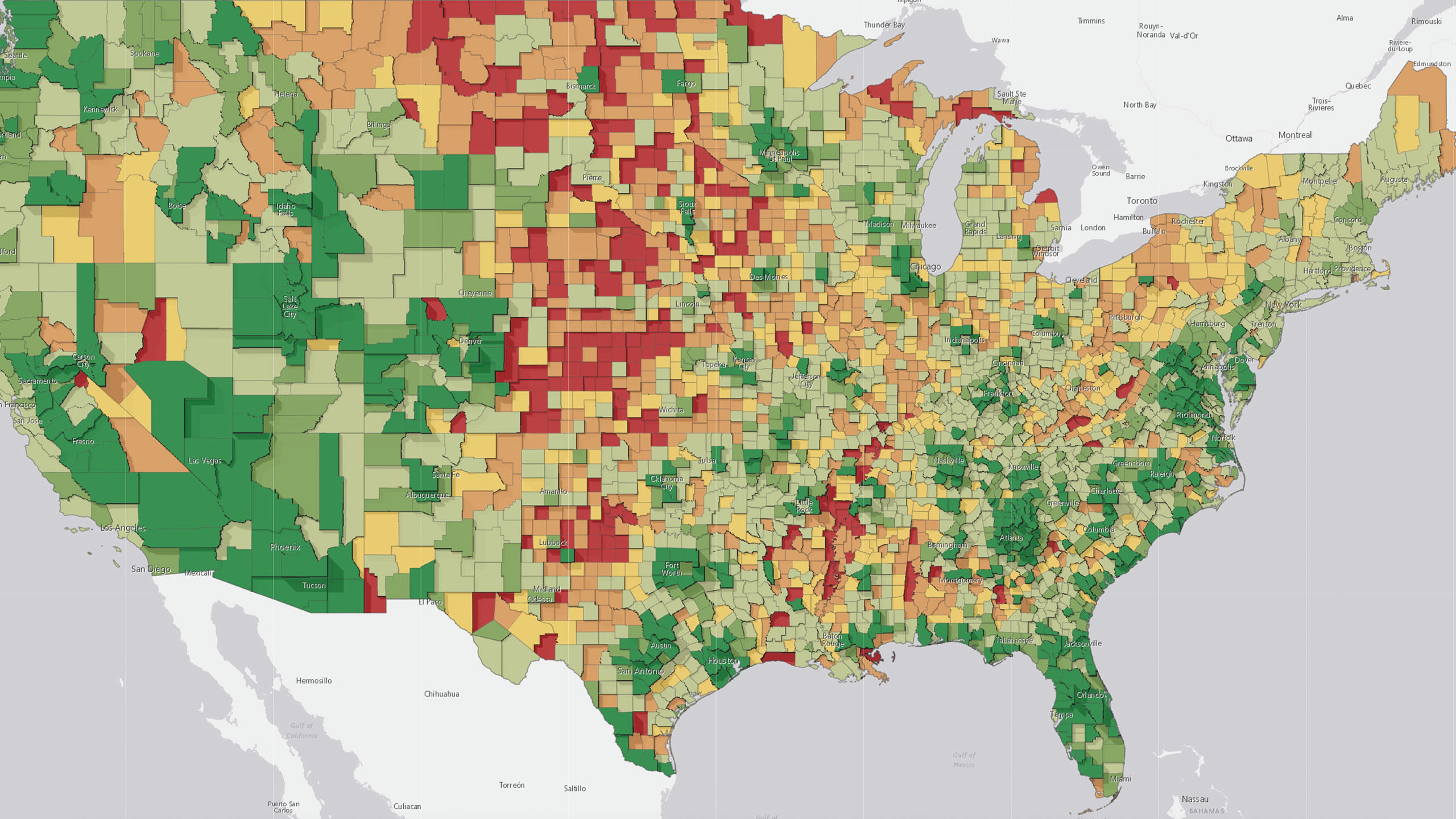

Measuring the market for e-sports in cities around the globe may be a new challenge, but techniques that guide any business expansion still apply. To determine the size of potential markets, companies typically examine demographic data first, assessing population characteristics such as age, income, and projected growth.

For more nuanced analysis, business leaders layer in psychographic details, which reveal any number of consumer characteristics. In the case of e-sports, this includes how much time people spend online and how many hours a week they devote to video games.

According to Cindy Elliot in “Finding the Confidence to Grow a Business,” this kind of location intelligence drives stronger investments:

The primary engine of that intelligence is a planning tool called a geographic information system (GIS), which maps the location of—and relationships between—consumer trends, spending patterns, and other data in potential markets.

With modern GIS technology, bank planners [for example] can see the demographic and psychographic characteristics of ZIP codes, cross-reference those with a targeted customer profile, and choose a branch location that serves the highest concentration of those ideal customers.

In the case of e-sports, business planners could use GIS-driven psychographic reports to find gamers as well as potential spectators for gaming tournaments. They could also map out how companies are marketing their brands through e-sports, since marketing represents 40 percent of the industry’s spending, according to Newzoo. That data could reveal sales and partnership opportunities for venue owners.

(For a look at how business leaders use location intelligence, read this e-book.)

Human Weather Analytics

Innovative executives go beyond basic analyses by adding new forms of location insight to their market reports. For instance, a company planning an e-sports venue could use demographic and psychographic reports to identify the city with the highest population of gamers and gaming fans. Then, to understand where within that city to place a gaming arena, planners might turn to an IoT data source called human weather.

According to Jim Young, author of A New Forecast: Human Weather, human weather includes anonymous information that reveals preferences of people who frequent any area of a city. He writes,

Companies are learning much from the location exhaust generated by mobile applications that use location awareness. . . . Third-party providers aggregate and anonymize that information, then serve it out as geographic, or spatial, data so companies can do things like call up storefront locations and see what retail traffic looks like at their own locations and those of competitors, comparing today’s traffic to the previous week’s or last month’s.

Planning executives might supplement the view of human weather with social media analysis by mapping where posts about e-sports or other activities are most prevalent—even at what time of the day they’re most popular. By identifying geographic hot spots of gaming activity, executives are able to get hyperlocal, finding pockets of e-sports interest within the region.

More Insight from AI

A final layer of analysis involves artificial intelligence. Companies now have access to aerial imagery of all kinds—from satellites, planes, and drones. Using AI tools that decipher patterns, executives can analyze imagery to reveal, for example, city parking lots with high activity rates, possibly pointing to an area with the best potential for an arena.

Research shows that all these analysis techniques—from basic demographics to AI-based analysis of drone imagery—are on the rise. Among retailers, for instance, 75 percent of companies consider location intelligence important to their business. This number is up from 40 percent in 2017, according to RSR Research.

As competition continues its march through all industries, business executives looking for solid investments are turning to location intelligence. Stacked with advances like AI and IoT data, the context of location empowers leaders to more precisely gauge potential in markets they plan to reach.